WHY BITCOIN IS ACTUALLY A DIRTY LITTLE BASTARD!

As bitcoin gains momentum among general population, especially during price spikes and media fuss, energy use of the network spikes too. Even though informative articles compare that energy use to various countries (Digiconomist metrics currently show Israel at the time of writing – see here), it is not that simple! Headlines currently circling around the World Wide Web are full of worrisome articles about bitcoin mining operations emitting as much carbon emissions as 1 million transatlantic flights, consuming more than 159 countries and so on. Read those spectacular headlines. Those are good warnings, it makes sense to start with awareness raising in the early phases. While many people are trying to deal with estimates, unless we have concrete data, or at least the slightest hint of what’s going on, it’s all mumbo jumbo. Inform yourselves but take it all with a pinch of salt. As everyone in the cryptoverse states, Do Your Own Research (DYOR). Even though it is mumbo jumbo, the point they are making is absolutely right. Bitcoin is a dirty little bastard! And not only Bitcoin - Ethereum, Litecoin, and all other cryptocurrencies. This is not because it is their nature, it is because we are not yet ready. Our infrastructure is old and inefficient. We lose more than we can afford to, we produce more to make up for the losses. Vicious circle, isn’t it?

But, let’s leave solving real-world problems to engineers, we should worry about our cryptocurrency gains. BTW, this is what being an engineer means:

Do we really want to leave the fate of the world in the hands of these people? A joke, but not as much as you think (I’m one of them). An explanation very close to reality. But let’s get back to the topic of the article, the dirty little bastard(s).

The puzzle

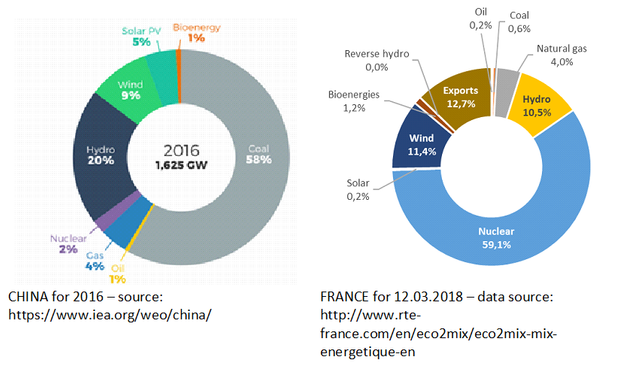

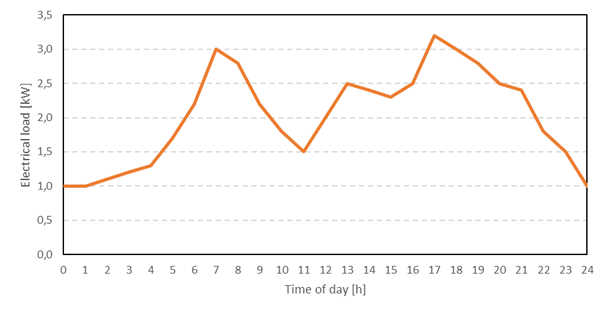

The estimates on cryptocurrency energy consumption figures, they are what they are… We’re to blame, it’s on us to make it better. Now… to the beginning of the problem. Electricity supply infrastructure of a country consists usually from various different types of plants. We can show this through two examples, for instance China and France.

Here we see perhaps the most obvious difference. Coal has approximately 58% share in energy production mix in China. Nuclear has more than 59% share of energy production mix in France. The conclusion is…complete opposites (you can find other opposites yourselves). Perhaps it is easier to check the data in a table.

Wonderful, right? Another conclusion is that China’s electricity system creates much more carbon pollution than France’s (I’m not going to discuss the problem of nuclear waste disposal, DYOR). And, on top of that, France has 12,7% of capacity reserved for export (again majority nuclear plants). There is, however one important detail in the whole story – plant operation regime.

Plant operation regime

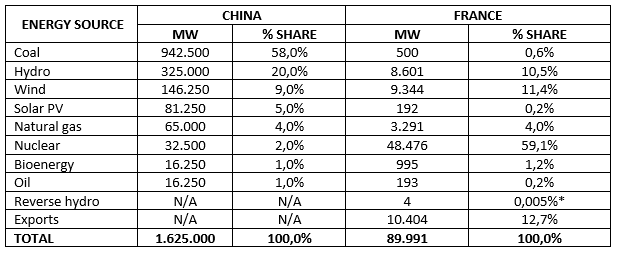

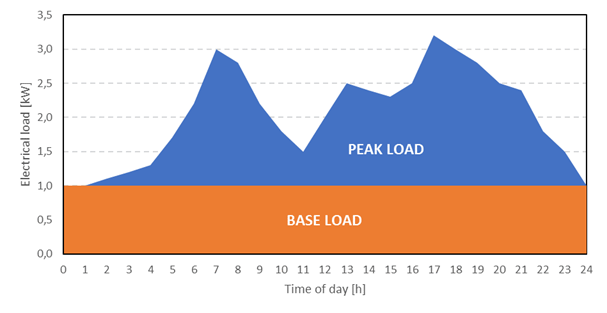

According to the traditional belief, there are two types of plants: base load plants and peak load plants. Base load power plants generate electricity to meet the minimum demand of the system, while peak load power plants generate electricity when the demand increases. I must state here that I do not believe that this is the only way of running the electrical system, that’s why I mentioned “traditional belief”. So that’s that. Let’s see that load thing on a typical daily electricity load chart.

So…this is what a daily electricity load curve looks like, e.g. for a typical household. Notice that there is always some load, approx. 1 kW at midnight? That’s the minimum demand which must be produced, i.e. base load. This is what typically your fridges, freezers and devices in stand-by mode use. The rest is peak load. Let’s see that again now that we know the difference.

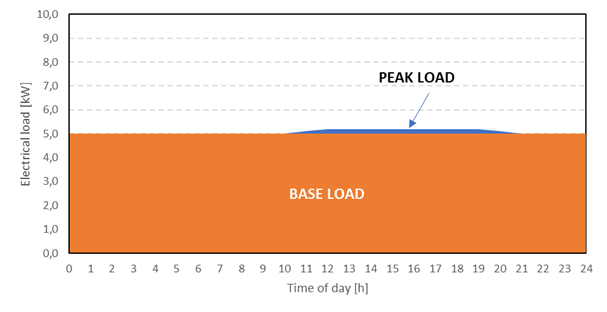

Now we know what a household electricity load curve might look like, shall we take a wild guess at what an electricity load curve of a cryptocurrency mining operation might look like?

You’d want to mine 24/7, 365 days a year, right? Constant load, right? This maximizes your profits.

See the difference compared to the household? In general, this is perfect – the energy supplier can easily predict the energy load for a cryptocurrency mining operation, it’s almost a constant! No volatility, no extreme peaks, no huge differences between minimum and maximum loads. Electrical engineer’s dream, they will all confirm that, trust me on that one! This means selling more of the cheaply produced electricity from base load plants at market price. Higher profits! Every economist’s dream! But as always, simplicity has its drawbacks.

Base load plant

A typical base load plant is operating majority of time throughout the year and providing stable output at every single moment. It is the backbone of the electrical system with its stable and massive output. But even though it is the backbone, that does not necessarily mean it is good (they’re usually bad bad boys). So, if you look at the comparison between China and France again, what would you say base load plants are in these cases?

You’re right! Coal in case of China and nuclear in case of France. These typically are the most frequently used base load plants. Both are equally bad – burning coal creates insane air pollution and nuclear… well, we all know what happened in Fukushima and why a lot of countries in Europe started phasing out or announcing phase outs of nuclear plants. Of course, there are other examples of base load plants, such as hydroelectric plants or geothermal plants. Don’t be fooled that base load hydroelectric plants are renewable energy sources because they are not. They are massive and require an equally massive change of the environment (including relocation of people, infrastructure, landscape destruction). They can even create potentially bad effects for the climate. Google about it a bit. Geothermal is the perhaps the only source we (for now) believe is up to a certain extent “clean”. Biomass is an option too, but it would require burning unsustainable amounts of biomass in most cases.

“Instead of coal fired power plants, we could use natural gas power plants, which are considered to be much “cleaner”.” – says the reader.

We could, but it boils down to profit. Natural gas is much more expensive than coal – google it. Again, the bloody economics! Due to their massive capacities, base load power plants typically require huge investments, but have really low fuel costs compared to other plant types. Calculate the lifecycle costs and you’ll see the results.

Peak power plants

Peak power plants operate whenever the electrical load grows beyond the capacity of the base load power plants. That means that peak power plants do not operate the same number of hours as base load power plants. Plants of this type usually use natural gas or oil. They can be powered with hydro power, solar power or any other power source us engineers have thought of.

Well, if you operate less, you sell less energy compared to base load power plants, right? And you still have a higher fuel cost than base load plants (except renewables). That means your electricity is much more expensive to produce.

The dirty little bastards

Allrighty, now we know the difference between base load and peak load power plants. We’ve shown what base load means and what a typical household might require. Both base load and peak load. Emphasis on the peak load since the base load is quite small. We’ve also shown what a cryptocurrency mining operation might need. Both base load and peak load, but this time with a strong emphasis on base load (remember the example chart). This means that the biggest share of energy used by a cryptocurrency mining operation will be from base load power plants. Check China case again and see which plant that is. Right, coal plants have the biggest share – which means base load. As I mentioned at the beginning, all cryptocurrencies are dirty little bastards. Cryptocurrency mining operations require constant electricity supply and that’s why they are so dangerous. All of a sudden coal fired plants have a strong reason to survive. We are constantly striving to consume less and less, but then comes a speculative asset and throws efforts made in the past 15-20 years down the drain.

But does this mean we’re doomed? No, of course not. It’s just a hurdle we’ll have to skip, but this is a major drawback for the environment for the sake of profits (as usual). In the era of major discussions about climate change and renewable energy sources, we’re trying to keep the dirty bastards alive. Perhaps this is the last breath they take?

What I believe Bitcoin managed to start is a new level of innovation. I believe that the cryptoverse can accelerate development of modern energy systems where we don’t need coal fired plants anymore to have a stable electricity supply. I believe that this will only accelerate the transition to a carbon free future and renewable energy sources, especially considering all the money that revolves around cryptocurrencies. Lately, quite a few new energy focused projects in the cryptoverse have been underway (PowerLedger, WePower, Restart Energy MWAT) and those just might be the ones which contribute to the change. See for yourself.

Meanwhile, try to reduce your climate impact as much as possible, even one person means the start of a change. Spread the word, make a difference. Alternatives are always there, it is just the matter of your choice.

Comment, like, don’t like, just stay informed.

*rides into the sunset

Coins mentioned in post:

Take a look at #SolarCoin and #Gridcoin. The former incentivises clean energy generation, the latter distributes its currency based on the amount of useful computations done.

There are answers, its just many in the crypto-space arent ready for change; irony for ya.

Well, crypto-space is not the only issue in this case. The changes in the hundreds of years old energy systems are the biggest issue. How to force the huge monopolists to change their energy systems? How to enable fair market competition? The energy transformation might take another 25 years and I believe that blockchain technologies can offer a lot in that transformation cycle.