Trading Cryptocurrencies- Crypto Academy / S4W6- Homework Post for @reminiscence01 by @swaylee

Good day prestiged readers, I welcome you all to my week 6 assignment on the Steemit Crypto Academy. In this post I will be giving you an in-depth look into the trading process especially with respect to types of trading with advantages and disadvantages and various kinds of orders in trading and the best part is that we are going to be practicing them. Let's have a look at the first question.

Explain the following stating its advantages and disadvantages: (i) Spot trading (ii) Margin trading (iii) Futures trading

As someone interested in trading cryptocurrencies, you would have to have a little knowledge of what you are signing up for and knowledge of what kind of trading best suits you because if you just jump in and attempt anything you see then you are doomed to make numerous loses. Below are the various trading styles available to traders.

Spot Trading

When I got introduced into the world of cryptocurrencies, I started with the binance app because it was the easiest to work with, very trusted, reliable and it was widely used around the world. It was on binance that I got to know about spot trading. From the name, we can analyze that the trade is carried out immediately (on the spot). Spot trading involves the direct interaction between the buyer and the seller where the assets are bought or sold and the buyer takes ownership of such assets immediately the payment has been made. They are sold/bought for current price of the asset as at the time of the purchase/sale called the spot price and this trade is usually carried out in the spot market. As newbies in crypto trading, it is adviceable to start with spot trading as we can keep the currency and wait for it's price to rise so we can sell and make some profits. It is the easiest trading method. Some key points to note in spot trading are; you can choose to hold on to those currencies for as long as you like for they cannot expire. The two main types of spot markets are Over the Counter (OTC) and market exchanges. Attimes the delivery doesn't get completed immediately so it would be completed in T+2 which means from the day of trade + 2 working days.

Advantages of Spot Trading

- The trade is carried out on the spot. The buyers recieve the assets they paid for once the payment has been confirmed. No need to tie funds away in expectation for the goods which might never come.

- It makes us make better trade decisions. Due to the volatility of the Crypto market, a spot trader whose assets have reduced in value can easily hold on to them and wait for a favourable moment to trade with ease as he has full possession over such assets and is under no pressure to get rid of them.

- Low capital requirements. Spot traders can begin their trading with little or a standard amount of capital unlike in the case of some future trading contracts where the capital requirement might be too big for one to handle.

- They are easier to carryout. Contracts in spot trading are much easier to carryout since you basically make an order and make payment based on the current price and in no time you get your assets. The system is much easier compared to that of the futures trading which is complex and needs a certain level of mastery. A newbie would find spot trading much easier than future trading.

Disadvantages of Spot Trading

- High risk of loss during trade. Especially occurs with traders who have the fear of missing out and buy in large scale when the cryptocurrency is at it's peak, then as soon as the purchase is made and the assets have been transferred to the buyer the assets price could fall rapidly making the buyer lose so much if he decides to panic sell.

- Not enough profits. For spot traders with large capital, it would be more profitable to make use of future trade or margin trading to get more profits instead of relying on the spot trading mechanism.

Margin Trading

I always come across this kind of trade on the binance app but I would overlook it but now that I have made a kind of in-depth look into it, I have come to realize that margin trading is a situation where traders borrow assets from other investors or even in some rare cases the exchange platform to contribute to their capital so they can leverage their positions. It basically allows traders to make spot transactions with the help of borrowed funds. The investors who lend them the money would also earn interest. Margin trading has the ability to multiply the traders capital if the transaction goes as predicted so it is necessary to accumulate alot of capital. It has a higher profit than spot trading but also has a far higher level of risk.

As a trader, if you keep making loses, the third party who lent you the funds can issue a margin call and the essence of this margin call is to alert the debtor to find a way to keep the funds from going below the minimum value or the maintenance margin and if this margin call is not adhered to he can perform a forced sale. A forced sale occurs when the third party investor closes any open position so as to maintain the minimum amount of funds that is supposed to be in the account and this can be done without the consent of debtor.

Advantages of Margin Trading

- It gives Higher Profit. By allowing Investors to borrow funds and trade, they can make much more profit without necessarily adding more capital. For example, I borrow N100,000 naira to add to my N100,000 naira capital making it N200,000 naira and we are able to make a 30% gain, that means I can pay back the investor and still have N160,000 naira

- It opens investors up to better opportunities. The problem of many experienced and professional traders is the lack of adequate capital but this can be prevented because margin trade allows for borrowing so as to enable traders raise capital.

- Since the margin trade is enjoyed by those with higher purchasing power, investors can make use of their capital and borrow from third parties to raise their investments.

Disadvantages of Margin Trading

- It has a very high risk. Let's not forget that anything that has a high reward also has a high risk. One can stand to lose more than they invested and this won't be good for the investor as his/her can be liquidated by the broker if they cannot pay up the amount they borrowed whether he/she approves it or not

- It requires high level of expertise. A newbie in the Crypto world can't just start his journey and jump right into this kind of trading. Anyone who wants to survive or make profit in this system must be able to carryout proper Technical analysis and make the right decisions.

Futures Trading

Last but not the least we have futures trading, I'm sure alot of us must have heard this either from a friend or some of us trade futures. I got quite the worst first impression from futures trading and this goes to show that newcomers are to stay away from futures trading until they have a fair share of knowledge and expertise. Here traders make price predictions and depending on their predictions, they make gain or they lose. Here once can multiply his profits without really having very large capital. In futures trading, the trader sets a quantity of a particular asset to be bought or sold at a predetermined time in the future.

Advantages of futures trading

- One can make large amount of profits with little or standard amount of capital. Unlike in the spot trading where your capital earns you your assets worth or in the case of margin where you have to borrow to make up your capital, the futures trading can earn you great rewards with your standard capital.

- It enables traders to make better decisions. When compared to spot trading, future traders have alot of decisions to make and analysis to carry out in order for their predictions to come through inorder to make profit so it's not just something you rush into. You have to think twice and know exactly what you are signing up for.

Disadvantages of Futures trading

- Investors here do not really own the assets in question unlike in spot trading where you take ownership of the asset once the payment has been confirmed.

- From my first experience with futures trading, you stand to lose alot when your prediction goes wrong and if you keep making the wrong decisions or jumping in without making proper analysis then you might continue making large losses.

- Inability to predict the future. We are in a world of many possibilities, an event can take place before your predicted time, change the tides of the currency you predicted and also ruin your whole analysis.

2a) Explain the different types of orders in trading.

2b) How can a trader manage risk using an OCO order? (technical example needed).

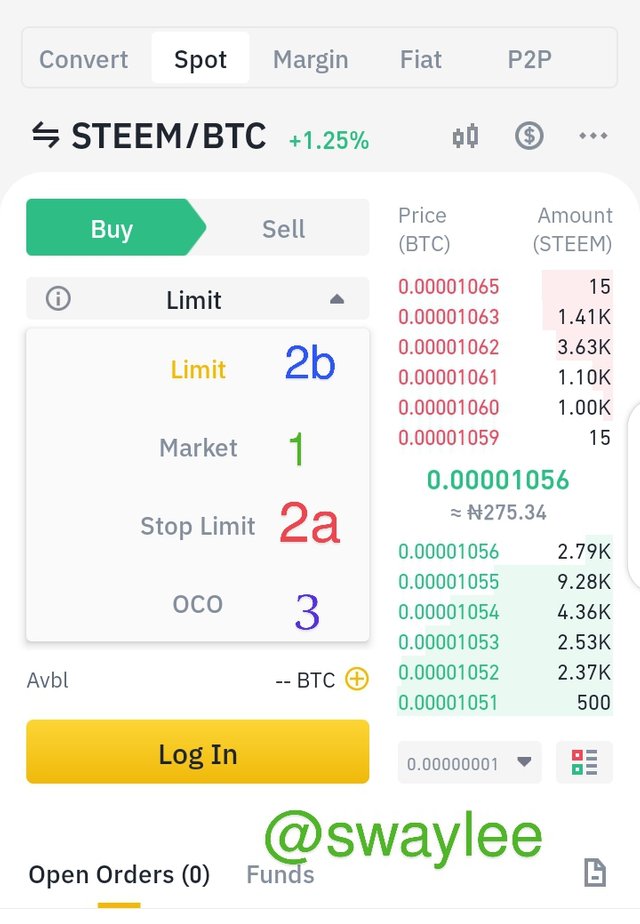

The various types of orders are 3 in number and we will be looking at each of them individually. First we have the

1. Market order

When it comes to a market order, the investor places an order to buy or sell an asset at the current market price. They are price takers meaning they take whatever price is given to them without trying to have their way. This order is executed quickly because it depends on the current market price and not a determined/specific price. The traders that use this are market takers. I personally use this order whenever I want to convert my SBD to steem so can power up. For example, I place a buy order on BTC so it doesn't matter whether the price is was $55,555 and dropped to $52,555 at the time of the order, it just executes the order based on the current price.

2. Pending order

When we talk about a pending order, the investor places some requirements for the order to meet before it gets executed so it stays pending until those requirements have been met hence the name pending order. Traders in that make use of this kind of trade are known as market makers because they try to bend the market to their favour. There are other kinds of orders classified under the pending order which are the limit order, the stop-limit order and the One Cancels the Other (OCO) order so let's have a look at them. shall we?

Let's start with the

• Stop-limit order:

This order offers combined features of both the stop order and the limit order as you can see from the conjoined name. In this kind of pending order, the order has to reach the stop level before transitioning into the limit order function meaning after reaching the stop price it then executes the order whenever the limit price is achieved. It is used to reduce risks.

• Limit Order:

This is an order given by the investor to buy/sell whenever the order reach a certain point or lower. If it is a sell order, he/she can place a high price so the order only executes whenever it gets to that price or even higher. If it is a buy order he/she can place it on a low price so the order would only execute whenever it falls to that price level or even lower. Let me give a practical example before we proceed. I set the order to buy btc whenever it falls to $51,555 so until this requirement is met, the order won't be carried out. But if it can fall to this $51,555 or lower the order will be executed.

• One Cancels the Other (OCO) order:

In this kind of order, two different orders are placed but only one of them is to be executed. So depending on the one that is executed first, the other gets cancelled hence the name one cancels the order. It also helps reduce trading risks. For example, steem price ranges from $1 and $1.5, the trader would place an OCO order consisting of two orders, the first would be a buy stop order just above $1.5 and a sell stop order just below $1 so when one of them gets executed, the other one would be cancelled.

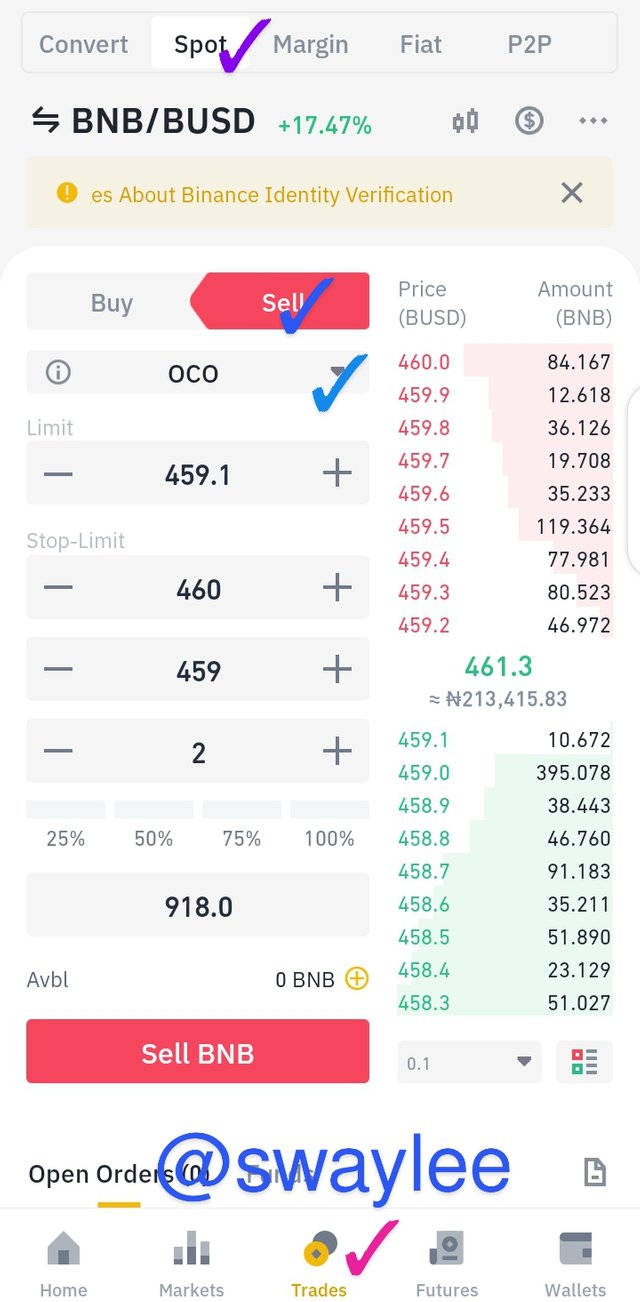

Now for how a trader can reduce risks using an OCO order, I would be explaining it below with a practical example

As I said earlier, an OCO helps reduce risk and why do I say this. We basically set 2 orders, a buy limit order and a stop-limit order and depending on how to we set it we stand to greatly reduce risk. The 2 orders were set in a bid to check and avoid losses so whenever the sell limit order criteria has been met, the stop limit order gets cancelled and vice versa.

I went to the binance app, clicked on trades as seen ticked above then clicked on spot and set it from limit which you would see initially to OCO then set the 2 orders and execute. From the screenshot above, A sell limit order to sell 2 BNB at $459.1 and also a stop-limit order to sell 2 BNB at $459 when a stop price is hit at $460.

3. Exit Order:

This kind of order can further classified into two namely the stoploss order and take profit order. I would be starting with the stoploss order.

• Stoploss Order:

When trading, attimes things go out way and attimes they don't go as planned, this is where the stop loss order comes in. Here the trader sets the order to automatically execute when the security reach or goes through the stop price. This order is used when our prediction doesn't go as planned.

• Take Profit Order:

This is an order usually used to maximize the amount of profit one can make from that trade. We can even call it the direct opposite of a stop loss order. In this order, the trader sets the trade to executed at a higher price than the current price in a bid to try and see how much you can make from the trade. When ever the price gets to the required level then the order is executed.

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

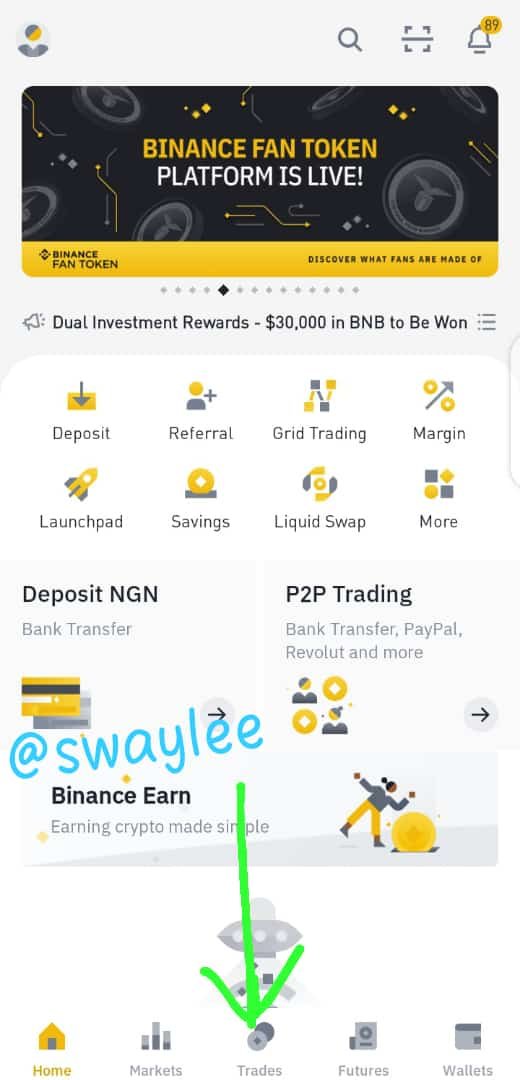

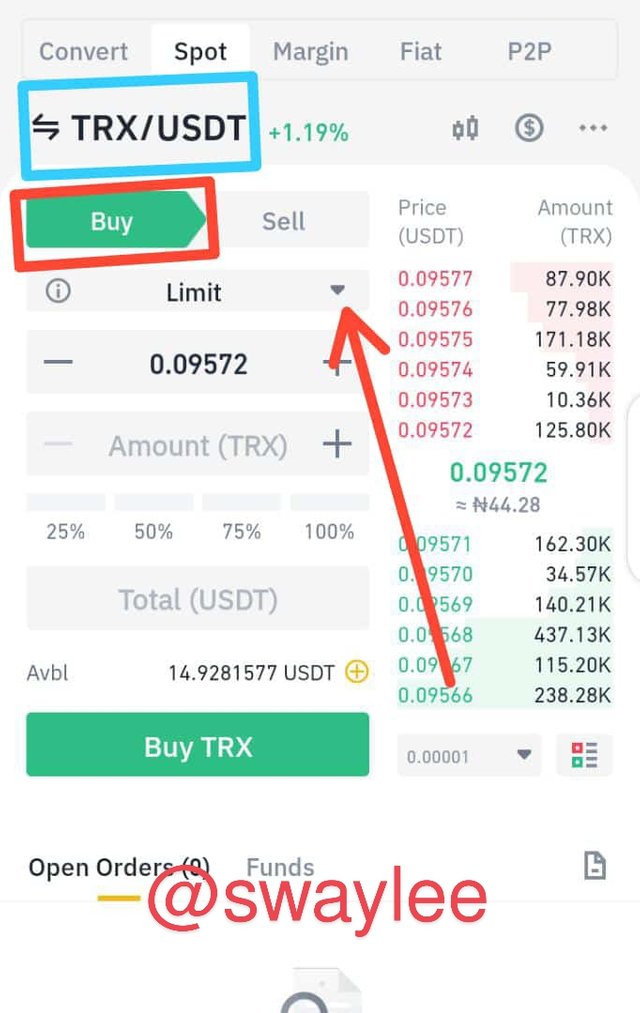

- Step 1: First off, you start by opening the app in question. Here I made use of the binance app

- Step 2: Click on Trades which is the 3rd icon at the bottom.

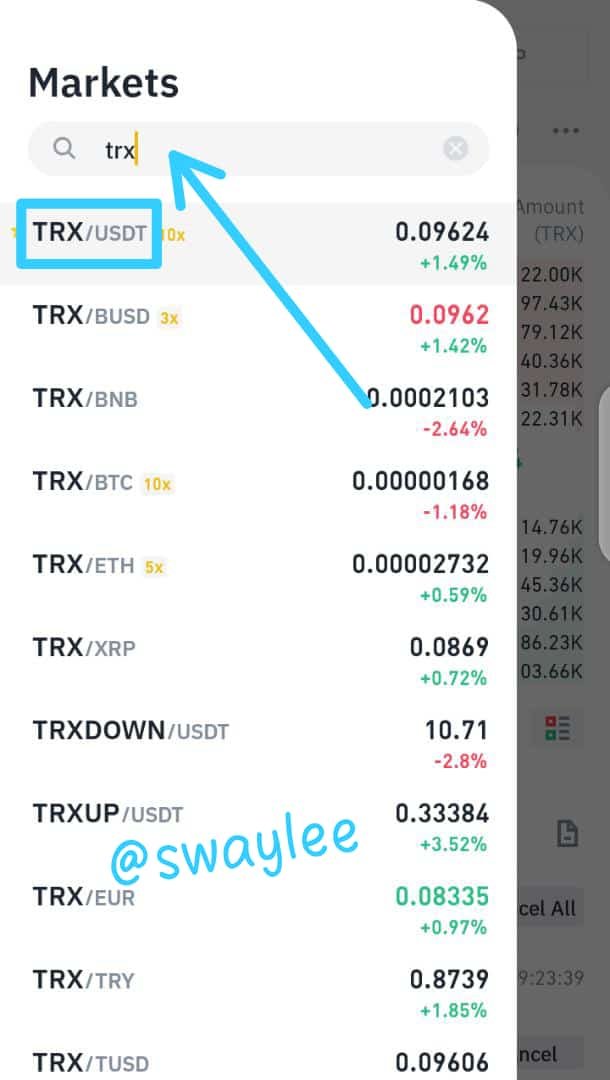

- Step 3: Search for coin pair you want to trade and select it so it shows at the top of the trade section.

- Step 4: look at the arrow. That section would be at market so you would have to set it to Limit order. Select the order you want to make whether it is a sell or buy order. As you can see in the diagram above, it is a buy order.

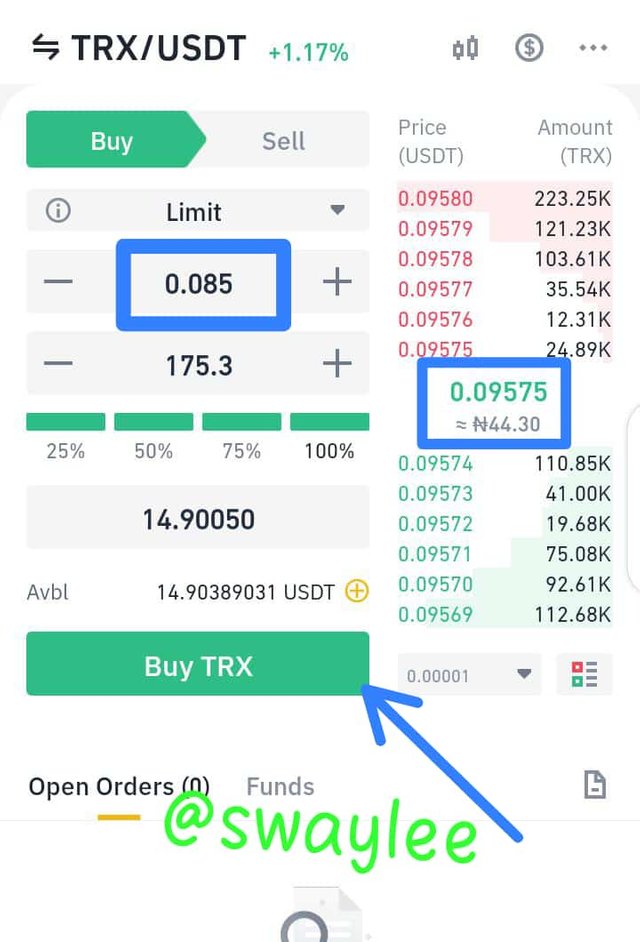

- Step 5: Tweak the price a little as seen below, set the exact amount you would prefer to trade with then click the buy Trx. In this context, we are trading 14.9 USDT for 175.3 Trx and a limit order has been set so the order won't be executed until it reaches the limit price or below.

- Step 6: As you can see the order has been made successfully and now we wait. These are the steps necessary for carrying out a buy limit order.

All the images used in this work are screenshots taken by the author on the binance app

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected. (i)Why you chose the crypto asset (ii)Why you chose the indicator and how it suits your trading style. (iii)Indicate the exit orders. (Screenshots required).

I opened a meta Trader 4 demo account. As I was speculating, I noticed that monero (XMR) was bearish so I set my fibonacci extension to ascertain how much the market had fallen and how much it got retraced. From the chart below we can see that it was in an uptrend before it fell and made a retrace but it encountered a small resistance. It was still in an uptrend so I made use of my MACD indicator and found out that the downtrend was coming to an end as the Indicator crosses the red line it signifies that buyers are in control. So we can say that my MACD indicator gave me a go ahead to buy.

I also made use of my RSI indicator and found out that it was going towards the oversold region meaning that at any moment the buyers can take over. I made use of the price action and the two indicators to conduct my analysis and confirm that there was going to be an uptrend

Conclusion

Trading cryptocurrencies is not a new thing. We can all trade cryptocurrencies depending on our level of expertise and the kind of trade we want to carry out. From the above work, we are able to figure out what kind of trade a newbie can carry out and the amount of capital he/she needs to carryout such trade. We should also put in mind that to be able to trade effectively it would involve proper analysis and market study and not just random guessing and false signal predictions. Once the appropriate technical analysis is carried out, we are sure to make profits.

Hello @swaylee , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Thank you so much for this kind words. I really took my time to do this assignment so I could impress you. I'm really glad it worked.