Steemit Crypto Academy Season 2: Week2 | Homework Task( Cryptocurrency Contracts For Difference (CFDs) Trading) by @silencewan

INTRODUCTION

Hello guys, it's another week of the crypto academy homework assignments. Today we will be dealing with Cryptocurrency Contracts For Difference (CFDs) Trading. But before I want to commend the hard work of professor @kouba01 for his wonderful lecture note. I must say that it was really simple and understanding. Thanks to you for the wonderful resource.

To set the ball rolling, we must ask ourselves some questions, what a CFD trading is. In other to understand the question at hand, these are some questions we should ask and try to make our research in the direction of that

Question One

What is a cryptocurrency CFD?

Cryptocurrency is a type of digital asset or a digital currency. it does not appear in physical sense as is the case with regular fiat currencies such as the Dollar and the Euro. Cryptocurrency not regulated or managed by any financial authorities or banks in the same way as traditional currency, but is mostly self-regulated, using various encryption techniques.

CFDs works by an individual putting down a portion of his investment amount. So this simply means that leverages can multiply the prices change on what profit the investor has gained or loose. This could sometimes lead to you losing money rapidly.

Cryptocurrency CFD is then defined as a way in which an investor can hypothesize in the change of price of a cryptocurrency, examples are ethereum or Bitcoin.

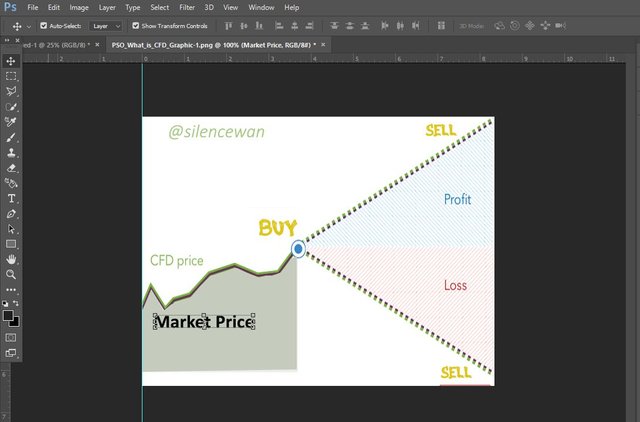

The CFD Market Chart. Designed by me on photoshop

How CFDs Work

A contract for various CFDs gives an opportunity to investors to hypothesize on the future market transactions of assets available, this is done without taking or owing actual or physical delivery of the assets available. These CFDs are available for assets underlined, these are shares, foreign exchange, and commodities.

We can also determine how they work through the following channels

- Spread and commission

Deal size: Contracts vary depending on underlying assets

Duration: Keeping CFDs over time leads to an overnight charging

Profit and loss

Here, we can use the formula below to calculate the profit or loss in a CFD trade

Profit or loss = (The number of contracts x the value of each contract) x ( the closing price - the opening price)

The video link provided below teaches more for those who want to further learn how the CFD really works and what actually it entails.

Question Two

How do I determine if cryptocurrency CFDs are suitable for my trading strategy?

We will be able to determine if cryptocurrency CDFs are suitable for your trading strategy only if we make some investigations based on the following. But before, although some people profit from asset price changes it doe not work for all investors. therefore, one can determine if cryptocurrency CFDs are suitable for his trading strategy if;

The investor can endure the cost of taking risk of trading in unconducive environments. This means that the investor should be able to take the risk whatever that happens, this way you can know if your cryptocurrency CFDs are suitable for your trading strategy.

Also, investors should have a short-term plan in their trading strategy. You should not make it a long term because you do not know what might happen along the way so you can know if it's best to suit only if you have a short term trading strategy.

Investors can also know if their cryptocurrency CFDs the best suit their trading strategy if they want to profit from trading but with a very low initial startup capital.

Furthermore, an investor must also put it at the backside of his mind that buying cryptocurrency is expensive for the fellow. This way you can be quite certain with what you are dealing with. Since you know that buying these cryptocurrencies is too expensive you know what you dealing with so therefore it will be a perfect way to know if your cryptocurrency CFDs best suits your trading strategy.

In addition, an investor must lay his focus on winning small price changes. You should not just be too focus on making a huge profit. Sometimes the little you make can pull up something big as they say "Little drops of water make the mighty ocean". So investors should also focus on winning small price changes. This way one can also know if his cryptocurrency CFDs best suit his trading strategy.

lastly, one can also determine if his cryptocurrency CFDs best suit his trading strategy if he wants to benefit from entities that provide a safe trading environment through regulated CFD brokers who inturn to provide protection for the investors. This way we can also know if our cryptocurrency CFDs are suitable for our trading strategy.

Question Three

Are CFDs risky financial products?

Everything we do, there are always risk involved. That is the more reason why I will be telling you the risk involved and some advantages and disadvantages of trading cryptocurrency CFDs.

RISK INVOLVED

The risk involved is justifiable since dealing with cryptocurrency CFDs is not stable.

Price volatility: This tells us how vulnerable in price change due to an unexpected series of events that may transpire leading to changes in market value

Another risk I want to mention is price transparency. there could always be some kind of variations in the pricing of cryptocurrencies needed to determine the value of your CFD position. This means that there could be a greater risk of you not receiving a fair accurate price for the trade.

Charges and funding costs: The risky part of this is also the charges involved. Sometimes these charges significantly go higher comparing to other CFD positions.

Leverages: This is the last risk I will be talking about, some entities offer leverages up to 50:1. This leverages then tends to increase your losses and your profits,. This can also have a significant effect on fees which places you at a position of losing more than your initial investment.

Advantages of cryptocurrency CFDs

In this type of investment, you have options to various benefits over the direct buying and selling of cryptocurrencies.

Some of the advantages are

Easy setup: People who do not know much about technology are always scared with wallet opening procedures but not needed in the CFDs trading process.

Leverage trading: Having access to leverage chances is more reason why most investors go into trading cryptocurrencies via CFDs

Better regulation: There are companies with reputable financial watchdogs to protect the interest of investors thereby preventing people from being frauded.

Disadvantages of cryptocurrency CFDs

"To every action, there is an equal but opposite reaction" therefore, once there are pros there should definitely be cons.

Price considerations: Most CFD trading goes with prices, this represents the difference between buying and selling. In a case you pay it anyway not considering the outcome of the trade, you may experience losses at the time of entering into the crypto CFD position.

Trust considerations: This is based on a significant amount of trust since is CFDs based. You will need to make sure the prices stated on your broker's platform conforms to the general market value.

Question Four

Do all brokers offer cryptocurrency CFDs?

Not all brokers offer cryptocurrency CFDs. Not all the time a mediator is needed or an agent standing in between an investor and a crypto seller to perform a transaction. One can trade without having to pay fees to a centralized exchange so therefore, not all brokers offer cryptocurrency CFDs

Question Five

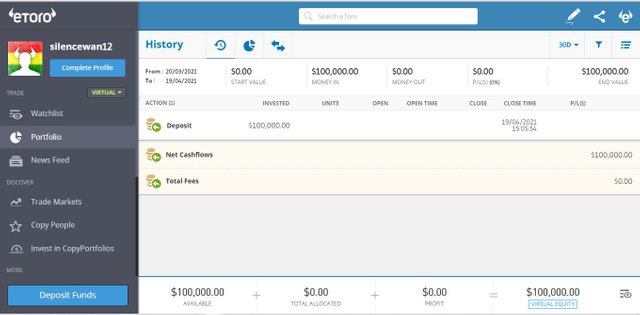

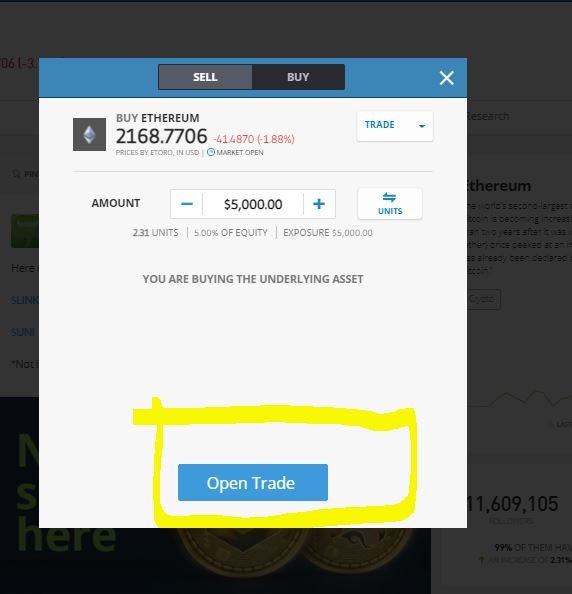

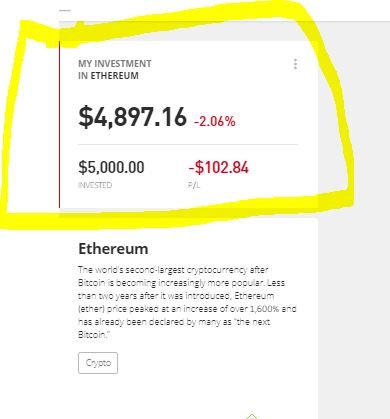

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account)

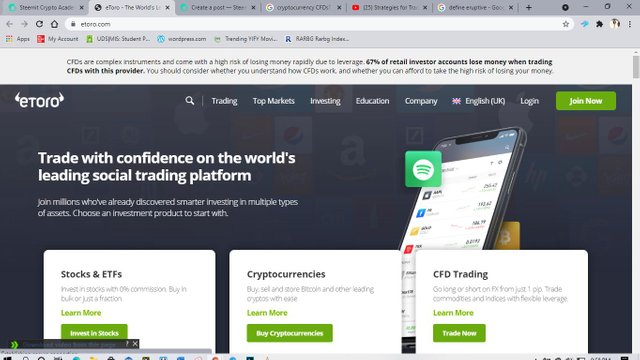

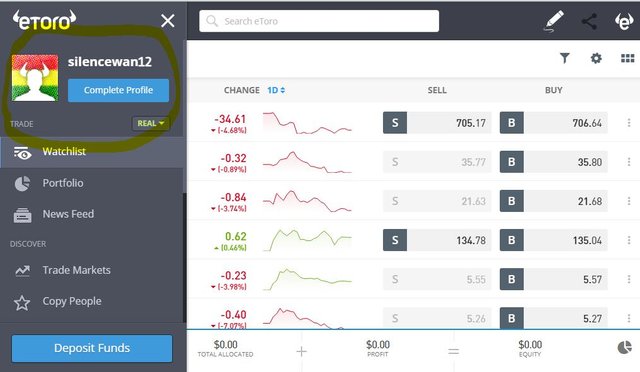

- I, first of all, visited the official website on https://www.etoro.com/

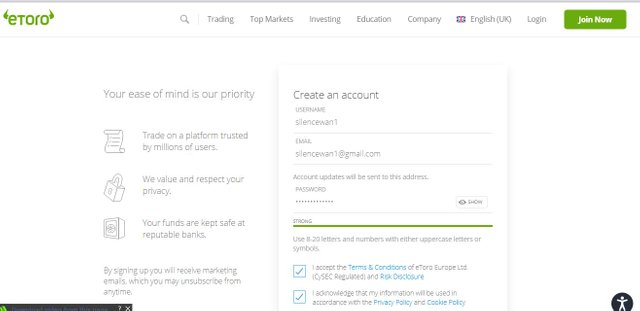

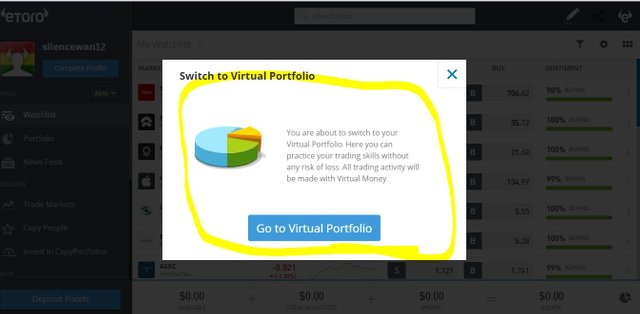

- After which I created an account first before proceeding to switch from real portfolio to virtual portfolio

- Completed my profile by visiting the profile page

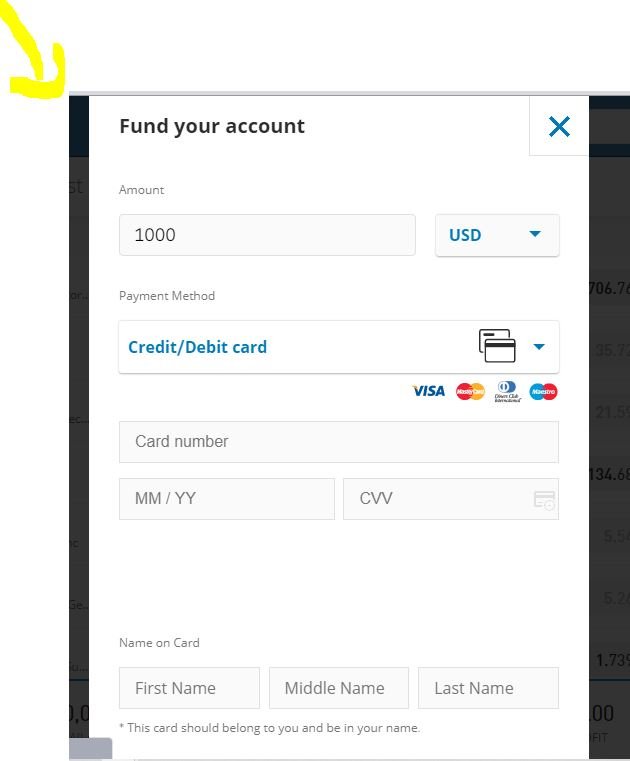

- After which I tried to deposit some funds by clicking on the deposit funds button below the left bottom corner

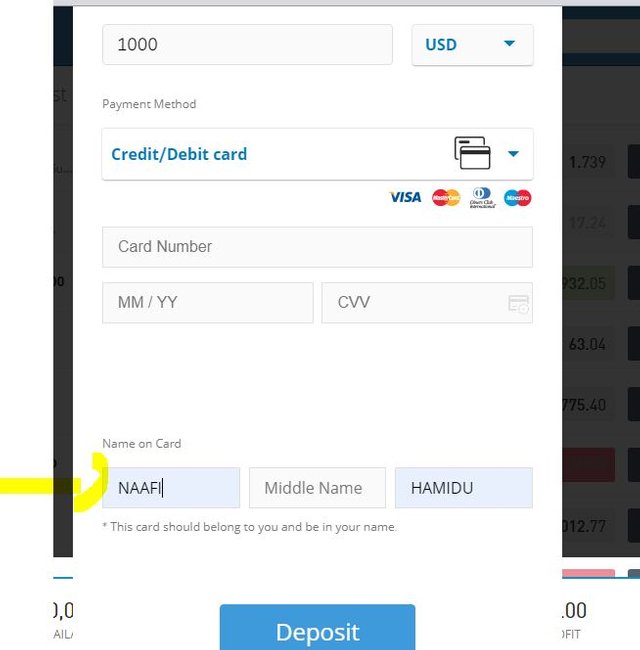

- I filled in my details with my credit (VISA CARD) to proceed.

- After that, I tried visiting my virtual portfolio to see if the transaction was successful which it had gone through successfully.

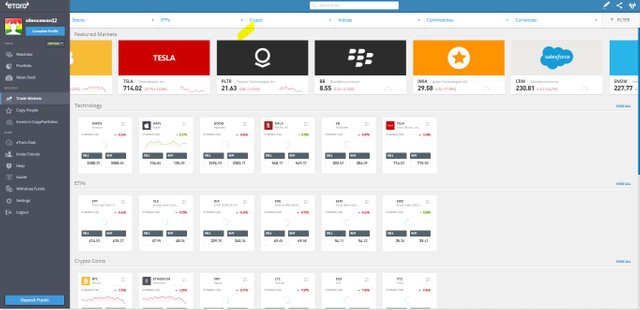

- You further move to trade markets

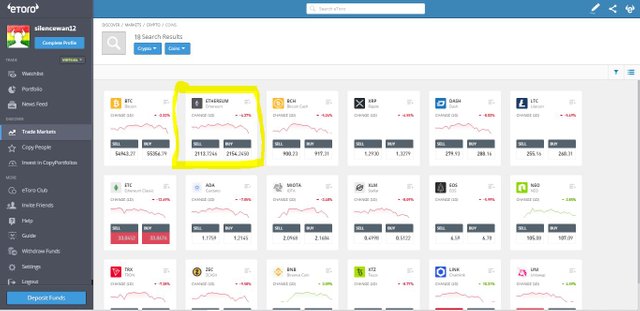

- You then search for ethereum since is the chosen one for the sake of this lecture.

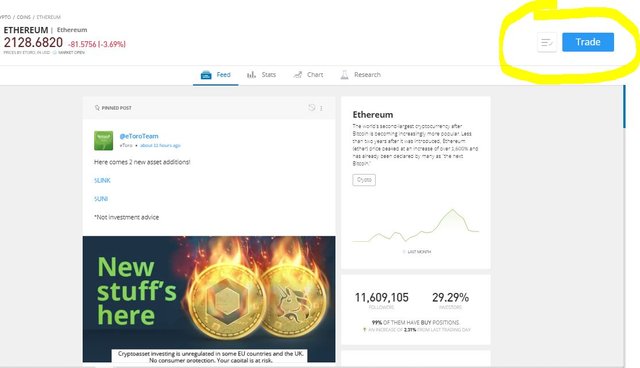

- After which I opened a trade of $ 5,000.00.

Below are screenshots of the process I took through

Conclusion

I will like to conclude by saying that cryptocurrency CFDs are widely known and their importance to traders making short-term profits. And also, one must be diverse when it comes to his strategic method of trading. CFDs seem to be diverse therefore one must also adapt to changes in its environment.

Thank you for reading

_concept_image.jpg)

Hi @silencewan,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 10/10 rating, according to the following scale:

My review :

This is the first article that I checked regarding my homework. In fact, I congratulate you for this wonderful work, which testifies to the seriousness of the research and the description of the information to answer the questions asked, I hope that the next articles are at the same level.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thank professor @kouba01 for you wonderful remarks. I will always do my best to bring out the best of articles.

That's excellent. Keep it up bro🤜🤛

Thank you. We all will keep the fire burning.

Excellent work, congratulations.

Regards.

Thank you. I appreciate

Marvelous work done brother ✊

Thank you bro. Appreciate