Dow Industrials Reversal Lower Could Be Double Whammy For Stock Bulls

Monthly Dow Jones Industrials  Monthly Dow Jones Industrials

Monthly Dow Jones Industrials

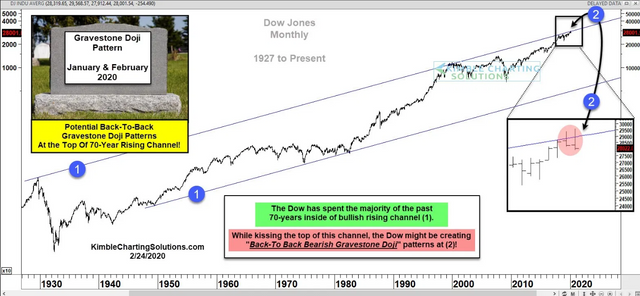

The Dow Jones Industrials Average has spent the past 70 years in a wide rising price channel marked by each (1). And the past 25 years have seen prices test and pull back from the upper end of that channel.

The current bull-market cycle has seen stocks rise sharply off the 2009 lows toward the upper end of that channel once more.

In fact, the Dow has been hovering near the topside of that price channel for several months.

But just as the index is kissing the top of this channel, it might be creating back-to-back “monthly” bearish gravestone doji patterns at (2).

This “double whammy” would be bearish for stock bulls and could mark the beginning of a correction. Stay tuned.

This month marks my 40th year in this business. When I look back in hindsight, this is something I haven’t seen, since entering the business in February of 1980. An observation; the major tops in 2000 and 2007 didn’t create these patterns. Time will tell if the patterns that formed in January and February of 2020 are suggesting that an important top is in play or just some noise at the top of a long-term rising channel. The next couple of months mostly, not days or weeks, will tell us if these patterns are important on a long-term basis.