August jobs report: job market 'falling back to earth,' unemployment rises to 3.7%.

Paul Davidson USA TODAY

Paul Davidson USA TODAY

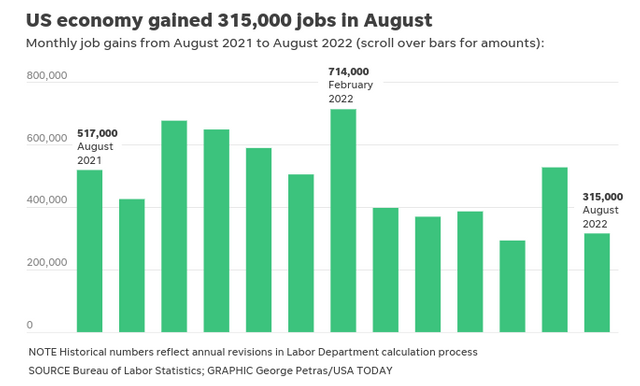

Hiring slowed sharply in August but remained sturdy as employers added 315,000 jobs despite softer consumer spending gains, rising interest rates and a sputtering economy.

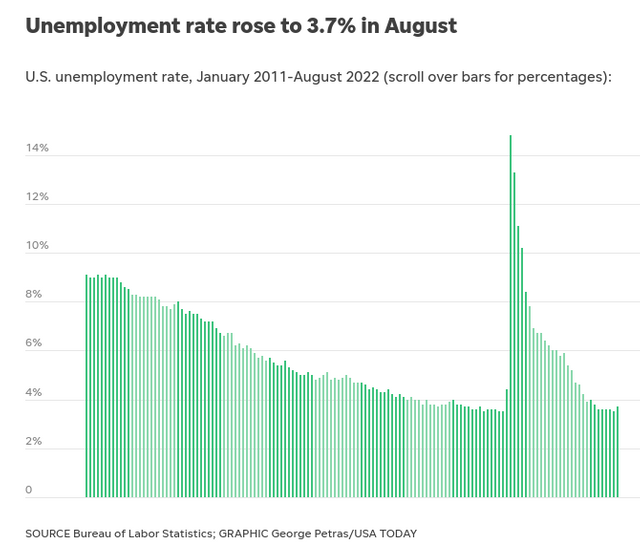

The unemployment rate rose from 3.5% to 3.7%, the Labor Department said Friday. That's because the labor force -- the number of people working and looking for jobs -- shot up by nearly 800,000, with many of those on the sidelines streaming into a favorable labor market.

Economists surveyed by Bloomberg had estimated that 300,000 jobs were added last month.

Job gains for June and July were revised down by a total 107,000, painting a somewhat less booming picture of the labor market than previously believed. The change for July was small, still leaving that month with a blockbuster 526,000 additions. But the revision means the economy recovered all 22 million jobs lost in the pandemic in August rather than July as initially thought.

“The job market we see today can’t keep defying gravity and is falling back to Earth," says Daniel Zhao, senior economist at Glassdoor, a leading job site.

What field has the highest job growth?

Professional and business services led the August advances with 68,000. Healthcare added 48,000 jobs; retail, 44,000; and manufacturing, 22,000.

Leisure and hospitality, which includes restaurants and bars, the sector hit hardest by the pandemic, added a relatively modest 31,000 jobs after averaging 90,000 the first seven months of the year. The sector, which has been struggling to find enough workers, remains 1.2 million jobs short of its pre-COVID level.

One encouraging sign: The portion of Americans working or looking for jobs jumped from 62.1% to 62.4%, matching the recent peak in March but still well below the pre-pandemic level of 63.4%.

That share had been rising as workers returned to a hot labor market after caring for children or staying idle because of COVID-19 fears. But it broadly edged down in recent months, suggesting widespread labor shortages could persist and push pay increases higher. That likely would further fuel inflation that’s close to a 40-year high.

In August, average hourly earnings rose 10 cents, keeping the annual increase unchanged at a still-hefty 5.2%.

Slowing job growth and the big rise in the labor force could help moderate inflation and lead the Federal Reserve to raise its key interest rate by half a percentage point this month instead of a third straight three-quarters point hike, says economist Michael Pearce of Capital Economics.

Labor Secretary Walsh reacts

In an interview, Labor Secretary Marty Walsh noted the labor force participation rate for prime-age workers (25 to 54) is now just below its pre-pandemic level at 82.8%. The rate for women in that age group, at 77.2%, shot past its pre-COVID mark last month.

“We’re getting Americans back to work,” Walsh said.

He partly credited the greater availability of child care workers and services as well as companies’ increased willingness to allow employees to work remotely, at least some of the time.

How does the jobs report affect the stock market?

Markets open higher Friday with the Dow Jones Industrial Average rising 130 points, or 0.4%, as of 10 a.m. EST. The S&P 500 was also up 0.4%.

Why is it so hard to hire right now?

Many experts reckoned August finally would mark the start of a pullback in payroll growth now that the U.S. has recouped all the jobs lost in the pandemic. So far this year, the labor market has averaged 438,000 monthly payroll gains, shrugging off a shrinking economy, soaring inflation, and mounting recession fears.

Persistent labor shortages have made many companies reluctant to cut staffers and even encouraged some firms to bring on workers they don’t need in the current wobbly economy with an eye toward an eventual rebound.

And some industries, like restaurants and bars, are still well below their pre-COVID employment levels and struggling to catch up as Americans resume dining out, traveling and other activities in larger numbers. For now, the robust job numbers mean more household income and spending, insulating the economy from a recession, at least in the short term.

Tom Bemiller, CEO of the Aureus Group, which owns three auto body shops in the Philadelphia suburbs, has seen sales surge since the second half of last year as Americans began driving more after cutting back early in the pandemic.

He has hired three technicians so far this year and plans to add five more. But, he says, “It’s very challenging. It’s rare that somebody responds to a job ad.”

The labor shortage “has required us to make changes to the business model,” Bemiller adds.

He has started bringing on some mechanically-inclined workers with no auto body experience as apprentices. Until they’re trained, they perform simpler tasks, like dismantling parts on damaged cars while more skilled technicians do repairs, he says.

While the labor market remains strong, most employees who were laid off in spring 2020 have been rehired, leaving less space for outsize employment gains in the months ahead. Also, aggressive Federal Reserve interest rate hikes to fight inflation have been expected to eventually dampen business hiring and investment.

Contributing: Elisabeth Buchwald

Moody’s Analytics predicts payroll advances will slow to about 100,000 a month by the end of the year. Some economists are forecasting a recession by the middle of 2023.