WALL STREET IN BETTER SHAPE AND DJIA HOLDS ABOVE THE PIVOT ON BULLISH CORRECTION TESTING 21-D SMA

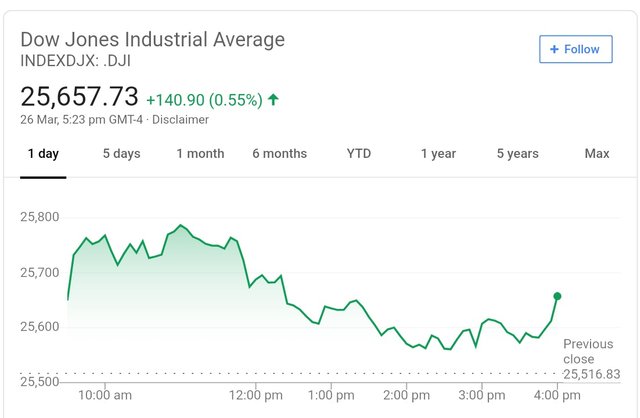

The Dow Jones Industrial Average DJIA, added 140.90 points, or 0.6%, to 25,657.73 although had been up by as many as 200 points during the session.

The S&P 500 index SPXadded 20.10 points, or 0.7%, to 2,818.46, with financial and energy shares leading the gainers.

The Nasdaq Composite put on 53.98 points, or 0.7%, to close at 7,691.52.

Wall Street was looking in better shape on Tuesday with the energy and financial sector leading the way until housing and consumer-confidence data, as well as political strife, weighed on sentiment. Brexit is a lingering concern with too much uncertainty for investors to bear.

Another uncertainty comes with U.S.-China trade negotiations resuming after a period of consolidation and conflicting headlines jarring market performance. There is some optimism that trade talks will draw to a positive closure by the end of April. U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin are due in China later this week.

US data disappoints:

US data continues to a softer economic outlook with home prices growing at the slowest pace in more than six years while consumer confidence dropped sharply in March, according to the Conference Board’s consumer confidence index, which fell to 124.1 from 131.4 in February.

DJIA levels

The DJIA is pressuring the 21-D SMA and has made a higher low on Tuesday, holding above the pivot located at 25516. However, since suffering a sell-off from last Tuesday's high of 26109, until the 26000 level is breached again, there is the risk of a run all the way down to the 23.6% Fibo retracement of the late Dec swing lows to late Feb swing highs at the low end of the twenty-five hundreds. This area guards a break all the way down to the 38.2% Fibo of the same range around 24400.