Crypto Academy | Season 4 Week 4. Homework Post for |@fredquantum| - Crypto Assets Diversification (CAD)

Hello buddies and welcome to the week 4, season 4. Here I will be undertaking the homework post of our dear professor @fredquantum.

Question 1. Explain Crypto Assets Diversification.

A few months back, one of my friends stumbled on a supposed "good token" and without doing proper research, he went in with a major part of his portfolio with the hope to "blow" from it. Sadly, upon launch, the price of the token dumped massively and has not risen since then. Now a large chunk of his money is tied in just one token. This brings me to the topic of this homework - Crypto Assets Diversification (CAD).

Meaning of Crypto Assets Diversification

The term "diversification" means to have a variety of options. in this context, Crypto Assets Diversification is a strategy in crypto investment or trading, in which the trader effectively manages his portfolio by distributing his crypto holdings between various assets as a way to minimise losses and maximise profits. This brings into play the popular adage in the Southeastern Nigeria that says: "do not test out the deepness of the water with both feet." What will happen if it is too deep and drowns both feet?

The crypto market is remarkable for its volatile nature which is ladened with uncertainties, and as such, one can only take precautions against the unpredictability of the market. One way to do that is to distribute one's crypto assets through many coins and tokens. In this way, a plummet in price of one or two will not affect the person's overall crypto assets.

One of the attributes of a good trader is to understand the need to strike a balance when allocating their assets. This also includes further distribution of assets through various classes and subclasses. For example: your crypto assets should consist of various classes of cryptocurrencies and tokens, like the ERC tokens, BSC tokens, NFTs, TRC tokens, etc. Then from each classes, it should also be further diversified through various subclasses. Like in BSC, you can hold various tokens, same with ERC and all. With this way, you are leveraging favourably on the heterogeneous nature of the cryptocurrency market.

Why Do You Need Crypto Assets Diversification (CAD)?

First of all, it is worthy to note that price of cryptocurrency is not stable and can move in either a positive or negative direction at anytime of the day. While this price movement can be advantageous when it moves positively, it can also be disadvantagous if it moves negatively. Imagine if an investor "A" put all his investment in on coin and it does a 50% loss, and another investor "B" invests in multiple coins, even if the other coin does a 50% loss, there is a possibility of other of his coins having some gains.

Furthermore, it is easier for the overall portfolio to experience gains by using the individual gains of the coins that performed positively to offset the individual losses of the ones that performed negatively in a typically well-balanced and diversified portfolio.

Easy Ways To Diversify Crypto Assets

There are some ways you need to get handy with when you want to effectively diversify your crypto holdings for profiting. Here we will look at them.

Diversification by Class of Crypto: When diversifying your assets, you can do so by including varying classes and subclasses of cryptos. Example: You can include smart contract cryptocurrencies (like BSC and ERC), stable coins (like BUSD, DAI, USDT), Privacy coins (like Dash and Monero).

Diversification by Project Type: You can also choose to diversify your crypto holdings by the potential applications of each cryptocurrencies. For example, you can make a list of exchange tokens, payment settlement tokens etc, and then distribute your portfolio among them. However, always ensure that your list is done with proper research and it is as dynamic as possible.

Diversification by Time: This kind of diversification option has to do with investing a certain percentage at intervals and spreading them out, instead of just buying everything at a particular time. This is also known by traders as "dollar cost averaging".

Question 2. What are the Benefits/effects of Diversifying one's assets?

Benefits of Crypto Assets Diversification

To minimise losses: When a trader has all his portfolio in one bag and the price implodes, he would make excessive losses. But when he balances it between various assets, the effect will be cushioned. Obviously, when some coins are down, the ones that are up will balance out the trader's portfolio.

To reduce extreme results and uncertainties: There is a particularly case of a well-known cryptocurrency that rug-pulled a few months back and went off with millions of dollars of investors monies. Imagine if someone holds only that particular cryptocurrency, his entire portfolio will be wiped out and he will start afresh. By diversification, one can easily prevent the occurrence of this kind of scenario.

It is however, important to note that, as diversification of crypto assets holds advantages, there are also some negative effects to it and we will discuss it.

Negative Effect of Diversification of Crypto Assets

Reduction of ROI - Returns on Investment: The performance of the assets that are having a positive price movement will be generally affected by the assets that are on the downward trend, and the effect will consequently be felt on the overall crypto portfolio.

Effects of price correlation: Sometimes, some crypto assets have relative prices. That is, a dump in price of one many also cause a dump in price of another relative token and it may also affect your portfolio even though you have diversified it. For example, a particular scenario happened a few weeks back when the price of Bitcoin fell a bit and noticeably, the price of other coins fell too.

To minimise the negative effect of cryptocurrency diversification, an investor or a traders can go just beyond cryptocurrency to invest also in bonds and stocks. With this way, even if cryptos are not performing as expected, he also has other bags.

Question 3. Construct Crypto Assets Diversification according to the 1 - 4 Rule - Choose 4 crypto asset (State the reasons for choosing them), discuss each of the assets, and perform a detailed fundamental/technical analysis on them. Invest a part of at least 15 USD into each of the assets based on the diversification constructed earlier, proper stop loss and take profit levels must be put into place.

Here, I will be performing some practical trading while putting the 1-4 rule into consideration. But here's a brief explanation of how 1-4 rules works.

This is simply a trading strategy whereby a trader shares his capital into at least 4 parts (which represents 25% of the capital) before investing, so as to minimise losses.

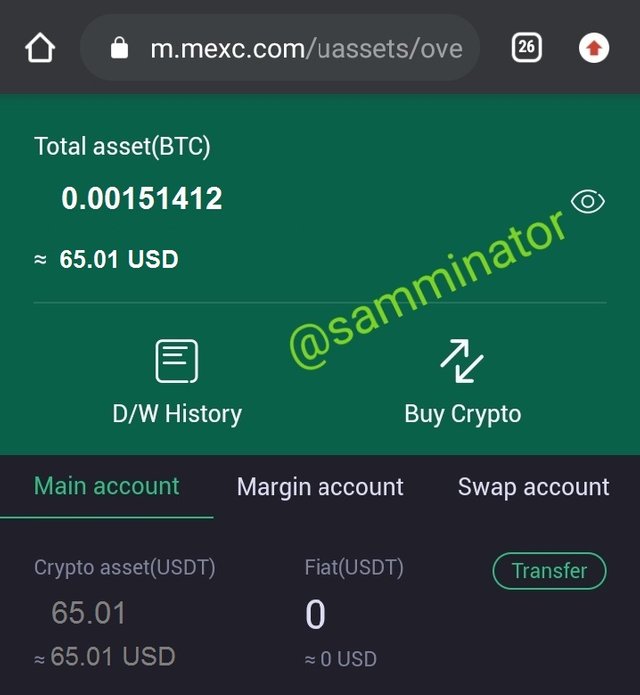

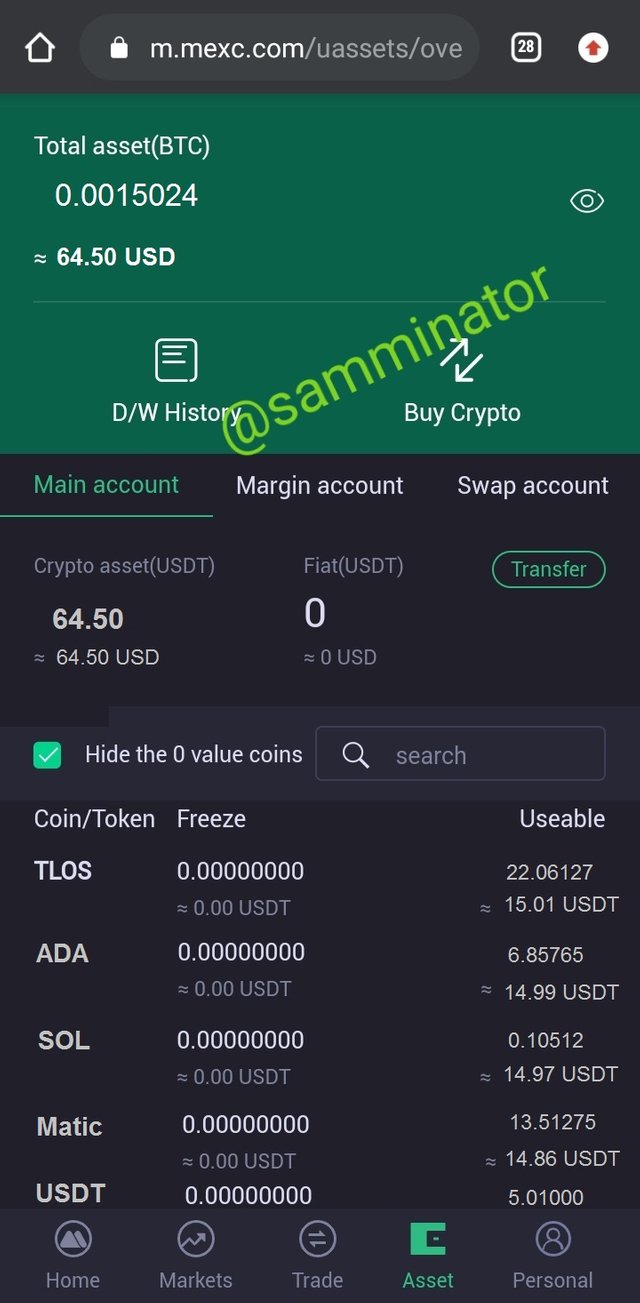

Now let us go to the practical. For the purpose of this homework, I opened an account with mexc.com and moved some funds into it. With this funds, I will be making purchases of 4 tokens. Here's the screenshot of the balance before trading.

The cryptocurrencies I will buy are:

1. TLOS

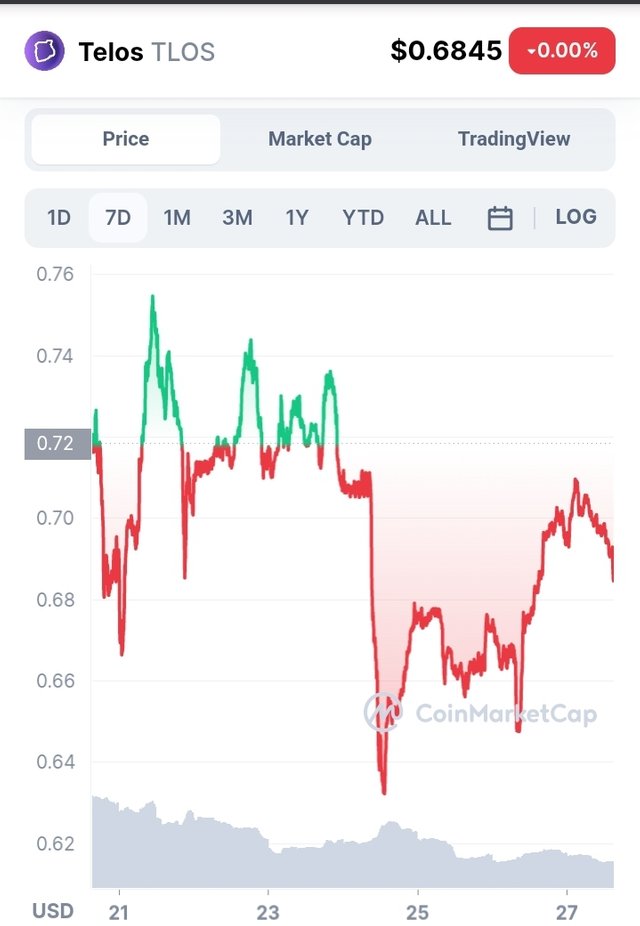

A few days ago, TLOS Blockchain announced its partnership with a decentralised blogging platform and this means that the possibility for TLOS to increase in price over time is high. More so, the chart of TLOS over the last 7 days suggests a good buying position at the moment ($0.68)

2. Cardano (ADA)

The TradingView chart of ADA for the last 5 days looks like a good option to buy because it is experiencing a slight correction which is expected to increase further in the coming days.

More so, the news surrounding ADA lately is one that will favour long term hodl. Like the development of their own Blockchain ecosystem, etc.

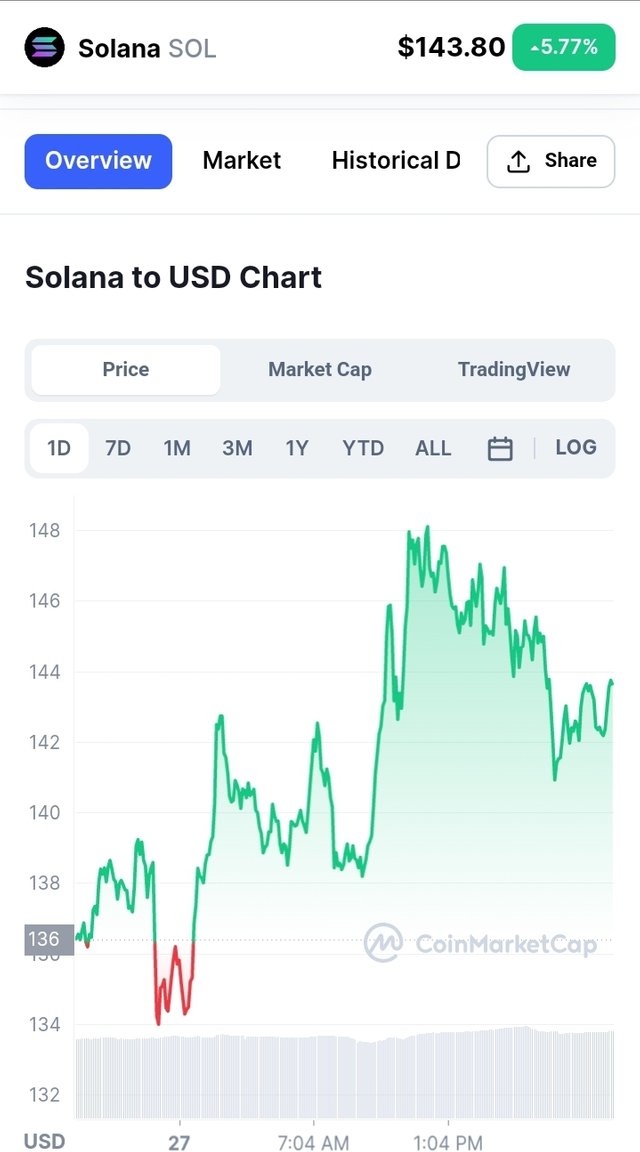

3. Solana (SOL)

This has its own Blockchain and from fundamental analysis, tokens that are built on their own Blockchain have potentials to do well in the long run. Furthermore, more projects are built on the Solana Blockchain and that means more usability of the SOL token and that will mean further increase in price.

Here, I totally based my decision on fundamental analysis and the fact that SOL has hit an ATH of $213 and occupies the 7th position in market rank.

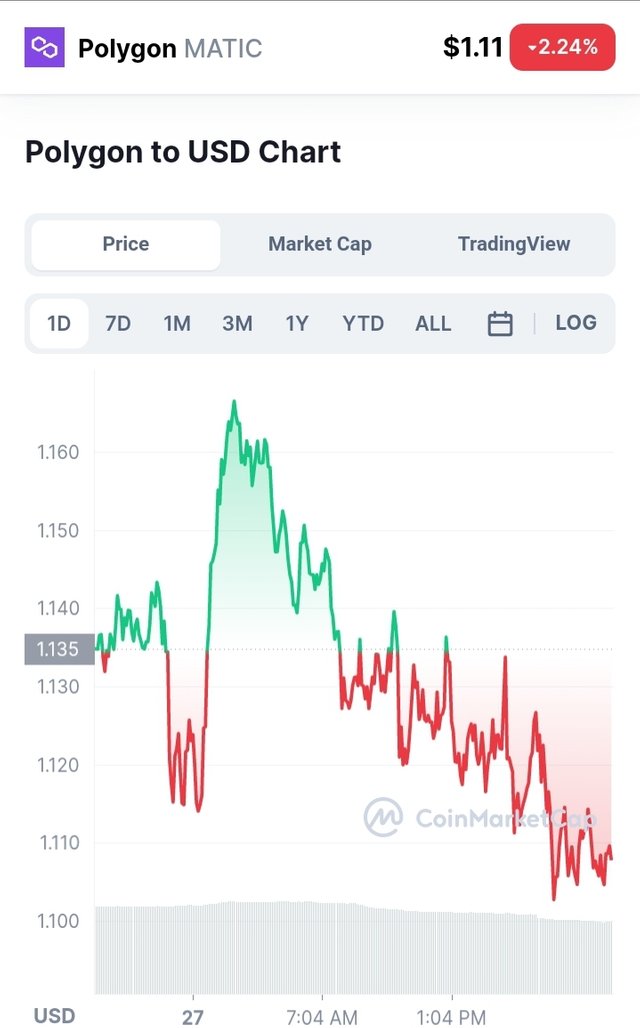

4. Polygon (Matic)

With the integration of Polygon in some well-known NFT marketplaces like the OpenSea, it is expected that this use-case will further increase the price of Polygon and it will become a gem, based on fundamentals.

Now let us buy these aforementioned assets

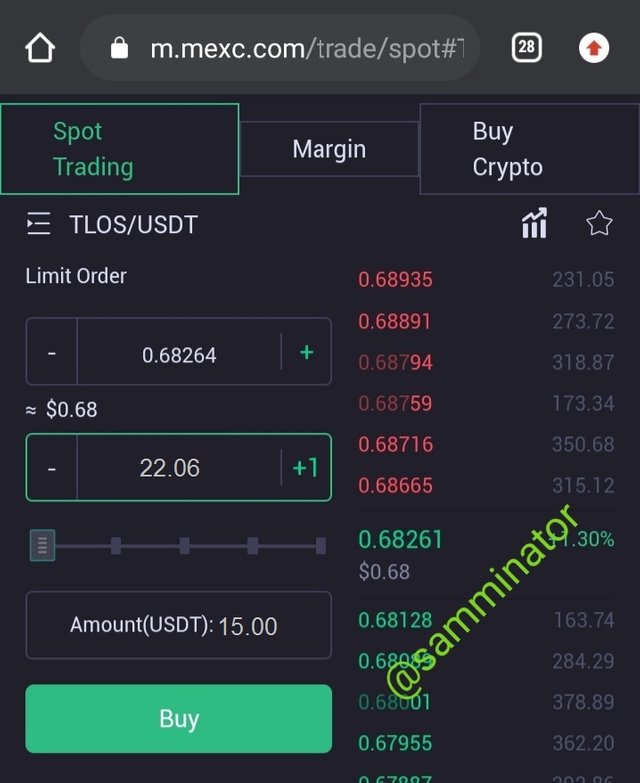

1. Buying TLOS

- Coin: TLOS

- Price: $0.68

- Targets: $0.70, $0.75, $0.80

- Stop loss: $0.60

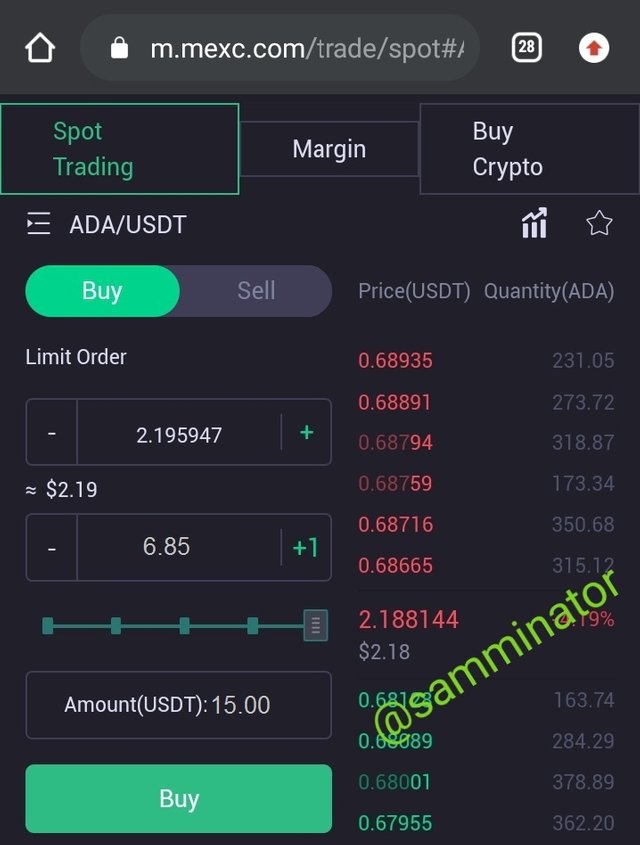

2. Buy ADA

- Coin: ADA

- Price: $2.19

- Targets: $2.50, $3.00

- Stop loss: $2.00

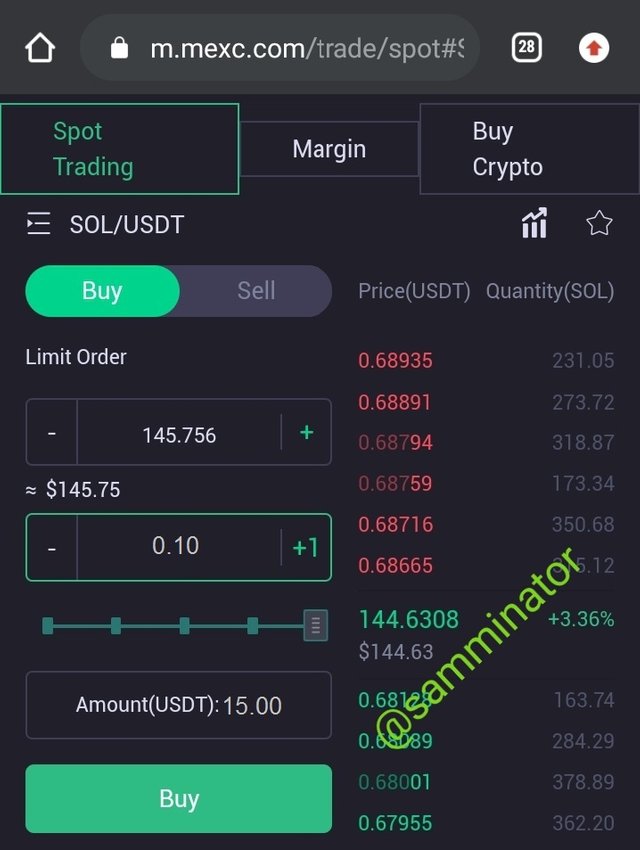

3. Buy SOL

- Coin: SOL

- Price: $145.75

- Targets: $150, $155

- Stop loss: $135

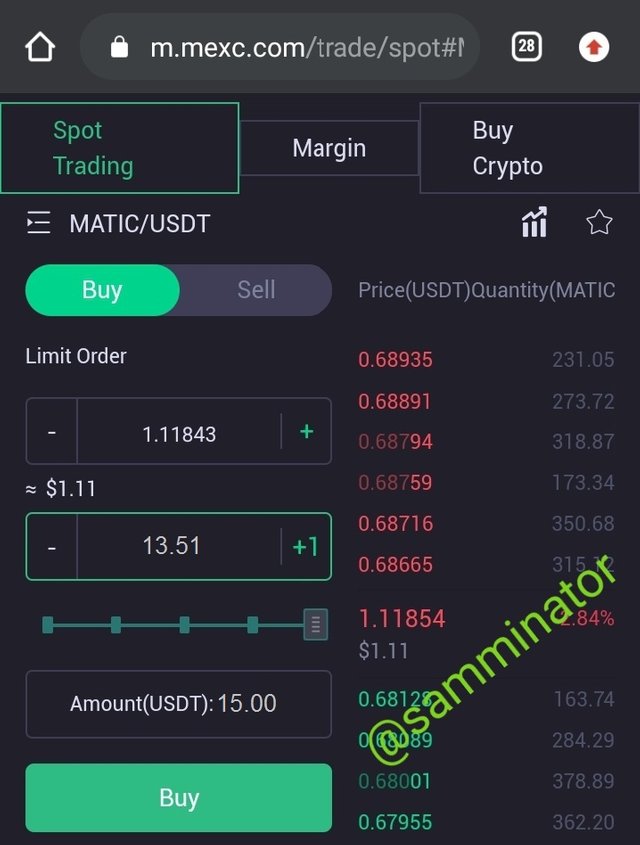

4. Buy Matic

- Coin: MATIC

- Price: $1.11

- Targets: $1.50, $1.70

- Stop loss: $1.00

Here are the total assets in the portfolio after diversifying the assets into four.

Question 4. Explain Arbitrage Trading in Cryptocurrency and its benefits.

What is Arbitrage Trading?

This is a strategy in trading where a particular asset is bought in a different market and sold in another. For example, the price of Bitcoin varies slightly from market to market and what arbitrage trading does is to exploit these differences with the hopes of maximising profits. The trader that engages in arbitrage trading is called an "arbitrageur".

In more cases than none, these differences in market prices of identical assets can close up very quickly, so an arbitrage trader has to take advantage of the window very fast so as to get the required profit.

It is also worthy to note that the risk involved in arbitrage is usually low and as such, the profit margin is usually low too. This means that for an arbitrage trader to make an extensive amount of profit, he must use a large amount of capital for trading.

Categories of Arbitrage Trading

When it comes to cryptocurrency trading, there are many types of arbitrage trading and we will subcategorize them into three:

Exchange Arbitrage: This is arguably among the commonest types of arbitrage and it puts into consideration the differences in identical assets over different exchange platforms. An arbitrageur takes advantage of this difference and buys in the exchange which has a lower price and consequently sells on the exchange which has a higher price.

Fund Rate Arbitrage: This specifically has to do with futures contract. Upon purchase of an asset (maybe a coin or token), a trader may decide to hedge its movement of the price with a futures contract. That is a process of shorting for the same value of the asset that you have purchased.

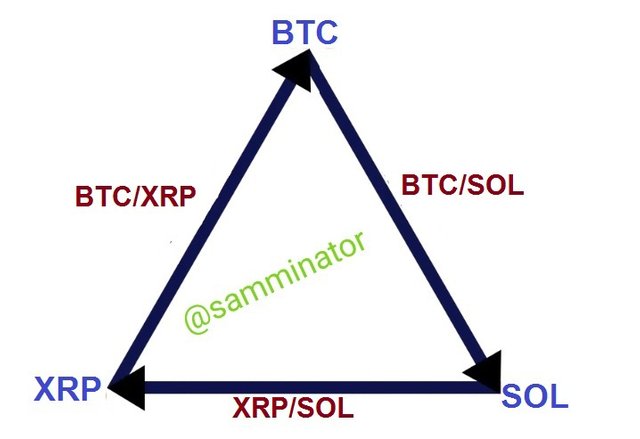

Triangular Arbitrage: This is a type of arbitrage trading that takes advantage of price difference between 3 different cryptocurrencies (as in a nature of triangle), subsequently exchanging each of them - thereby creating a loop between them.

Benefits of Arbitrage Trading

There are a host of beneficial reasons people engage in arbitrage trading and we will consider them.

1. Low risks: There is a potentially low risk related to arbitrage trading because of the fact that the trading is being done mostly on identical assets.

2. Quicker profits: Performing an arbitrage trading can be done in minutes and the trader will make his gains quickly instead of buying and hodling the assets to be sold at a later time.

3. Provision of wider opportunities: There are numerous numbers of cryptocurrency exchange platforms with their various features and functions. Engaging in arbitrage trading (particularly the exchange arbitrage) will give you the opportunity to explore many of them.

Disadvantages of Arbitrage Trading

It is a natural law that anything that has advantage also has its downsides. So let us look at the CONs of Arbitrage Trading.

1. Exchange fees: Obviously, there are fees attached to moving cryptocurrencies in and out of exchange and some others include transaction fees. These fees may eat deep into the overall profit made on the arbitrage trade.

2. KYC issues and other requirements: Some exchanges have strict requirements (like KYC) that must be fulfilled before cryptocurrencies can be withdrawn from the exchange. For example, for you to withdraw from Binance, you must have passed the KYC requirement and this may require you to upload a valid ID. Fulfilling the requirement of each exchange that you want to engage with arbitrage trading may become an uphill task.

3. Withdrawal limit: Some exchanges have a pegged withdrawal limit and this will be disadvantagous if a trader wants to move a large amount of assets from that exchange for arbitrage trading.

4. Time interval: Time can pose a big issue when engaging in arbitrage trade because of the uncertainties surrounding cryptocurrencies. Delays in transactions may result in losses because the market may move quickly. By the time a coin may be sent from one exchange to another, there is a possibility of change in price.

Question 5. Discuss with illustration how to take advantage of Exchange Arbitrage.

We have talked a bit about Exchange Arbitrage in the categories of arbitrage. Here, we will discuss it in details and how a trader can take advantage of Exchange Arbitrage.

Exchanges have dissimilar prices for the same assets due to certain factors like the trading volume. For example: An exchange that has a larger volume trade of a particular cryptocurrency may tend to have a bit lower price. Conversely, an exchange with a minimal trading volume may experience an increased price. Though the cause is not limited to just the volume. However, these differences are what the traders take advantage of to trade arbitrage.

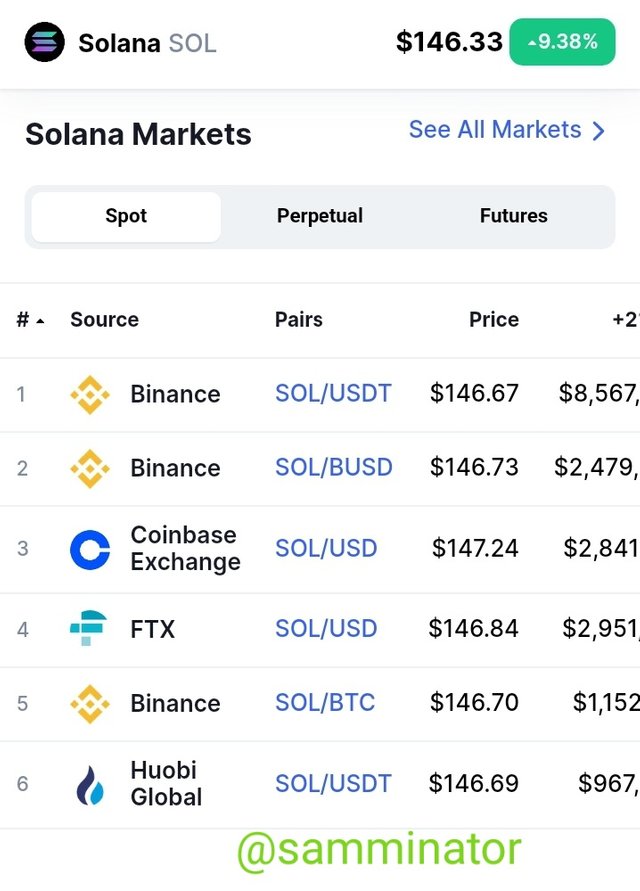

Take the Solana Coin (SOL) for example. At the time of making this post, the price in CoinMarketCap is $146.33.

However, you will notice that there is a host of others prices in various exchanges as shown in the screenshot below.

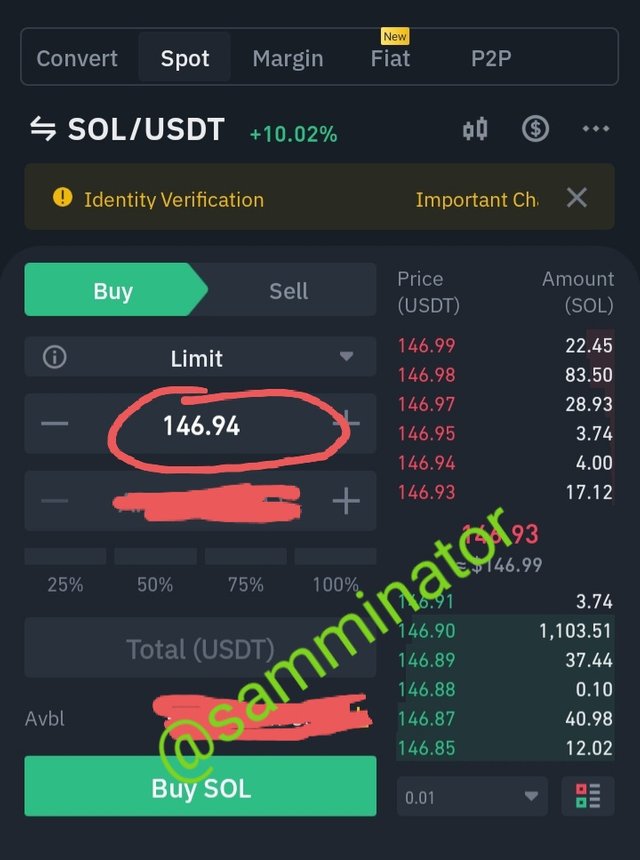

Now, to take advantage of this, a trader will buy from the exchange with a lower price. Here, I use Binance for example; I will buy SOL from Binance at a lower price.

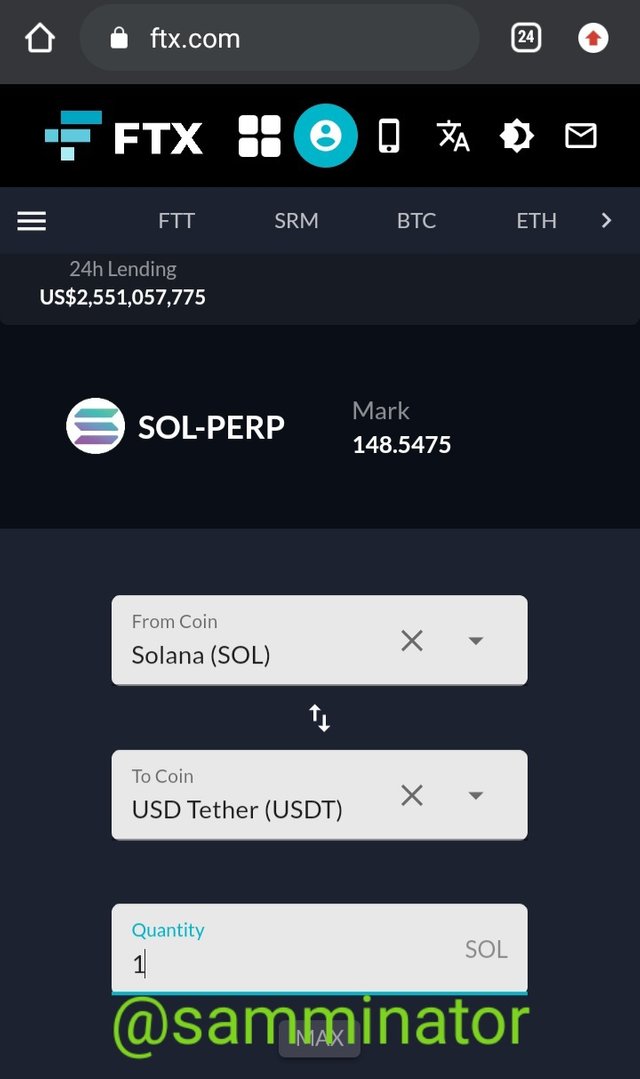

Notice how the price is $146.94 in Binance at the time of purchase. Now the SOL will be moved to another exchange with higher price. Here, I will chose https://ftx.com. Once this is done, I will then swap SOL to USDT at a higher rate and would make my profit in minutes.

Notice how the price is $148.5 in FTX as against $146.94 in Binance. With this trading, over 1% profit was made from the arbitrage trading and it is not bad.

Question 6. Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved.

The volatile nature of cryptocurrency market has presented some opportunities for crypto traders to take advantage and make profits. There is a scenario where the prices of three cryptocurrencies (typically in the same exchange) will vary and will present an opportunity whereby the trader can swap between the three currencies (just like a triangle) with the hope of making profits. For example, when a coin is swapped for another coin, the coin will also be swapped for another one and finally swapped back to the first coin.

Let us assume we want to trade 3 cryptocurrencies - SOL, BTC and XRP on a single exchange using the price difference in arbitrage and the exchange has: SOL/BTC, SOL/XRP and XRP/BTC pairs. Then we can take advantage of it this way:

Now let us explain the triangle at each stage.

Stage 1: The first stage is to start with the first cryptocurrency which, in this case, is BTC, which is also the cryptocurrency that the trader will arrive at after going through the arbitrage trading triangle.

Stage 2: In this stage, the initial cryptocurrency, which is BTC, will be swapped for the second one, which is SOL.

Stage 3: Here, the second cryptocurrency will be swapped for the third one - XRP.

Stage 4: This is the final stage where the third cryptocurrency is swapped for the original one.

When the triangle is completed, you will discover that the final stage (which is the initial cryptocurrency) would have increased a bit from the starting amount.

Factors to consider in Triangular Arbitrage

There are things to consider when you want to engage in a Triangular Arbitrage and they are:

Identifying the opportunity: This is the most crucial part of it because it will be the deciding factor if profit will be made. Here, what you need to do it to make an analysis of price differences of the cryptocurrencies in view, and then compare the overlaps in pricing - that is the difference between the lowest ask price and the highest bid price.

Execution Time: Just as we know, the price of cryptocurrency is not stable and this should be considered. From the point of stage 1 (converting from the first cryptocurrency) to the final stage (converting back the first one), there should be a minimal time difference between them so as to minimise the eventualities of negative price movement.

Repeat the process: Once the same conditions are sustained, you can repeat the same Triangular Arbitrage Trading for the same cryptocurrency pairs. However, once the conditions become unfavourable, you can proceed to another pair.

Risks/CONs of Triangular Arbitrage Trading

Low liquidity: In the event that one of the trading pairs in a triangular arbitrage has a low liquidity, it may lead to delay or stagnation of the trade.

Negative price fluctuations: Price can drop drastically in a matter of minutes and in that case, it may affect the final output of the cryptocurrency negatively.

Transaction fees: Some cryptocurrency pairs have higher transaction fees than the other. This may affect the trading triangle and may reduce the final output.

Conclusion

The sole purpose of engaging in any form of cryptocurrency trading is to make and maximise profits. However, with the uncertainties surrounding the crypto space, one needs to put in extra efforts so as not to run into overall losses. One way of doing this is by distributing your portfolio through various assets. This is known as Crypto Assets Diversification. We have discussed extensively on it and also talked about ways to use it to our advantage. We have also considered Arbitrage Trading and its effects in crypto trading.

Thanks all for reading, and special appreciation to @fredquantum.

Thanks for reading