Introduction

MoonDeFi is a convention on Ethereum for trading ERC20 tokens without the requirement for purchasers and merchants to encourage interest. It does this by means of a condition that naturally sets and equilibriums the worth relying upon how much interest there is. Unlike most trades that charge expenses, MoonDeFi was planned with an exceptionally low expense structure.

On MoonDeFi, Traders can trade Ethereum tokens without confiding in anybody with their cash. Clients can loan their cryptographic forms of money to the liquidity pool and gather a charge. This is finished by a condition that naturally decides and balances the worth dependent on real interest. This is one of the principal completely decentralized conventions for computerized liquidity arrangement in the Defi. There's no organization included, no KYC, and there's no individual included that is interceding things.

What is MoonDeFi

MoonDeFi is an Ethereum-based decentralized trade (DEX) where clients can exchange ERC2O tokens versus Ethereum completely on-chain utilizing shrewd agreements, eliminating the requirement for request books as observed in conventional trades. It is an extraordinary sort of DEX called a token swapper. The principle advancement from a convention like MoonDeFi is to build up an easy to understand stage on which clients can undoubtedly trade tokens without experiencing a tangled trade interface, while additionally permitting anybody to turn into a liquidity supplier and latently procure exchange expenses. It likewise gives benefits that a DEX does, similar to decentralization and control obstruction.

Fundamentally, MoonDeFi acquires the best elements of Swap and Staking from top Defi stages like Uniswap, Harvest Finance, Curve Finance, and so on Being an updated adaptation of those Defi stages, MoonDeFi possesses the most extraordinary highlights. This segment is to feature the critical thoughts on how MoonDeFi functions, the components behind its activity, and the most inventive elements of this stage.

What is Staking

Marking in DeFi implies clients can partake, using shrewd agreements, on different issues by means of casting a ballot in a proof-of-stake model just as acquiring detached compensations by securing their crypto.

What is Liquidity Mining

Liquidity mining is an organization interest methodology in which a client gives funding to a convention as a trade-off for that convention's local token.

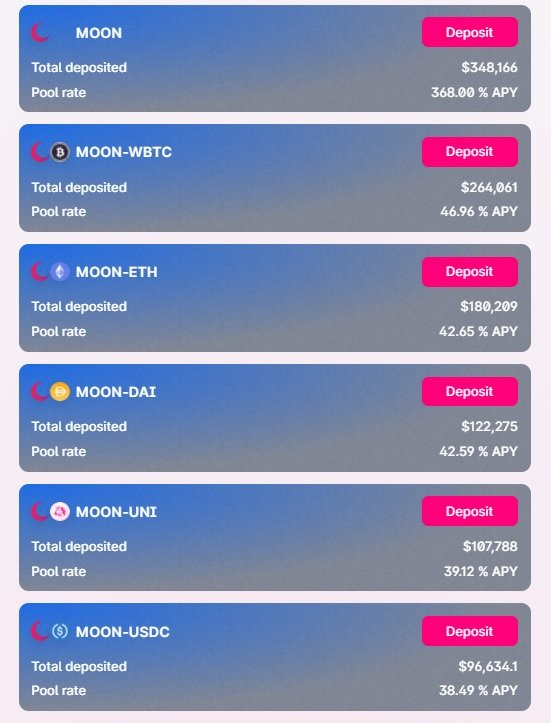

MoonDeFi Liquidity Pools

Advantages of MoonDeFi

Open Source

MoonDeFi is a public, open-source application, which implies later on if the MoonDeFi group leaves the venture under any conditions, the MoonDeFi people group can at present keep up the extend and grow new usefulness.

Highly Decentralized and Autonomous

MoonDeFi works with no concentrated specialist organization or center man, and since all exchanges occur on-chain, can't be stopped as long as Ethereum is utilitarian.

High Degree of Anonymity

Since there are no client records to sign into and anybody with an Ethereum address can utilize MoonDeFi, there is a serious level of obscurity. There is likewise no KYC cycle prior to utilizing MoonDeFi, not at all like in numerous different trades.

High community concern

MoonDeFi as referenced before is the full overhauled adaptation of different esteemed Defi stages. Along these lines, plainly MoonDeFi has pulled in a lot of network concern.

Lower Gas Fees

As per MoonDeFi, because of its moderate plan and system, it is a larger number of gas proficient than its decentralized trade partners.

User Friendly

MoonDeFi has given a very easy to understand interface. Indeed, even individuals new to crypto can undoubtedly trade their ideal ERC2O tokens in only a couple of clicks. Due to the basic UI and absence of request books, MoonDeFi has additionally extraordinarily decreased stacking times, an issue that has tormented different DEXs.

The interface even permits brokers to set slippage cutoff points, and request clocks with the end goal that requests are dropped if not executed inside a period limit, which assists with alleviating front running.

MoonDeFi Liquidity Staking

Imaginative Defi stage MoonDeFi has as of late made liquidity mining accessible to clients. After the Liquidity suppliers contribute their coins to the pool, they will get LP tokens. Those tokens speak to a lot of the whole liquidity pool. These liquidity tokens can be reclaimed for the offer they speak to in the pool. In addition, Liquidity Providers can utilize those tokens to partake in the Staking Program to pick up MOON with a high benefit rate.

The prize will be disseminated among clients who store assets to the liquidity pool and join this program. Regularly, they can procure APY of 30%-45% for marking LP tokens. The Staking program is likewise applied for holders of MOON and different tokens. Clients can likewise stake different tokens with a similar ERC-20 convention, including MOON – the local badge of MoonDeFi to get APY of 30 – 40%. With a set number of tokens (complete gracefully of 210 million tokens) and the rapidly expanding request of MOON, marking this symbolic will give clients radical advantages later on.

MOON is the local badge of the MoonDeFi stage. The interest of the MOON will develop following the advancement of MoonDeFi. MoonDeFi is an exceptional decentralized framework, incorporating numerous capacities, acquiring the qualities of other Defi stages. With an expert and systematic advertising procedure, high loan fees, and appealing prizes, it is certainly a venture which is worth putting resources into.

Concerning Moon token – a local badge of MoonDeFi which has a restricted gracefully, just 210 million alongside a fast expansion popular, possessing this coin will unquestionably get high worth the future for any speculator. It is important that marking MOON token has the most noteworthy interest following the LP tokens. With a set number and the emotional expanding request of MOON, marking and holding this symbol will without a doubt give clients extraordinary advantages later on.

MOON Token Allocation

210 million MOON have been minted at the genesis and will become accessible over the course of 4 years. The initial four-year allocation is as follows:

69.00% to MoonDeFi community members 144,900,000 MOON

18.25% to team members and future employees with 4-year vesting 38,325,000 MOON

12.50% to investors with 4-year vesting 26,250,000 MOON

0.25% to advisors with 4-year vesting 525,000 MOON

A perpetual inflation rate of 2% per year will start after 4 years, ensuring continued participation and contribution to MoonDeFi at the expense of passive MOON holders.

More Information

Twitter:

@moondefi_info

Telegram channel:

t.me/moondefiofficial

Telegram group:

https://t.me/moondefiofficialgroup

Name:Bayanganhitam

Profile:https://bitcointalk.org/index.php?action=profile;u=2851798;sa=summary