SLC | S21W2 | Costs for entrepreneurs - Cost elements

Greetings from

Sitaraindaryas,

.jpeg)

I hope all are fine and happy. Here i am back to participate in steemit learning challenge. I hope all of you really love and kike my this participation post that is related to costs and financial accounting. So, let's start writing.

What is the relationship between costs and financial accounting?

Costs and financial accounting have a effective relationship between each other because the costs have a very close relationship with financial accounting, as they are the fundamental components for evaluating the company's profitability and it's efficiency. Financial accounting is uses costs to assess with the company's profitability and it's efficiency. In which the costs are the recorded & classified to determine cost of manufacturing, the values of inventories & the company's total net income. Below in table there are the some key points that highlight the relationship between costs and financial accounting.

| To Recording & the Classifying Costs | As you know the financial accounting classifies costs into different categories such as fixed & variable costs, direct and indirect costs. |

| To Determining the cost of manufacturing & Production | Costs are also used to determine the total cost of manufacturing & production and services that offered by the company. |

| To Valuation of the inventories | Costs are used to evaluate the inventories & determine their values at the balance sheet. |

| For calculating the net income of company | Costs are subtracted from the revenue to calculate the company's total net income. |

| To analysis of profit | Costs are also used to assess with the profitability of the company business and make informed decisions. |

| For the financial reporting | Costs are presented in the financial reports, such as the income statement and the balance sheet etc. |

| Decision making | Costs are critical to strategic decisions such as pricing, asset investment, and project evaluation. |

In short, costs are the crucial component of the financial accounting, as they allow to the company to evaluate it's profitability and it's efficiency and make informed decisions at all.

Establish the difference between fixed costs and variable costs, providing examples of each.

Fixed costs are those that do not relay with the company's level of production or it's sales. These costs are incurred to the regardless of quantity of products or services they produced or sold. Here there are some examples of fixed costs such as, the rent a plant, salaries of management & administrative panel & employees, the depreciation of equipment and machinery, Insurance of company, it's fixed advertising costs auch as media ads & publicity etc.

Variable costs are those that are directly relay with the company's level of production & sales. These costs can be increase or decrease that is depending on the quantity of products or services they produced or sold. These are some examples of variable costs such as, Direct raw material, Direct labor, Manufacturing supplies (materials, fuel, etc.), Sales Commissions, Shipping and delivery costs, Packaging and shipping costs

Variable marketing and advertising expenses (promotions, etc.), Key differences between Fixed Costs and Variable Costs:

In a real or fictional case, identify the cost elements in manufacturing a product or providing a service.

In the above question's answer i clearly clarify the difference of fixed and variable costs, so in the case of manufacturing any product such as a wooden furniture, i will easily identify the cost of elements that are use in the manufacturing of this product,

| Rent of Factory | 3000$ |

| Employees Salaries | 8000$ |

| Equipment & Machinery | 1500$ |

| Company Insurance | 500$ |

| Raw Materials | 1000$ |

| Daily labour | 400$ |

| Shipping costs | 300$ |

| Other Utilities | 100$ |

| Daily Building Maintenance | 50$ |

Here i fictionally identify the cost of wood furniture manufacturing as it's fixed and variable costs. I hope it is enough for the answer of this question.

The company Steemians manufactures a single product. During a given period, the following costs were incurred

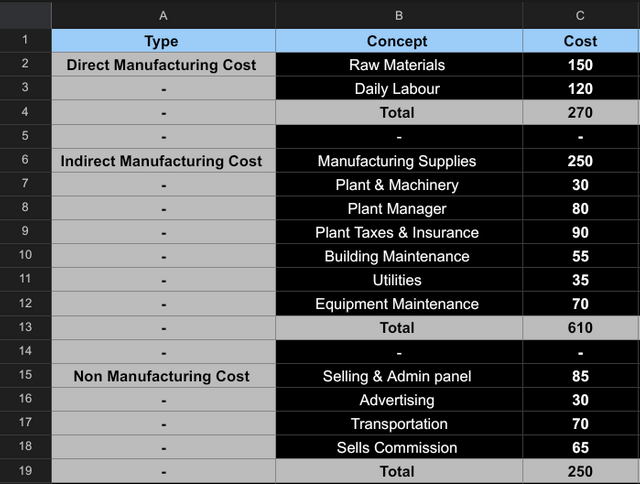

I have describe my steemian company costs into 3 categories such as Direct cost, Indirect cost and non-manufacturing costs. In which my total direct cost is 270 for factory rent and labour salaries. The total cost of indirect manufacturing is equal to 610. And non manufacturing cost of this company is 250. So, here in the below i put my company cost data in excel sheet.

Here now i stop my writing by inviting my friends @ashkhan, @suboohi, @aaliarubab for participating in this challenge. Cc, @yolvijrm & @adeljose Thanks for teaching us.

Regards,

Sitaraindaryas

Thank you.

Cc,

@yolvijrm