Cryptocurrency Hedge Funds Generate Huge Returns As Bitcoin Surges

Cryptocurrency Hedge Funds are a real thing and doing well but watch out as correlation is high to the bitcoin price index and the newly created Crypto-currency fund index

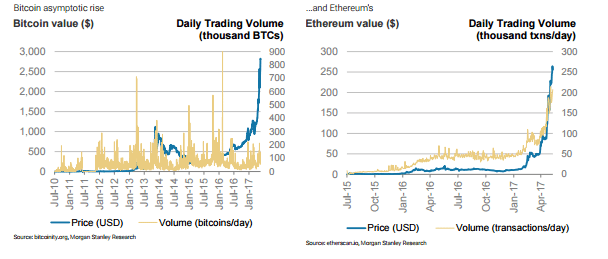

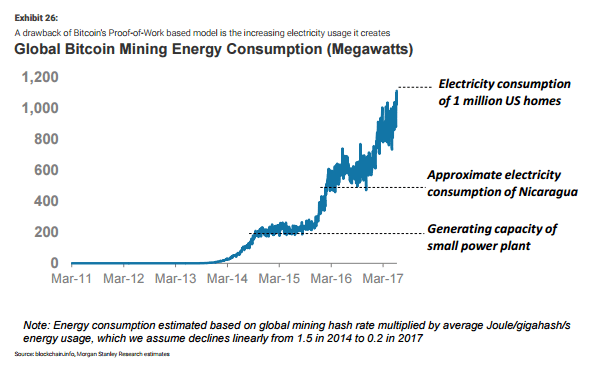

No matter how exotic the asset, if there are profits to be made you can be sure Wall Street will find some way of getting in on the action. That’s exactly what has happened with Bitcoin and the rest of the cryptocurrency space. The size of the cryptocurrency market has exploded during 2017 with the market reaching a total size of $100 billion on June 9 and rising to $113 billion this week. Bitcoin, which is possibly the most talked cryptocurrency accounts for 37.8% of this market and together with another currency Ethereum has a market capitalization of $77.6 billion. While Bitcoin grabs the headlines, Ethereum, which attempts to address some of the technical shortcomings of Bitcoin, has been gaining value at an even faster rate. Ethereum may be a better substitute to Bitcoin for blockchain. According to Morgan Stanley’s analysts’ Bitcoin scales poorly due to increasing electricity consumption and long transaction times that can often take 10 minutes to more than an hour, and even that with no guarantee. Ethereum and others have tried to address those scaling challenges by centralizing more of the blockchain function, but increased centralization could also lead to increased hacking risk.

Cryptocurrency hedge funds generate huge returns as bitcoin price surges

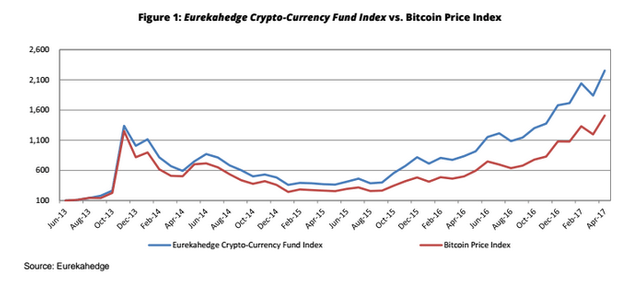

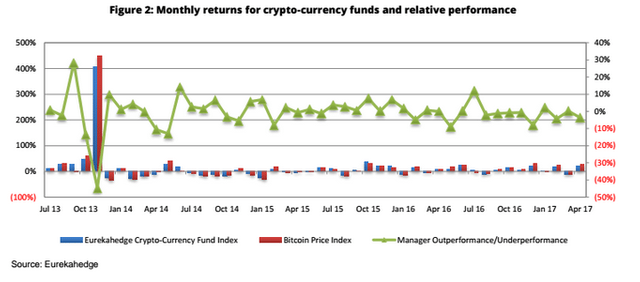

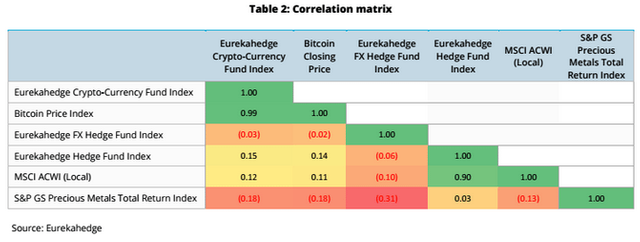

To bet on a further increase in value of these cryptocurrencies, last year former Coinbase employee Olaf Carlson-Wee raised $10 million to fund Polychain Capital, a hedge fund made up of cryptocurrencies such as Bitcoin. The fund managed to secure seed funding from none other than Andreessen Horowitz among others. Polychain might be the latest cryptocurrency hedge fund, but it certainly isn’t the first. Pantera Capital and three other firms have been offering cryptocurrency hedge funds for quite some time, and hedge fund data firm Eurekahedge has been running and alternate Crypto-Currency Fund Index since 2013. The Eurekahedge Crypto-Currency Fund Index tracks the performance of five actively managed ‘Alternative-Coin’ cryptocurrency Hedge Funds that carry exposure to Bitcoin, Ethereum, and other cryptocurrencies. Like traditional hedge funds, these funds employ a range of strategies seeking to maximize upside while minimizing the downside. Since inception, the performance of this index has left traditional hedge funds trailing, and returns have even eclipsed those of the vanilla Bitcoin price index. According to Eurekahedge’s latest report: “Over the 46-month period shown below starting as of end-June 2013, the Eurekahedge Crypto-Currency Fund Index has returned a cumulative of 2152.32% in contrast to a return of 1408.11% for the Bitcoin Price Index. On an annualized basis, this comes to 125.35% for actively managed cryptocurrency strategies versus 102.96% for the Bitcoin Price Index.” Even those these returns might seem appealing; the index is “massively volatile” with annualized standard deviation for the Eurekahedge Crypto-Currency Fund Index coming in at 213.11% making it one of the most volatile strategies tracked by the data provider.

Unsurprisingly, with an annualized return of 125.35%, Eurekahedge notes that “cryptocurrency hedge funds have outperformed the average global hedge fund, traditional FX hedge fund strategies, the MSCI ACWI and the S&P GS Precious Metals Index over all periods.” The index’s constituents also appear to provide a less volatile way to bet on the success of cryptocurrencies than just buying Bitcoin or Ethereum, although the level of volatility is off the chart. The report notes, “over a period of 14 months between December 2013 and January 2015, the Eurekahedge Crypto-Currency Fund Index lost almost 73% of its value from its 2013 high. In contrast, the Bitcoin Price Index lost almost 81% of its value.”

Like bitcoin price and popularity, Cryptocurrency hedge funds are new, uncertain and volatile and correlated to Crypto-currency fund index

It’s the volatility of Bitcoin and its peers that’s holding back further adoption according to Morgan Stanley. According to a recent report from the bank on the topic of Bitcoin, cryptocurrencies, and blockchain, while merchants are attracted to the opportunities cryptocurrencies might offer, they generally “find that the cryptocurrencies are far too volatile to be used.” Still, these concerns have not stopped the recent appreciation in value of these currency alternatives. It is not clear why cryptocurrencies are appreciating so rapidly, but Morgan’s analysts speculate that there are three possible reasons behind the gains, all of which are based on increased demand as buyers rapidly warm to the opportunities these instruments provide.