Franklin D. Roosevelt on Familiar Fascism

Franklin D. Roosevelt, 32nd President of the United States

Message to Congress on Curbing Monopolies.

April 29, 1938

https://www.presidency.ucsb.edu/documents/message-congress-curbing-monopolies

“Unhappy events abroad have retaught us two simple truths about the liberty of a democratic people.

The first truth is that the liberty of a democracy is not safe if the people tolerate the growth of private power to a point where it becomes stronger than their democratic state itself. That, in its essence, is Fascism—ownership of Government by an individual, by a group, or by any other controlling private power.

The second truth is that the liberty of a democracy is not safe if its business system does not provide employment and produce and distribute goods in such a way as to sustain an acceptable standard of living.

Both lessons hit home.

Among us today a concentration of private power without equal in history is growing.

This concentration is seriously impairing the economic effectiveness of private enterprise as a way of providing employment for labor and capital and as a way of assuring a more equitable distribution of income and earnings among the people of the nation as a whole.”

…

“We believe in a way of living in which political democracy and free private enterprise for profit should serve and protect each other—to ensure a maximum of human liberty not for a few but for all.

It has been well said that “the freest government, if it could exist, would not be long acceptable, if the tendency of the laws were to create a rapid accumulation of property in few hands, and to render the great mass of the population dependent and penniless.”

Today many Americans ask the uneasy question: Is the vociferation that our liberties are in danger justified by the facts?”

…

“Even these statistics I have cited do not measure the actual degree of concentration of control over American industry.

Close financial control, through interlocking spheres of influence over channels of investment, and through the use of financial devices like holding companies and strategic minority interests, creates close control of the business policies of enterprises which masquerade as independent units.

That heavy hand of integrated financial and management control lies upon large and strategic areas of American industry. The small business man is unfortunately being driven into a less and less independent position in American life. You and I must admit that.

Private enterprise is ceasing to be free enterprise and is becoming a cluster of private collectivisms: masking itself as a system of free enterprise after the American model, it is in fact becoming a concealed cartel system after the European model.

We all want efficient industrial growth and the advantages of mass production. No one suggests that we return to the hand loom or hand forge. A series of processes involved in turning out a given manufactured product may well require one or more huge mass production plants. Modern efficiency may call for this. But modern efficient mass production is not furthered by a central control which destroys competition among industrial plants each capable of efficient mass production while operating as separate units. Industrial efficiency does not have to mean industrial empire building.

And industrial empire building, unfortunately, has evolved into banker control of industry. We oppose that.“

Some Estimates for Context

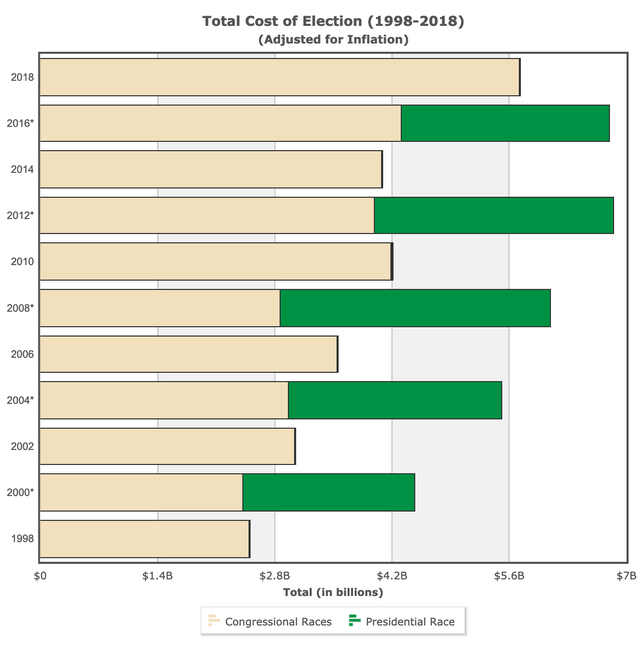

OpenSecrets.org “Cost of Election”

https://www.opensecrets.org/overview/cost.php?display=T&infl=Y

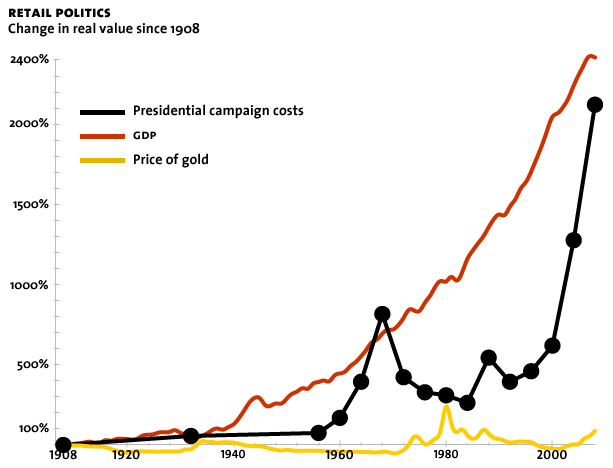

The Crazy Cost of Becoming President, From Lincoln to Obama

https://www.motherjones.com/politics/2012/02/historic-price-cost-presidential-elections/

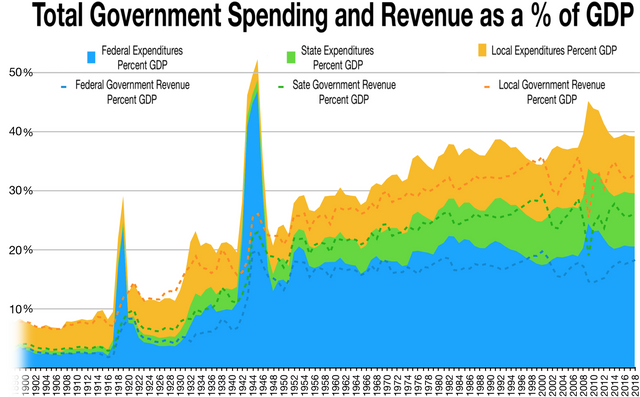

https://en.wikipedia.org/wiki/Government_spending_in_the_United_States

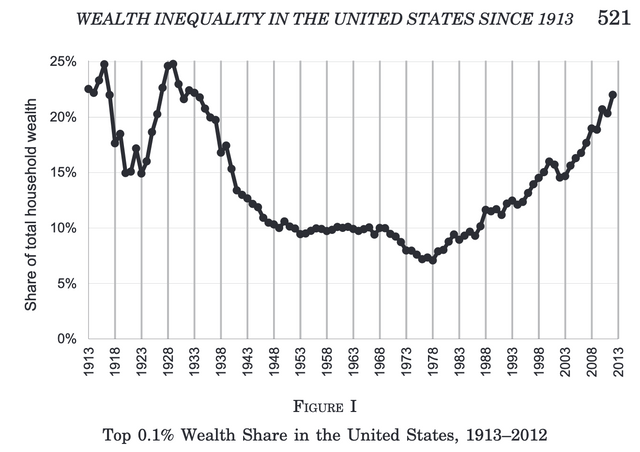

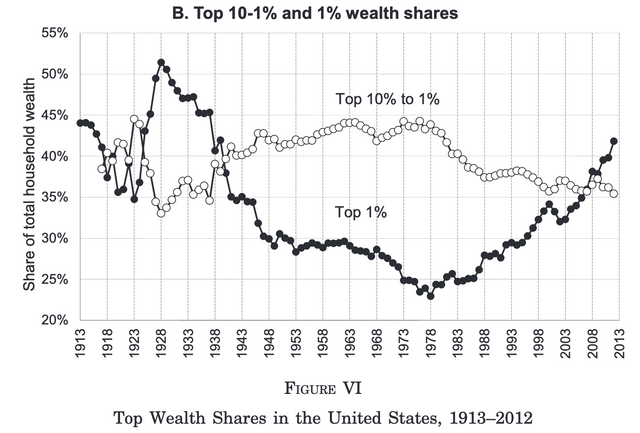

WEALTH INEQUALITY IN THE UNITED STATES SINCE 1913: EVIDENCE FROM CAPITALIZED INCOME TAX DATA

Emmanuel Saez and Gabriel Zucman

https://eml.berkeley.edu/~saez/SaezZucman2016QJE.pdf

More food for thought ...