Fundstrat’s Lee: Virtually All Crypto Are Down 70% From ATH, Positive Signal

ALTCOINS

Fundstrat’s Lee: Virtually All Crypto Are Down 70% From ATH, Positive Signal

NICKCHONG | SEPTEMBER 7, 2018 | 8:27 AM

Following weeks of sustained positive price action, bulls finally ran out of steam on Wednesday, as prices throughout this budding market fell by upwards of 10% within hours. Altcoins unarguably had it bad, but a well-known analyst claims that the subset of crypto assets could potentially see a substantial boom in the coming months.

Fundstrat’s Altcoin Correction Index

As the market fell on Wednesday, the price of most small market crypto dropped like a knife. And unsurprisingly, Bitcoin dominance reflected this drastic drop, with the figure nearing year-to-date highs at 55 percent yet again, as major cryptocurrencies like Ethereum and Bitcoin Cash tumbled by upwards of 20% in a violent bout of sell-side action. At one point, Ethereum took a brief pit stop at $210, causing a multitude of traders to claim that the sky was basically falling on their heads.

Dramatics aside, while altcoins are evidently in a capitulation phase, Tom Lee, the head of research at Fundstrat Global Advisors, recently revealed that this sell-off shouldn’t be seen as all that bad.

https://twitter.com/fundstrat

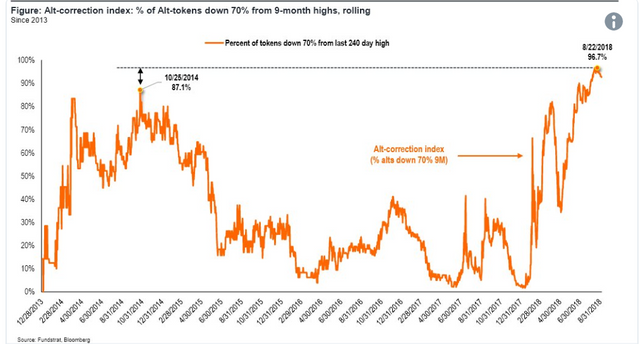

CRYPTO: 1/ To put the alt-coin sell-off in a historical context: we created an "alt-coin correction index" which measures what % of alt-coins are down 70% from their 9-month high. Recently, this index hit 97%, the highest reading since 10/25/14.

Conveying his in-depth analysis to his dedicated Twitter following of 56,000 individuals, Lee first expressed the importance of his firm’s “altcoin correction index,” writing:

“To put the alt-coin sell-off in a historical context: we created an “alt-coin correction index” which measures what % of alt-coins are down 70% from their 9-month high. Recently, this index hit 97%, the highest reading since 10/25/14.”

Elaborating on the historical significance of this statistic, the analyst drew attention to previous readings, pointing out that when Fundstrat’s correction index hit 87%, there was a “mini altcoin rally” in the weeks that followed. Lee calling the altcoin rally “mini” was actually quite an understatement, as the valuation of altcoins saw a 270% gain in just seven weeks time.

Although it would be foolish to expect for this same scenario to play out in a near-identical manner, Fundstrat’s head of research noted that the index, which is likely of his creation, suggests that “this latest downdraft is actually a tactically positive signal for altcoins.”

Nonetheless, some claim that this analysis, while insightful and intriguing, does not apply in bear markets. As reported by NewsBTC previously, Bitcoin has historically been a safe haven in bearish trends, as investors, whether from an institutional or retail background, seek solace in the (arguably) most reliable crypto asset. Additionally, while speaking at South Korea’s Blockfesta conference, Blockstream CSO Samson Mow divulged that a long-term position in any number of altcoins will substantially reduce potential returns. As such, some claim that any capital allocations into altcoins will be a mid to long-term threat to the safety of your portfolio.

Is Altcoin Season Near or Afar?

Some had other reasons to criticize this analysis, as a select few noted that Lee often enlists potentially outdated historical statistics to prove a point in the present day, which may not be a reliable method to forecast the future price action of an often unpredictable market.

Regardless, some hope that what the Fundstrat analyst said holds credence, as those high on “Hopium” believe that the long-awaited and near-deified “altcoin season” could be just around the corner, even if it’s against all the odds.

its a sign the market will bounce back soon.

Almost