Steemit Crypto Academy Season 4 Week 6 - Beginner's Course |Trading Cryptocurrencies.

Good day fellow students if the steemit crypto academy, its my pleasure to present my S4W6 assignment, after receiving a well profitable knowledge From professor @reminiscence01,

I will be writing my assignment based on CRYPTOCURRENCY TRADING as you read through I believe you'll enjoy your self to the fullest.

QUESTION 1

Explain the following stating its advantages and disadvantages:

- Spot trading

- Margin trading

- Futures trading

SPOT TRADING

Spot trading is a way or an act of buying a crypto asset with the mindset that it will appreciate in due time be for selling to get profit.

Thats just a short definition of spot trading there are more to spot trading, spot trading are mostly practiced by beginners in crypto, crypto traders buy any crypto they feel it will appreciate but for the advanced people in the journey of cryptocurrency they don't just just buy any coin or cryptocurrency with just feelings alone,they do some critical findings and some analysis before buying such cryptocurrency

Spot trading involve low risk that's why most people involve in it because people are afraid of losing their funds and capital but as a trader profit and loss is part of our lifestyle we just make sure our profit are far more than our gain.

ADVANTAGES

It involve low risk.

Trading capital can't be lost.

cryptocurrency can be held for a long period of time .

market orders are easily done here.

everything here are very transparent

DISADVANTAGES

Takes a long time before maximum profit is again.

profit is only made in a bull market, profit can't be made in a Bear market.

whales control the market and at time it might not be in favor of spot traders.

That's no proper planning in spot trading.

FUTURES TRADING

Future trading can be refer to as a way of trading the live crypto market with real time it involve trading with any cryptocurrency.

Futures trading is a type of trading done mostly by advanced and professional trader with trading experience , futures trading involves buying and selling using any of the market order

And profit can be made at any point whether it is appreciating ot its depreciating, here traders trade according to the volatility of the market and high profit can be made and at the sane time the trader can suffer huge loss depending on how the trader leverage on the market.

In futures trading traders don't just take trades anyhow they do critical analysis of the market using technical, fundamental and sentimental analysis before placing a trade.

ADVANTAGES

High profit is involved

Profit can be made when market appreciate

Traders are able to leverage on the market anyhow the want.

execution cost are very low

Futures us a very liquid market for making profit

DISADVANTAGES

High risk is involved.

High deposit of fund is required for newbies.

Fear of leveraging high

sudden effect of news on market can lead to lose of funds

MARGIN TRADING

Margin trading is very similar to futures trading, is just that in margin trading third party is involved where by traders borrow funds from third party provide or fellow trader to be able to leverage high in the market in such a way that if a trader have low amount he or she can buy cry to worth of $1000.

Just like futures trading ,margin trading involve high risk and at the same time involve huge profit as well, trades also have high advantage over the market with high purchasing power.

ADVANTAGES

High profit is involved.

Traders have high advantage over the market

Traders have more purchasing power to leverage on the market.

Traders can open so many trades at ones

DISADVANTAGES

High risk is involved.

Traders account can enter liquidation at any time.

newbies in trading can't involved in margin trading .

Funds can be lost due to high volatility if market.

QUESTION 2

a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed).

- MARKET EXECUTION ORDER

Market execution order is a type of order where instant market position order is taken, immediately we place the order here it trigger's

That's why is always advisable to do a proper technical analysis before taking any trade because once the trade trigger's there's no more going back except we force stop the and most times funds may be lost this way.

BUY LIMIT

Buy limit is a type of limit order that is very different from instant market execution because it does not trigger immediately, buy limit is limit that is set below a buy trade or bullish trend, for example if the chart is forming a bullish pattern

And it has not broken the neck line there is a probability that its going to retrace be for going to the original movement so Here we can place buy limit below the current market price

SELL LIMIT

Sell limit is very similar to the buy limit is just that its in the reverse manner, sell limit Is a market order placed above the current market price in the case of a bear market trend, for example the current market is at $57,655 and we want to set sell limit we will set it at $59,000 if we notice according to our analysis that the market Is going to retrace be for it continue its normal trend.

SELL STOP

sell stop is also an amazing market order that is is set above the current market price, when the market has not gotten to where we want to place our trade or we will probably not available when the market get to our entry price, then we can place a sell stop so as the price gets to the entry point it triggers, for example the current market is at $230 we can set a sell stop at $210 so as soon as the price gets to $210 it triggers.

BUY STOP

Buy stop is a market entry order just like the just explained sell stop order but here the reverse is the case buy stop is placed above the current market price, so a soon as the price gets to that particular entry point the trade trigger's for example we notice a continuation pattern and we wants to enter above the current price to join the trend maybe for example the current market price is at $20 and we want to set buy stop at $30 so a soon a the market price gets to $30 the trade will trigger.

EXIT ORDER

We have one two exit order:

Take profit

stop loss

Take profit: Take profit is one of the exit point, its an automatic order that trigger's where the trader wants to take His or her profit out if the market.

stop loss: stop loss is also an automatic exit point of the market where the trade trigger's by it self at that price and it also used to secure fund so as not to get liquidated when our trades go the opposite direction.

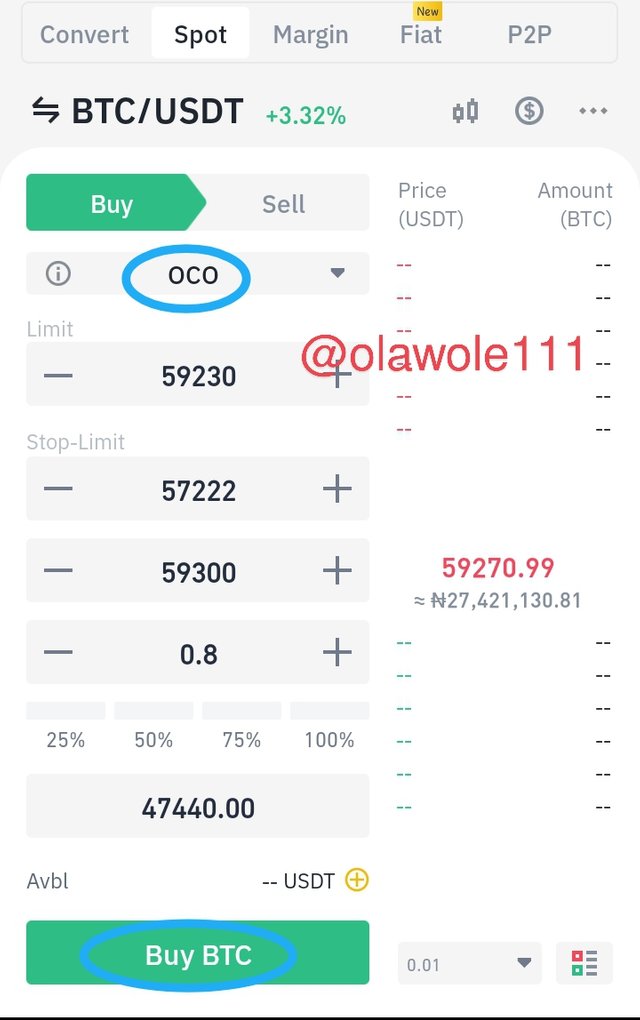

HOW CAN OCO USED TO MANAGE RISK

OCO which stands for (one cancel the other)

Is different from limit orders, traders makes use of this when they are not sure of the direction of the of the market, it helps to minimize risk when trading for example if a crypto asset is ranging for long time and we are not sure if it will be a reversal or a continuation we can just place an (OCO) order assuming we place order (buy) on BTCUSD at $59k and we are not to sure just to be on the safer side we can place another order for a sell at $57k so anyone that first trigger the other position will be eliminated automatically and by so doing we've made use of the OCO Order.

QUESTION 3

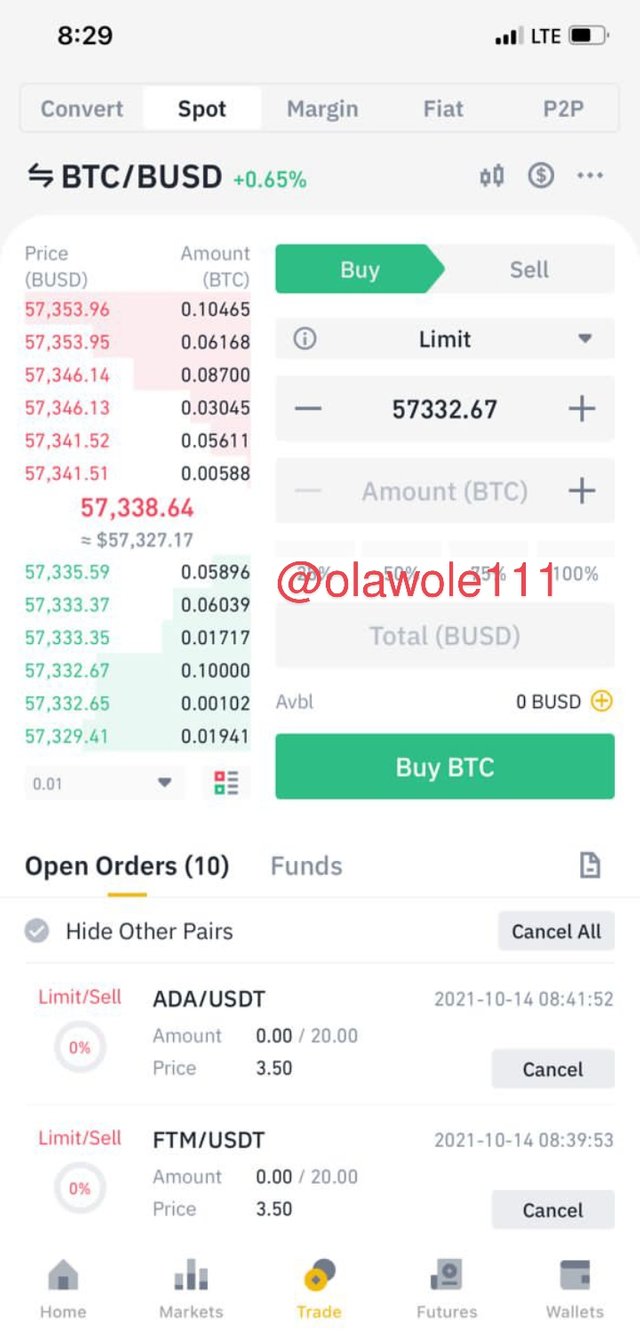

a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps

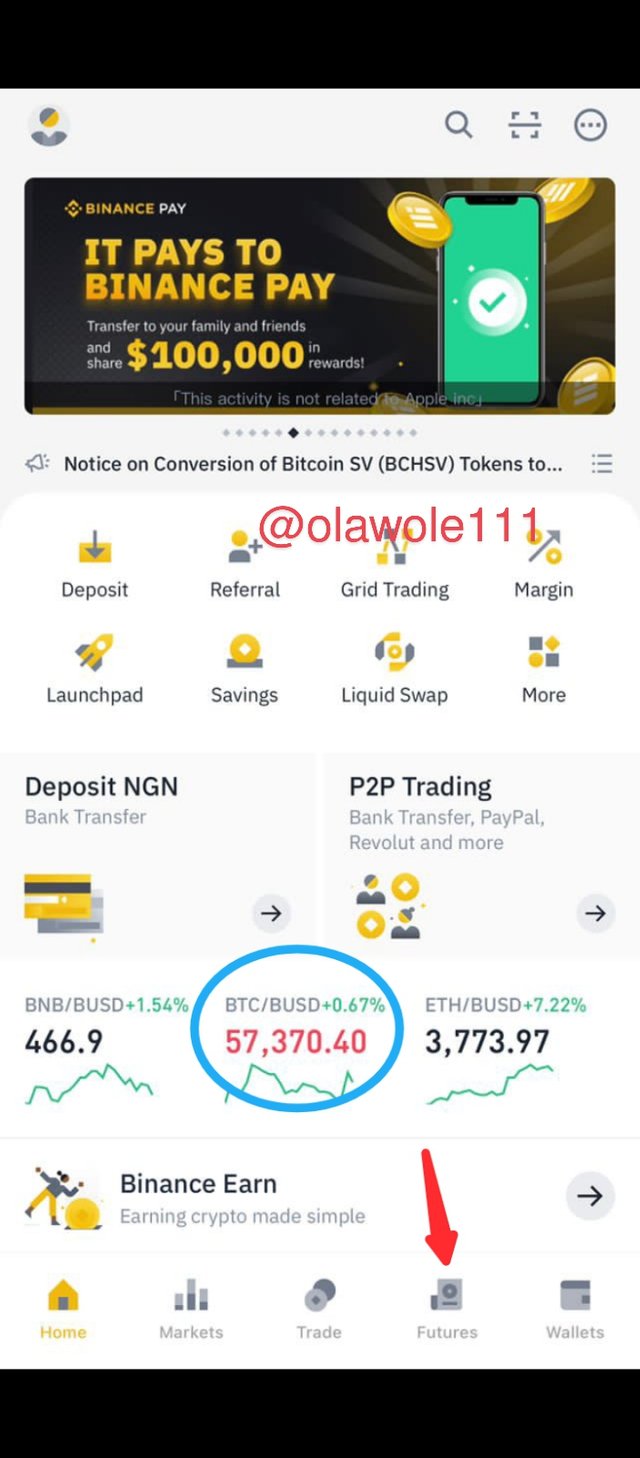

In this aspect I will be using a binance exchange which is the number one exchange in the world ,

- step one: we first make sure we register with binance exchange with a functioning email address the we do all the necessary verification.

- step two: we'll click on futures which can be found below the first interface of the applications .

- step three:After clicking on the futures icon then it will take us to the trading interface where we can place a limit order.

- step four : Then we take our limit order and be patient for it to trigger

QUESTION 4

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders.

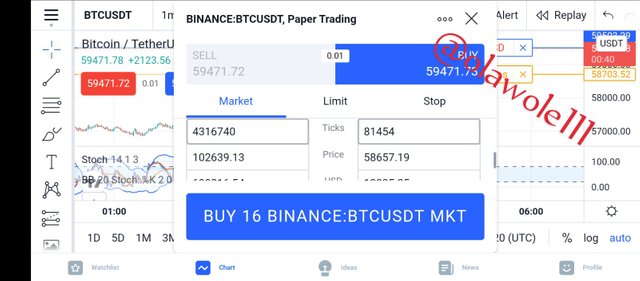

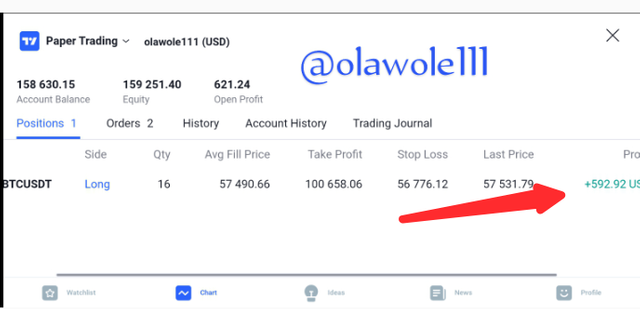

- Buy Entry

I made my analysis on BTCUSD with the combination of the stochastic and the Bollinger bands as soon as I notice that the stochastic crosses the Bollinger bands upward I took the trade.

I choose BTCUSD because its very volatile and all my intension of taking this position is just to scalp for few minutes and close the trade because the best way to scalp is to go to the lower time frame.

I also choose those two indicators because when I combine the two together they will show me the trend and direction of the market prices.

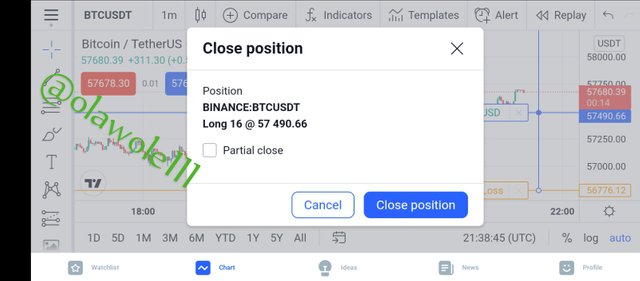

I left the trade for some minutes and due the the fact that the market was very volatile I made profit quickly and closed the trade at profit if $592.

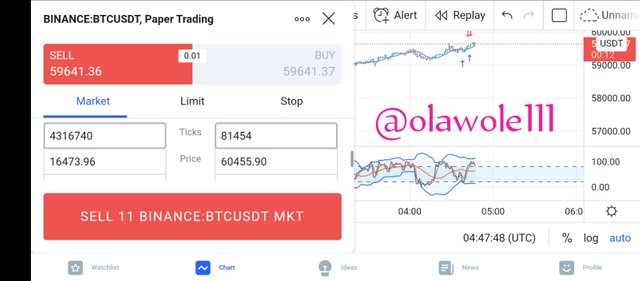

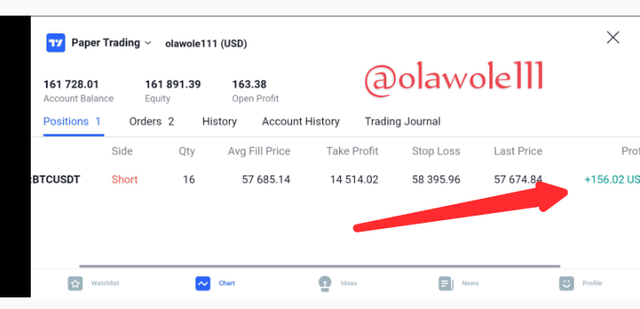

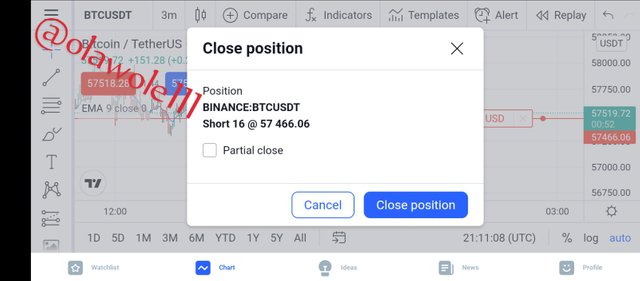

- Sell Position

I choose a very low time frame on BTCUSD because all my motive was to scalp a little then close my positions, I made use of the combination of stochastic and Bollinger band and as soon as the stochastic got to the overbought region and crosses each other downward I took the position which last for just 5 minutes.

I choose BTCUSD because its the most traded crypto market which made it so volatile and because of the fact that am scalping and scalping needs a very volatile market for a trader to make profit.

I also choose stochastic and Bollinger band because I want an indicators that calculate that fast reaction of the market and it shows trend and movement of the market Price.

I closed the position at $156 and took my profit because I don't want to stay long in the market.

CONCLUSION

Cryptocurrency trading entails so many things patient ,emotional control and how to read the market movement and we have so tools that help us move out trading career forward like the buy limit, buy stop, sell stop order e.t.c as a trader that trader's either futures , spot ,margin trading most know how to make us of all this market orders for example a working class trader that does not have time to check his trade till he closes at work all he has to do is to analyse the trade and set a (buy or sell limit) or (buy or sell stop) with his stop lost then when he comes back he check his trades.

I really appreciate the knowledge imparted from professor @reminiscence01.

NB : all screenshot are from trading view and binance exchange.

Hello @olawole111 , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

You didn't specify the type of orders placed on OCO order. It includes a limit order and a stop-limit order.

Recommendation / Feedback:

Thank you for participating in this homework task.

Thanks professor