What does the 2018 crypto market crash mean for blockchain adoption?

As the cryptoasset market slump continued, with the total market cap shrinking to $131 billion and few signs of recovery, a panic atmosphere settled in among enthusiasts towards the end of 2018. The question arises: What does the 2018 crypto market crash mean for blockchain adoption?

There are several key contributing factors, which partly explain the price drop of cryptoassets, and help us understand the consequences for adoption:

Regulatory Pressures: ETFs and U.S. Regulators

Historically there have been few regulations or rules in crypto market. Naturally with the arrival of more capital and serious investors, and on the back of high profile exchange calamities, crypto traders are demanding supervision to eliminate manipulative bad actors and legitimise the market. Under the oversight of institutions like Securities and Exchange Commision (SEC) and FINRA, the fear of consequence can lessen the impact of malicious projects and attract more crypto traders and institutional investors, reviving the market and decreasing the power of the current high-volume owners.

However, regulatory and global economic pressures have taken their toll on the crypto market through trade tensions, central banks’ tightened policies and the postponement of ETFs (exchange-traded funds.) Bitcoin ETFs would be securities that combine the diversification of mutual funds with the trading capacities of stocks. However, US SEC Chairman Jay Clayton stated “I think we’ve been clear that Bitcoin isn’t a security, but many of the ICOs that you see and talk about - they are securities,” highlighting the lack of clarity in mapping cryptoassets as classical financial instruments.

For the crypto market to tap further into institutional capital and attract investors, who value the trustworthiness and long-term gains of an investment more than the short-term risky gain, robust regulatory frameworks need to be introduced at Institutional, Governmental and International Levels. In the UK, the Financial Conduct Authority’s (FCA) cryptoasset taskforce recently published a report on its approach, but the targets to which it has committed remain research-based, and leave the UK years away from comprehensively defining and regulating the market.

However, there are positive examples to be seen in more nimble jurisdictions at governmental level, as Gibraltar this year became the first authority to establish a legally enforced DLT regulatory framework, allowing companies to be licensed to operate in the space.

Finally, as cryptoassets are effectively borderless and have been used extensively to transfer value internationally, it is paramount that international standards on issues such as anti-money laundering and know-your-customer (AML/KYC) are established. These initiatives are currently driven by privately established consortia like r3, but must ultimately fall into the remit of official global governance bodies.

Market Overheating: Speculation without Adoption

The demand for cryptoassets has significantly outpaced the speed of product development by blockchain projects and more broadly the rate of adoption of the blockchain technology. The promise a revolutionary technology, investment instruments with unheard of volatility, and new ways to raise capital through ICOs attracted numerous investors, and huge valuations were often assigned to projects with little or no underlying value (see extremes like JesusCoin).

The on-going market crash was arguably inevitable, as an unsustainable bubble had formed, where value increases were often driven purely by speculation. The recent sell offs have taken some air out of the bubble and have worked to realign the valuation of blockchain projects to the real status of blockchain adoption.

Manipulative Whales: High stakes and panic sales

87% of all bitcoins ever mined are owned by just 0.5% of Bitcoin wallets, and 61% percent of all bitcoins are owned by just 0.07% of wallets. While it’s important to understand that the ratio of addresses and wallets to actual people is not 1:1 (users are likely to have wallets on several exchanges, which in turn have varying storage structures, leading to multiple wallets per user).

This distribution is broadly mimicked across other cryptoassets and is driven primarily by early investor advantage and the distribution of tokens to project founders, sometimes creating overnight multimillionaires.

A key consequence of this ownership structure, is that individuals are able to move very large volumes of an asset, and significantly affect its price instantaneously — meaning there is a constant volatility risk. Such users have come to be known in the industry as “whales” and the term has expanded to incorporate high-value investors in ICOs.

Extreme manipulations and volatility in the market can lead investors and traders into panic mode. Recently, major price-drops and the reports like Goldman Sachs backing down from plans to start a crypto trading platform have stirred fear that investors and institutions are not interested in cryptoassets in the near term. This fear led to to mass sell offs, triggering a vicious cycle and accelerating the “meltdown” of the crypto market.

Bitcoin Cash Hard Fork: Uncertainty and partisanship

Finally, the uncertainty caused by the recent Bitcoin Cash (BCH) hard fork can also be argued to have triggered the latest bearish trends.

An ideological conflict between two groups ultimately led to BCH splitting into two chains on November 15th 2018: Bitcoin SV and Bitcoin ABC, resulting in doubt and fear amongst the investors and traders entering the market.

At first, the impending hard fork lead to a spark in BCH: with increasing trading volume from $200 million to $1.4 billion, BCH was trading around $586. However, on November 15th the BCH price went down to $205, as its market cap shrunk down from $9 billion to $3.7 billion in a matter of days. Other crypto currencies were struggling too, with the BTC market cap decreasing by 29.5% from $109.5 billion to $77.2 billion around same time.

Having considered the reasons for the on-going cryptoasset market downturn, what are the barriers and key next steps for mass adoption of blockchain?

The market crash is showing us the realities of the adoption of a new technology and how it is critical to prioritise improvements in blockchain technology and the long term infrastructure of the crypto market, over short term returns.

In a much-debated January 2019 piece, leading consultancy McKinsey & Co dissects “Blockchain’s Occam Problem,” pointing to the technology’s inability to jump Geoffrey Moore’s metaphorical chasm from the pioneering stage to mass scale adoption.

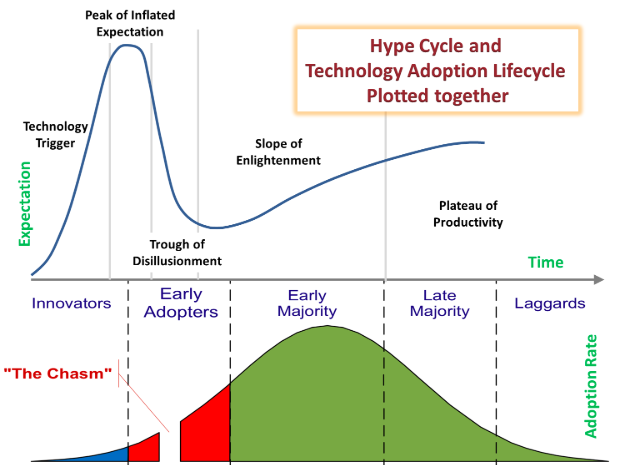

However, mapping Moore’s Adoption Curve against the Gartner Hype Cycle, which currently places blockchain towards the bottom of the ‘trough of disillusionment’, points us to a brighter future. Drawing on the example of the .com boom and crash, it often takes for an emerging technology market to endure a disillusioned purge of sorts, before serious adoption can take off.

In the blockchain sphere, as of 2018, of the 80,000+ known blockchain projects worldwide, only 8% have endured. Meanwhile of 4000+ ICOs, over half failed within the first four months.

The 2018 bear market has helped tame uninformed capital inputs and reduce the number of meaningless and non-robust projects in the space, potentially laying the ground for impactful projects to persevere in 2019, especially as the technology responds to market needs more accurately.

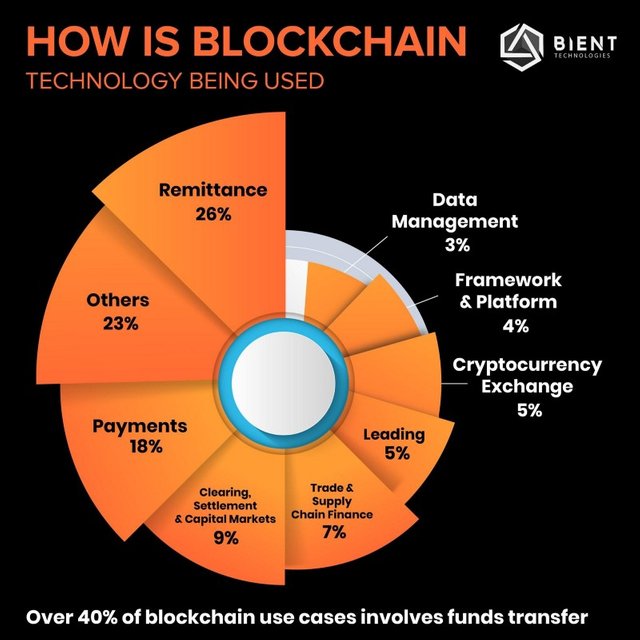

A key element to any subsequent increase in adoption, will be to ensure blockchain is used to address issues in areas where it is genuinely the best technology to use, such as certain remittance and supply chain projects, not simply forced into projects to generate hype and capital.

Stability in Crypto Market and Solid Use Cases in Blockchain are Needed

A disincentivising drive for investors has historically been the volatility of the cryptoasset market, which has in particular been blamed for the continuing absence of serious institutional capital.

Stable coins, are a new crypto financial instrument, on a mission to overcome the volatility of the market by pegging a token against a basket of assets including fiat currencies, crypto currencies and commodities. If they can live up to their name, stable coins can build trust and confidence in cryptos, supporting the adoption of blockchain.

After the hype of a new technology, the blockchain environment can change with emergence of solid use cases from start-ups or company developments that will make the speculative approach to blockchain more realistic. For example, payment protocol Ripple facilitates practically fee-less and immediate interbank settlements for global payments, making blockchain technology a core part of addressing a real life problem — back-end settlement through incumbent pre-blockchain systems in for instance Foreign Exchange trades can take 2–6 days.

Beyond currencies, applications of blockchain in the energy industry have been touted by the founder of Blockchain Research Institute Don Tapscott states “ We pushed out centralised energy to ‘dumb’ recipients and we’re moving into a new age that’s more distributed. If we can change the way energy works, we can change the world.”

As blockchain starts to address real life problems better than centralised alternatives, customers will be incentivised to adopt this technology which will also stabilise the crypto market.

The decentralisation of our core economic systems is likely to be a long and gradual process, as it requires a fundamental shift in user mindset and institutional infrastructures.

Nonetheless, even as enthusiasm for new blockchain projects and funding for ICOs has cooled dramatically, industry scale use-cases are picking up speed. Blockchain use for supply chain tracking is being cited as the new “gold standard” and becoming economically necessary to stay competitive. Simultaneously, the on-going data protection crises engulfing giants like Facebook and Google are pushing blockchain-based data sovereignty solutions to the fore.

To view more please visit my blog

https://steemit.com/@fermatsays

Thank you in advance for your comments...