Crypto Academy / Season 3 / Week 4- Homework Post for Professor @asaj - Topic: Spotting Market Reversals With CCI.

Market can be defined as platform where buyers and sellers can interact and also trade their assets with the aim of making profit. The price of an asset in a market is determined by the psychology of both the buyers and the sellers. When there is a change in the psychology of the market participant, the market which was formerly going in one direction will turn and begin to go in the opposite direction. This change in market direction is referred to as Market Reversal.

Hello everyone, welcome to week 4 of Crypto academy's season 3. In today's lecture, professor @asaj while teaching on the topic "Spotting Market Reversals With CCI" has explained to us how market reversal can be spotted using CCI indicator. Below is my response to the assignment he gave after the class.

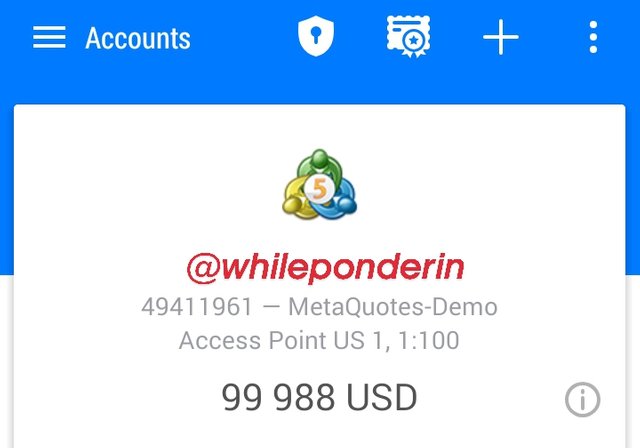

Question 1: OPEN A DEMO ACCOUNT ON ANY TRADING BROKER AND SELECT FIVE CRYPTOCURRENCY PAIRS

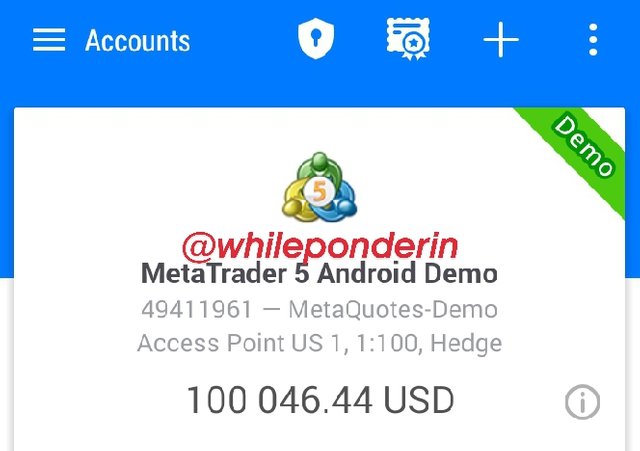

For this demonstration, I will be using the demo account of my MetaTrader 5 App.

Crypto Assets Selected

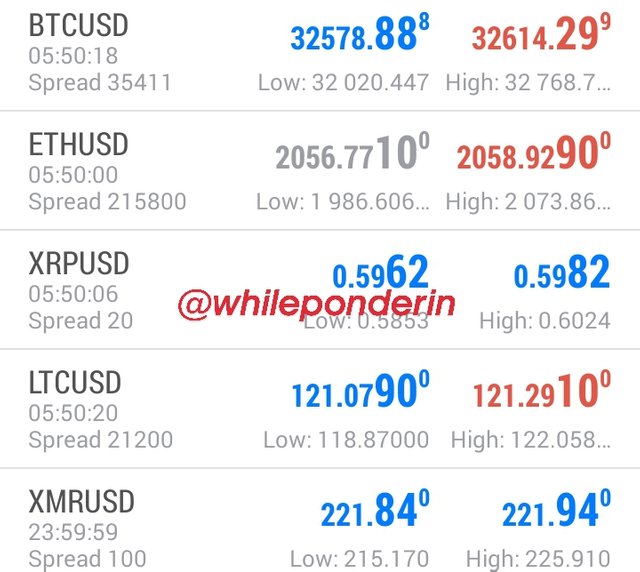

To carry out the assignment, I selected five crypto assets among the various crypto pairs offered by the broker. The following are the crypto assets I selected:

Bitcoin/US Dollar (BTC/USD)

Ethereum/US Dollar (ETH/USD)

Ripple/US Dollar (XRP/USD)

Litecoin/US Dollar (LTC/USD)

Monero/US Dollar (XMR/USD)

Question 2: CREATE A MARKET ENTRY AND EXIT STRATEGY

Market Entry and Exit Strategies are those trading rules a trader makes for himself so as to guide him in every step of the trade. Trading strategy consist of minute details such as risk ratios, when to use a certain indicator, candle type, chart patterns e.t.c.

There is no law guiding how a trader should draw up his trading strategy. It is totally dependent on the trader understanding of the markets movement and how he chooses to react to it. Looking at trading strategy, you can tell the personality of the person that designed it. A careful person will draw up strategies that will help him take less risk and make little profit, unlike a risk taker. Below is my market strategy

I normally use confluence-based trading strategies. These kind of trading strategies involves using various trading tools such as chart patterns, candlestick analysis, market structure, indicators, and fundamental analysis. They are most preferred by traders because of it's high profit ratio.

ENTRY STRATEGY CRITERIA

The following are the criteria I consider in setting up my trade entry:

1.Directional Bias:

Here, I check whether the market is ranging or trending. If it's trending, I will check whether it's an uptrend or a downtrend. I will also check how long the market has maintained that structure. On the other hand, if the market is ranging, I will consider if the market has enough points where s trader can perform short time trades.

2.Confluences:

Here, I check if the market structure aligns with the indicators. If they do, I will check what the trading volume of the asset has been in the last few hours. I will also study the candlestick and the chart patterns.

3.Risk to Reward:

This is where I decide my risk to reward. I normally chose a risk to reward ratio ratio between 1:1.15 to 1:3. This way I get to earn moderate profit per trade, at a reduced risk.

4.Risk Management:

This is where I decide how much of my whole capital am willing to risk per trade. I normally risk only 4 or 5% of my whole capital on a trade. This way I don't get to feel so bad if the trade ends badly, and I can easily recover.

EXIT STRATEGY CRITERIA

The following are the criteria I consider in setting up my trade entry:

1.Take Profit:

Take Profit is usually a trader's targeted profit in a trade. Once the price of an asset gets to this point, the market automatically closes, while the profit is added to the trader account balance.

2.Stoploss:

Although a trader hopes to make profit, he should also plan for a situation that the market goes opposite his prediction. When a trader sets "stop loss", he saying that once the price of an asset gets to this point, the market should automatically close. This way, he loses very little if the trade goes wrong.

3.Trade Invalidation:

This is the manual closing of the trade before it either gets to the take profit or the stop loss point. The result of an invalidated trade is dependent on whether it was in profit when it was closed or whether it was in loss.

I will be using the BTC/USD 1 hour chart shown below to explain my entry and exit criteria.

ENTRY POINT

Looking at the chart below, you will see that the market is on the upward trend, as it has already formed higher highs and higher lows. With the aid of Exponential Moving Average (EMA), I have been able to locate dynamic support areas (i.e the areas where the price touched the EMA lines and bounced off).

With the aid of commodity channel index (CCI) indicator, I was able to notice that the price of the asset is still in the neutral region, yet with high potentials of moving upwards for sometime before it reached the over sold region.

Based on these, I considered the entry points shown in the chart above as wise entry points.

EXIT POINT

I set the take profit above the EMAs and the market price at a risk to reward ratio of 1:1.5. I also set the stop loss below the EMA's at a the same risk to reward ratio.

Question 3: USE THE SIGNALS OF THE COMMODITY CHANNEL INDEX (CCI) TO BUY AND SELL THE COINS YOU HAVE SELECTED

Using CCI signals, I will be explaining how I bought and sold the coins that I selected.

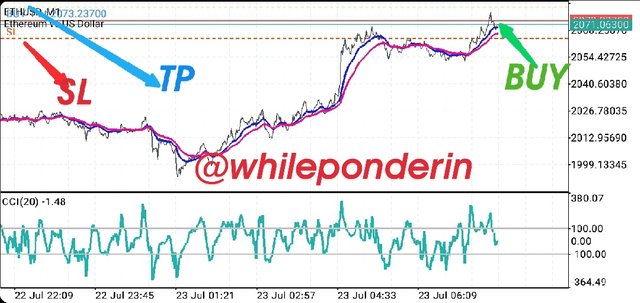

The commodity channel index (CCI) indicates that the price of the asset (ETHUSD) is within the neutral region, but already beginning to rise again, heading towards the overbought region. Also, looking at the EMAs, you will see that the asset just bounced off the 20 EMA and beginning it's ascent to the top.

These two indicators indicates that the best move is to "buy". I executed the trade at a risk to reward ratio of 1:1.5. At the end of the trade, I made profit. The trade chart is shown below.

The commodity channel index (CCI) indicates that the price of the asset (LTCUSD) is within the neutral region, but already entering the overbought region. Also, looking at the EMAs, you will see that the asset just bounced off the 20 EMA and has already formed two bullish candles.

These two indicators indicates that the best move is to "buy". I executed the trade at a risk to reward ratio of 1:1.5. At the end of the trade, I made profit. The trade chart is shown below.

Using the same principle above, I carried out the remaining three trades. There charts are shown below.

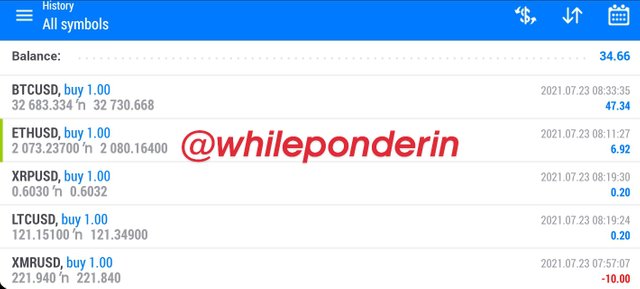

Question 4: DECLARE YOUR PROFIT OR LOSS

I made a total profit of $34.6. I made much profit from the traded positions of BTCUSD ($47.34), ETH/USD ($6.92), XPR/USD ($0.20) and LTC/USD ($0.20), while I lost $10.00 twice on the XMR/USD trade.

The demo account had a balance of 100,011.84 in the beginning of the trade. But with the $34.6 profit I made, my balance after the trade was $100,046.44.

Question 5: EXPLAIN YOUR TRADE MANAGEMENT TECHNIQUE

Although I have already set take profit and stop points in the chart, I closed the markets manually. I did that because, I saw that the market was already in my favor, and I was okay with the profit, therefore, I felt it was wise that I move out of the trade.

Also, close to the end of the market, the CCI indicator began to indicate a market reversal, and just as indicated by CCI, the price movement of the market soon began to reverse. When I tried confirming what the CCI indicator was indicating using the EMA lines, I observed that both were in contrast with each other, thus, I felt it was wise to pull out early before the market turns against me.

CONCLUSION:

Market reversals occurs whenever there is a change in the trade psychology of both the sellers and the buyers. Although a trader can make profit regardless of the direction the market is moving, no trader will like to remain a trade when a market reversal happens, as that implies he will lose all his profit.

With the aid of indicator tools, like CCI and EMA, the trader can be able to predict a market reversal before it happens, and therefore leave a trade before it starts going against him.

Thank you professor @asaj for this amazing lesson. I truly learnt a lot.

Good job @whileponderin!

Thanks for performing the above task in the fourth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 8 out of 10. Here are the details:

Remarks:

Another good performance from you. You have displayed a clear understanding of the topic. Keep it up!

Thank you professor @asaj