Crypto Academy Week 6 Homework Post for @yohan2on - DAI - A Stablecoin Crypto

Good Day Steemit Crypto Academy!

Today, we are discussing about Stablecoins for the week 6 homework task posted by @yohan2on. Specifically, we'll be discussing DAI in this article.

Oasis x DAI gif Oasis.

Dai may be regarded as the first-ever collateral-backed cryptocurrency. It is a cryptocurrency that supposedly maintains its value at par with the dollar, locking other crypto assets in a contract to make it stable.

What this means is that not like other asset-backed cryptos, DAI is the product of an open-sourced software called Maker.

Maker is a protocol that runs on the decentralized ETH blockchain.

It's very interesting how DAI keeps its value stable to the US dollar. It shifts when there are changes in the market. This process happens in the Maker platform through the use of the MKR tokens, smart contracts, and other stabilizing methods. DAI does not need a centralized authority unlike other stablecoins (see: Tether/USDT). The DAI/Maker project is entirely running on the ETH blockchain making DAI a truly decentralized stablecoin cryptocurrency.

Maker graphics Oasis.

Maker is a protocol running on the Ethereum blockchain. It facilitates 2 different tokens called Makercoin and DAI, which are both ERC-20 tokens.

This platform aims to create lines of stable digital assets tied to various assets like gold, currencies, and other financial instruments.

This is the platform where DAI is utilized. Users take out loans in Maker, and users will receive DAI - which is the platform's main product.

The smart contracts in Maker balance economic incentives to sustain the value of DAI to 1USD.

When DAI's value goes lower than a dollar, the system automatically provides incentives to users to increase the price. On the other hand, when it goes over 1USD, the incentives are reversed.

They also over-collateralize DAI, instead of a 1:1 ratio. For example, instead of 1 ETH = 100 DAI, you can only get 1 ETH = 66 DAI (depending on the ratio given by the system). This doesn't mean that you lose money though. You still get 1 ETH back if you payout your loan.

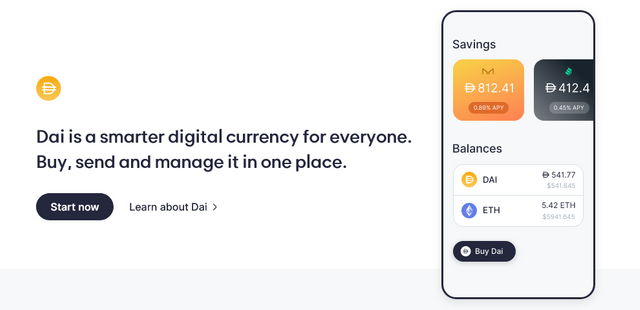

Oasis App webpage screenshot Oasis.

Oasis is the native platform used on the Maker system. This is where you can take out a loan for DAI and buy DAI directly from.

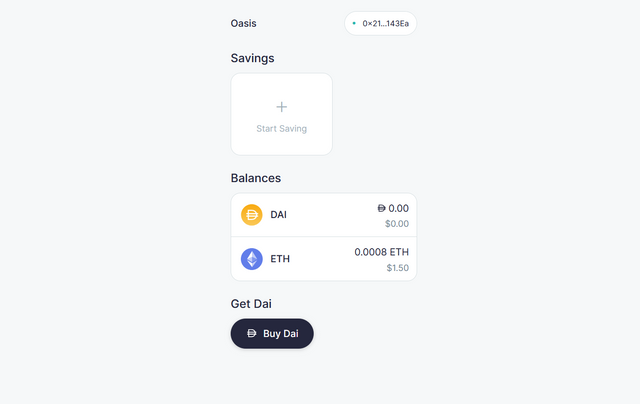

Oasis App main dashboard Oasis.

On the main page, you will be able to see your curreny balance on your ETH wallet. You have buttons to start your Savings or Buy Dai.

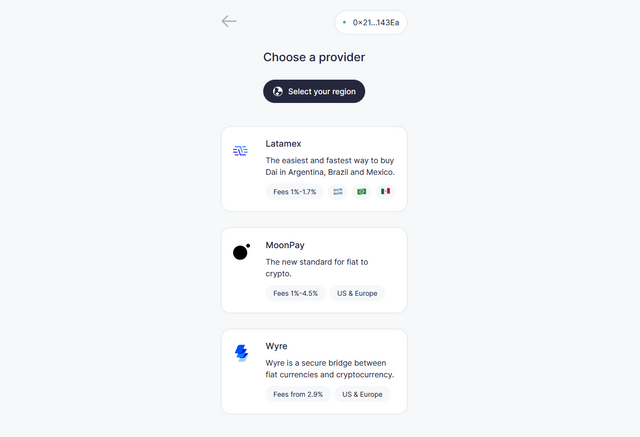

Oasis App buying DAI options Oasis.

If you press on Buy DAI, you will be asked to select your region and then choose a provider (might change depending on the region). You can just compare the fees in case you are given more than 1 option to choose from.

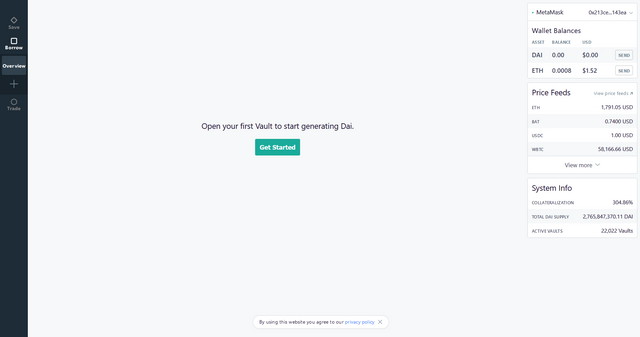

Another part of Oasis is called the Maker Vault. Which you can access from the main page or go directly to https://oasis.app/borrow.

Oasis App borrow feature webpage screenshot Oasis.

This is the main page, just click on Get Started to go through the process of opening the vault.

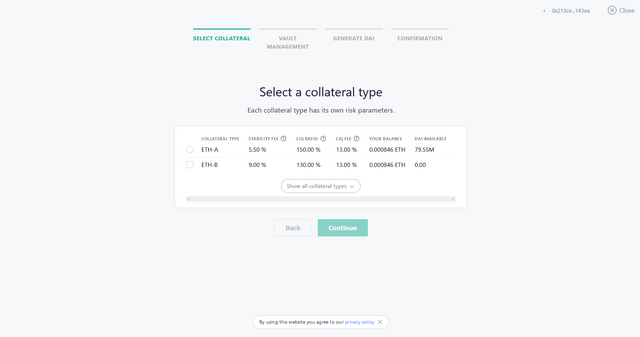

Oasis App borrow feature choosing the collateral type Oasis.

First, you will be asked to select a collateral type. There are comparisons on their differences so make sure to study those. Once you've made up your mind here just press Continue.

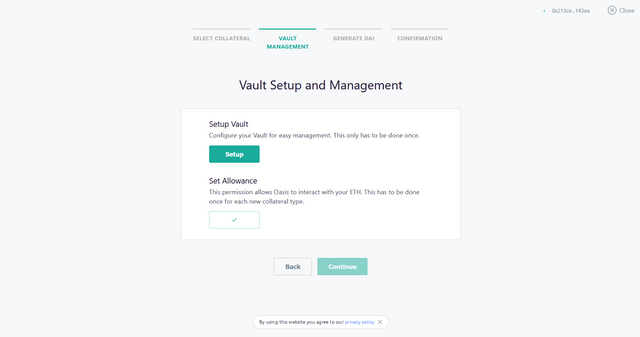

Oasis App borrow feature setting up the vault Oasis.

The next step is the vault setup and management. This is where you connect your wallet to start using it for the vault.

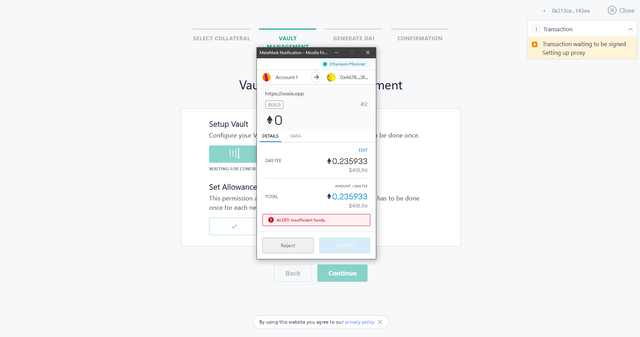

Oasis App borrow feature signing with connected wallet Oasis.

You will have to pay a gas fee to start this process (since this is only for learning, I can't go ahead and bypass this process, the gas fee is too high).

However, if we base it on the headings on the next 2 steps. They're pretty self-explanatory.

The next step will be the computation page where you will know how much ETH you put in and how much DAI you will be getting from the loan. Some more info may be presented as well, like interest rate or payment terms.

The last step is simply the confirmation where you will need to sign the process of the loan, either you sign or pay another gas fee to continue (no further info).

Oasis App borrow feature for btc collaterals Oasis.

Oasis also has a new feature where you can use BTC/Bitcoin instead of ETH/Ethereum to pay for the collateral when borrowing DAI. More info on https://oasis.app/borrow/btc.

Hi @luigienius

Thanks for attending the 6th Crypto course and for your effort in doing the given homework task.

Feedback

DAI is indeed an over-collateralized stable coin. Very well explained here. You indeed brought out that unique aspect about DAI.

This is very good work. Well done with the research. You creatively explained about DAI in a precise and clear way. I enjoyed reading your article and I feel motivated and insterested in seeking further information about DAI.

Homework task

9

Thanks a lot Prof!

Hi professor, please also check the reposted week 5 article with 10 grade. https://steemit.com/hive-108451/@luigienius/6wji4k-crypto-academy-week-5-homework-post-for-yohan2on-coinbase-wallet-a-defi-web3-wallet

Thanks a lot! Would be too bad if this gets missed again, if it will be missed I will not repost it anymore though. Thanks!