Fear and Greed Index - Crypto Academy / S4W5 - Homework Post for @wahyunahrul

Hello Steemian !!

In this article, I will discuss the homework provided by @wahyunahrul which is about fear and Greed Index.

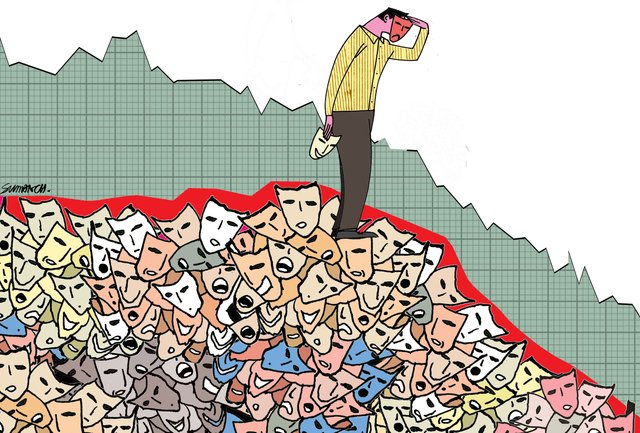

Relationship Between Emotional Conditions and Cryptocurrency Price Movements

All humans on this earth must have their own emotions and each of these emotions can depend on the character of the human being. Often these emotions are the reasons a person makes the decisions that person makes. Quality and character will greatly affect the way a person handles certain emotions. Emotions that can be controlled well can lead to good decision-making. But sometimes emotions can act as boomerangs that can lead a person to make the wrong decisions.

These emotions will also affect the environment of a human being, if the decisions made based on these emotions are wrong decisions, then it will also affect the surrounding environment. And the crypto market is no exception. The movement of the cryptocurrency market will not only depend on the value of the assets that make it up, there are emotional factors that take part in many opportunities for market movements from some investors who have very little relationship with the value of the assets they have.

A cryptocurrency market is a place where many people make transactions for buying and selling crypto assets, the movement of the price of a cryptocurrency is greatly influenced by the amount of demand and supply. So when a cryptocurrency has great demand for a certain period of time, the price will skyrocket. With this, the market sentiment originating from investors and traders will greatly influence market movements. The emotional state reflects how investors feel in the market, without being optimistic or pessimistic about the future.

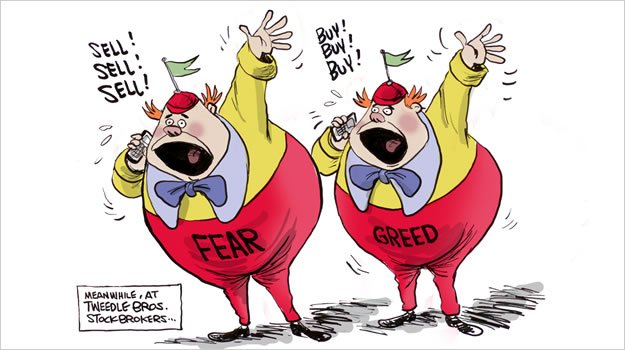

In the cryptocurrency market itself, there are two emotions that greatly affect the movement of the price of a cryptocurrency, among others: "Fear" and "Greed". Fear is a situation where investors start selling their crypto assets on a large scale to avoid losses. Then Greed's condition is a situation when investors start to get caught up in "Fomo" and make large purchases of crypto assets which makes the price of the cryptocurrency increase.

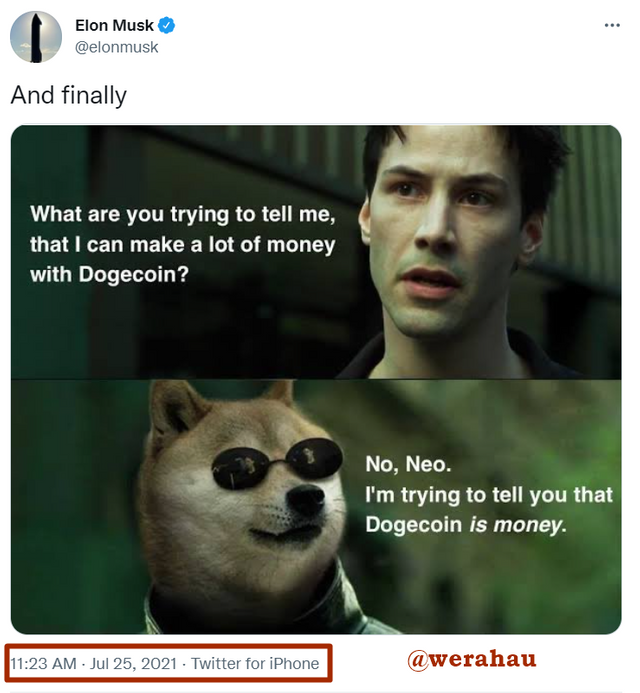

As an example of how to market emotions can affect the price movements of cryptocurrencies, we can see in the image below. On July 25, 2021, Elon Musk who is one of the richest people in the world made a tweet about DOGECOIN.

Because of this Tweet, many people flocked to buy DOGECOIN which made the price of DOGECOIN a very significant increase in the next few days.

From this, we can see how a Tweet is capable of influencing market emotions and resulting in cryptocurrency price movements in a very fast period of time.

Is the Fear and Greed Index a Good Indicator?

I think the Fear and Greed Index is an indicator that can be used as a technical analysis tool on the cryptocurrency market. The cryptocurrency market is a digital asset market that relies heavily on the law of supply and demand, an increase or decrease in the price of an asset or cryptocurrency will naturally provoke an emotional response from buyers and sellers. With the Fear and Greed index that is able to collect and evaluate various relevant data from sources relevant to the cryptocurrency market, everyone will know how the actual emotional conditions of the market are.

With various data taken from several sources such as:

- Volatility

- Volumes

- Social media

- Survey

- Domination

This data, in my opinion, is data that can be used as a reliable source for the Fear and Greed Index and these data will greatly assist this indicator in showing the actual market conditions. The Fear and Greed index proves to be very accurate and will serve as a good indicator for analyzing the emotional state of the market.

Then, the Fear and Greed Index also has a quite unique appearance compared to other indicators in general, thus making it seem like raising the level of the display of an indicator on the cryptocurrency market which on average uses lines and numbers that are rather difficult for people to understand. which is still new. This appearance will be a plus for the Fear and Greed Index as an indicator that can be used in trading.

But in addition, we should not take only the Fear and Greed index as a benchmark for making trading decisions, we should use a combination of several other indicators as additional indicators.

Additional Data For Fear and Greed Index

The data used by the Fear and Greed Index is very large and is also quite good as a benchmark and is able to represent the actual emotional condition of the market.

But I think there are some things that the creators of the Fear and Greed Index could add so that this indicator can be even better. These additions include:

1. Timeframe Variations

Until now, the Fear and Greed Index still only uses a 1-day timeframe because it is updated every 1 day. Thus making long-term traders less suitable for using this indicator. This can be improved by adding some updates in the short term and also this indicator can be recapitulated which is used as an update in the long term.

2. Cryptocurrency variations

By only supporting Bitcoin, the Fear and Greed Index is still hard for many to recognize. Because there are many people who prefer Altcoin over Bitcoin. As we know that there are already more than 10 thousand types of cryptocurrencies that have been made to-date so it would be a pity if most of all these cryptocurrencies were able to use this indicator. So if the Fear and Greed Index can be implemented on other cryptocurrencies, it will make this indicator more widely used by many people.

Technical Analysis Practice Using Fear and Greed Index

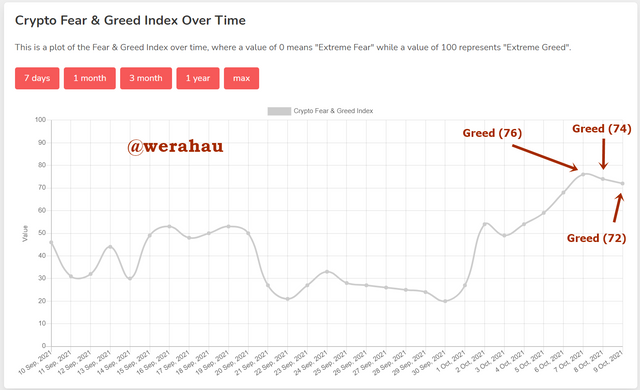

I will trade using a Demo account on Paper Trading. First, I will analyze the emotional state of the Bitcoin market for the previous 3 days.

Based on the historical graph from the Fear and Greed Index, in the last 3 days, the emotion that occurred in the market was Greed which indicated that the price of Bitcoin was already expensive, then we can see in the graphic above that the level of Fear's emotion that occurred began to decline from 76 to 74 and The last one is today which is in 72.

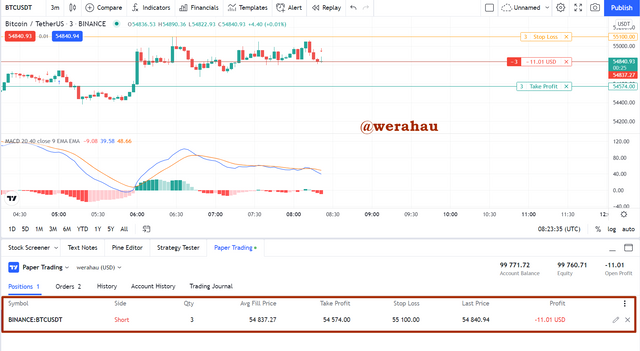

Then I started to analyze the Bitcoin chart on TradingView with the help of the MACD indicator which has 2 EMA lines with a length of 20 and 40 respectively. Based on the results of my analysis it can be seen that the MACD indicator gives a signal that the current trend in the Bitcoin market has entered a Bearish trend and there is already a "Death Cross" on the EMA line which indicates that the bearish trend will continue.

I started to enter the market at a price of $54,837.27 with the Risk/Reward ratio that I use is 1:1 which means that the risk of failure and profit are the same.

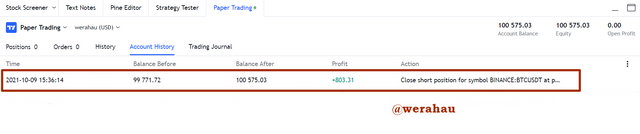

After that my trade was successful and I made a profit of $803.31 on my demo account at Paper Trading.

Conclusion

Indicators are a tool that is most often used in trading in the cryptocurrency market, with the Fear and Greed Index, the variety of choices on these indicators begins to increase and traders can freely use them as they please. The Fear and Greed Index has also succeeded in making an illustration of the same emotions that occur in the cryptocurrency market, especially the Bitcoin market. With this indicator, investors, and traders can really understand how important emotions play in cryptocurrency price movements.

Although there must be some additions that can be added to this indicator, and this is still reasonable because this indicator is still a new indicator so there are still many shortcomings. To cover these shortcomings, it would be better for traders to be wiser in using them together with other indicators in order to improve the quality of making trading decisions on the cryptocurrency market.

CC:

@wahyunahrul