MarketMoves #01 - 8 January 2018 - HIGH VIX CALL VOLUME, tech stocks, and ERC-20 stability!

Note: In MarketMoves, I cover market events of the last 24 hours in both crypto- and traditional markets. Do your own research before making any financial decisions; I can't stress that enough.

Going forward, I'll begin reviewing yesterday's thoughts/predictions in this spot.

Daily summary

- US equities up, anticipating Japanese equities up tonight and continued green tomorrow

- Crypto fall and bounce on CMC changes - BTCF8 futures at $14925, predicting $15750 tomorrow PM

- VIX volume anticipating slowing green or red tomorrow in equities

Indices, futures, forex, cryptos

- Almost all indices up; $AMZN, $FB, $NVDA, $BA continue to pull the S&P up

- Anticipating stable cryptos through the week, partial recovery on BTC and XRP as CMC news propagates

- Record long Euro right now

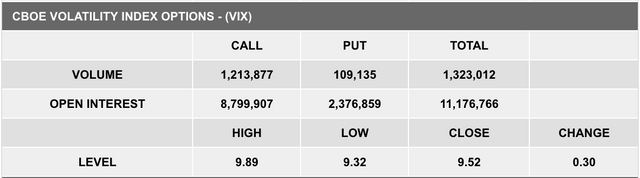

Source: CBOE

Interesting things we're seeing

- ~1.2M call, 100k short volume on VIX (above)

- $TSLA up 6% on no news - though I guess they have tended to perform better when Elon's rockets do well...

- Leveraged BTC ETFs might be coming from Direxion (older news)

Smaller cryptos to watch

- See my CoinReview earlier on $CAG, up 5% since I posted it mid-day. Expecting a continued run

- Expecting better performance of ERC-20 coins in the near term due to ETH stability - continuation of $REQ-sized recent surges

- Doing a CoinReview on Verify ($CRED) soon, I expect it to rise nicely as the other tx platforms/apps have

Source: unsplash.com

What I'm doing today

- Adding to long tech (software and chip) positions

- Increasing crypto allocation from 70/30 ETH/other to 80/20. Stable as hell with ETHBTC ratio fattening

- Cashing out a little $XIV, in case we go red this week I'm very willing to short volatility

If you have found my posts useful and wish to buy me a beer:

ETH:

0x51e3c7b68F8C9f707459990e55dE8Effd76B5f61

BTC:

12texFdkqxcWXH7FrrWeMRy6Bz5ptrqUA6