Unusual Options Activity In iPath B S&P 500 VIX S/T Futs ETN (VXXB)

So just in a couple of trading days, we had German manufacturing activity growth the weakest in six and a half years. Across the pond in the US, PMI fell to its lowest level in nearly two years.

Saying on the US side of things, Fed Powell left interest rates unchanged last week, signaling that the US economy isn’t as strong as people thinks. And for the first time since 2007, the three month bill vs. the 10 year note inverted.

This caused the Dow Jones industrial average closed down 460.19 points, or about 1.8%, to 25,502 and the CBOE Volatility Index (VIX) to spiked 24% on Friday

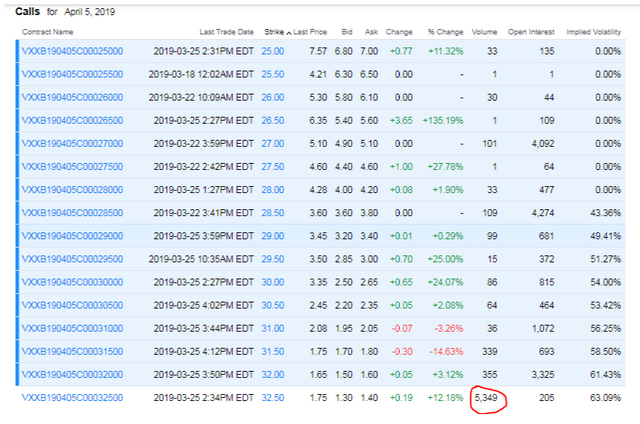

The VIX or fear gauge tends to increase when markets are decline. So it’ no surprise that I noticed unusual options activity in the iPath B S&P 500 VIX S/T Futs ETN (VXXB). This ETN is a popular option providing exposure to volatility with an average volume of about 8.3 million shares a day and $806.5 million in Assets Under Management (AUM). Yesterday the Smart Money bought over 5, 000 of the $32.50 strike, call options that expire in two weeks.

The options are profitable above $34. With two weeks remaining, stay tune.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Spikes can happen at any moment but the ahort volatility trade continues to work. I would prefer using the spike to write covered calls.

Posted using Partiko iOS