Trading Cryptocurrencies- Crypto Academy / S4W6- Homework Post for by @lordhojay

SPOT TRADING

Spot trading is defined as buy-and-sell transactions between two parties that take place instantly. It is the immediate settlement and execution of a cryptocurrency or stock asset purchase or sale. This indicates that the asset transaction between a buyer and a seller occurs in a split second.

Assets are purchased and sold at the spot price, which is established by both the buyer and the seller.

A Spot transaction consists of a buyer, a seller, and an order book. The Order Book supplies the prices that traders use to determine their own pricing. The order is filled when the market price matches the price specified by a trader.

Advantages of Spot Trading

• Spot trading is simple and straightforward.

• It ensures that assets are delivered quickly to both parties engaged in a transaction.

• There is less danger in spot trading because the original amount is not readily lost.

• Spot trading offers a lot of flexibility. To trade, one can choose from a variety of prices, or one can choose to hold.

Disadvantages of Spot Trading

• The profit made during a bear market is influenced by the volatility of cryptocurrencies.

• Spot traders can only deal with assets they have on hand.

• When there is a bear market, it is impossible to trade efficiently since the market is usually uninteresting and offers little opportunity for significant profit.

Futures trading

Future trading entails predicting the price of Cryptocurrency at a point in the future from when the deal is initiated. It provides for both optimistic and bearish market predictions, allowing for both long and short trading. The trader does not acquire the token, but rather the future contrast, which is a must-buy for the buyer and must-sell for the seller agreement of a purchase price at a certain time in comparison to the present market price.

The trader commits to a long or short position by stating what the Cryptocurrency's price will be at a specific point in the future. After the agreement is established, the transaction will shift towards a market position, giving the trader a profit or loss.

Futures trading allows for the acquisition of contracts with minimal cash by leveraging their value, allowing either the buyer or the seller to conclude their deal within the agreed-upon time frame.

To avoid asset liquidation, conduct thorough market research and utilize acceptable leverage while trading futures.

Advantages of future trading

• It makes the market more flexible since traders may go long or short to profit from the bearish market.

• Hedging helps to reduce asset loss and allows for a minimal commission payment for large trading transactions.

• It provides a trading platform that allows for the use of leverage and a little amount of cash, allowing for more profit with the proper forecast.

Disadvantages of future trading

• Trader might have to use strategies to reduce loss as these trading involves higher risk, making the trading more complex.

• If the market does not support your choice, liquidating your small money is a faster option.

Margin trading

Margin trading is using an existing asset or value as collateral to borrow additional money from a third party in order to enhance your purchasing power for trading, all with the goal of making a larger profit with a larger value.

The trader is obliged to deposit a portion of their worth to serve as a foundation for calculating risk leverage.

Margin trading allows a trader to trade both long and short market positions, with the long market position occurring when prices increase and the short market position occurring when prices fall, giving Margin traders the opportunity to profit from both types of market positions.

Advantages of Margin trading

• It provides a trading option that allows you to make more money with less money if the market is in your favor.

• It allows you to trade several Cryptocurrencies with a little amount of money by splitting them up and using them as collateral to borrow more money.

• It makes the market more flexible since traders may go long or short to profit from the bearish market.

Disadvantages of margin trading

• Traders may need to utilize methods to limit losses because these trades have a larger risk, making them more complex.

• Traders may need to utilize methods to limit losses because these trades have a larger risk, making them more complex.

Type of orders in trading.

• Market order: This is a trade order that requires the transaction to be completed quickly, with the current market price being used to execute the transaction. Only utilize the market order if the market has a big number of users and there is always a willing buyer or seller at any given time.

• Limit order: This is a type of trade order in which the transaction is completed at a later time when the transaction price reaches the market price. It allows a trader to open a transaction for a period of time during which he may not be present at the market, and then execute the deal when the market hits his chosen price.

• Stop limit order: This is a trading order in which a limit order is placed when the market price hits a predetermined point, known as the stop limit. To make this order, the trader will need to enter a stop limit price and a limit price for the order's execution.

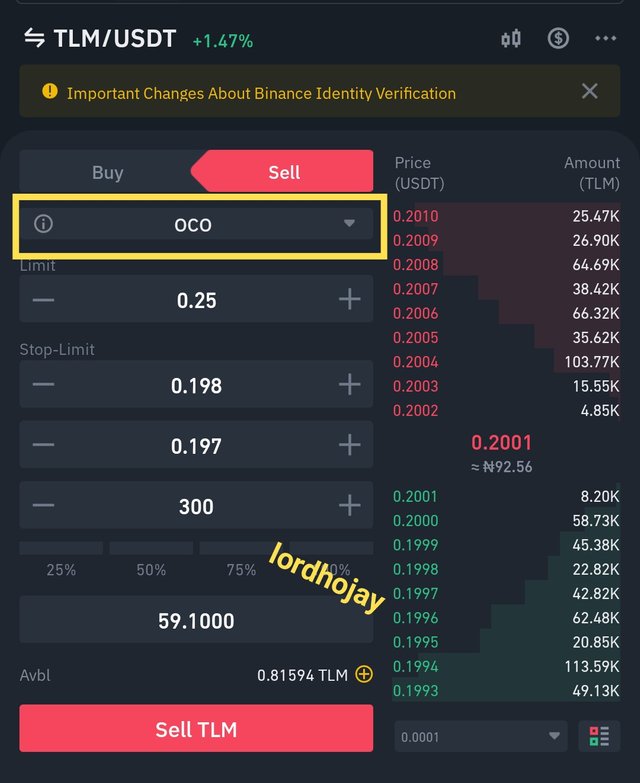

• OCO order: OCO which stands for "one cancel the other" is a trading order that entails putting a limit order to be executed if the market turns bullish or a stop-limit order to be executed if the market turns bearish, and when one order is completed, the other order is cancelled. The trader must enter a limit price that is higher than the current market price and a stop-limit price that is lower than the current market price in order to execute this order.

• Exit Orders: The stoploss order and the take profit order are two different forms of exit orders.

- Stop Order: A stop order is a form of exit order that allows traders to automatically quit a transaction if the trend of the trade does not match the forecast. If you anticipated a negative trend and the trend continues to be bullish, the trade will be immediately closed.

- Take Profit Order: A take profit order is a sort of exit order that traders use to leave the market after the necessary take profit threshold is met.

A trader can use an OCO order to enter a limit order and a stop-limit order. This allows the customer to restrict the amount of money they lose if the market price falls fast below the forecast limit price. The stop-limit will execute if the market begins to drop, which is for a sell order. The limit price helps to take profit and control risk since the stop-limit will execute if the market begins to decline.

Illustration

I have 300 $TLM for sell and the current market price is $0.200, to mange my risk , I would use an OCO order to place the trade at a limit price of $0.25 and a stop-limit of $0.198 just incase the market don't reach 0.25 and start to drop, this will minimise my loss and sell the token at 0.197

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

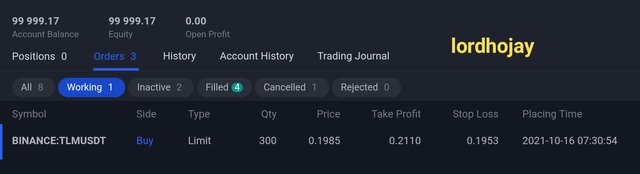

In this assignment, I will demonstrate how to open a limit order and how I create a 14-dollar limit order in the TLM/USDT market.

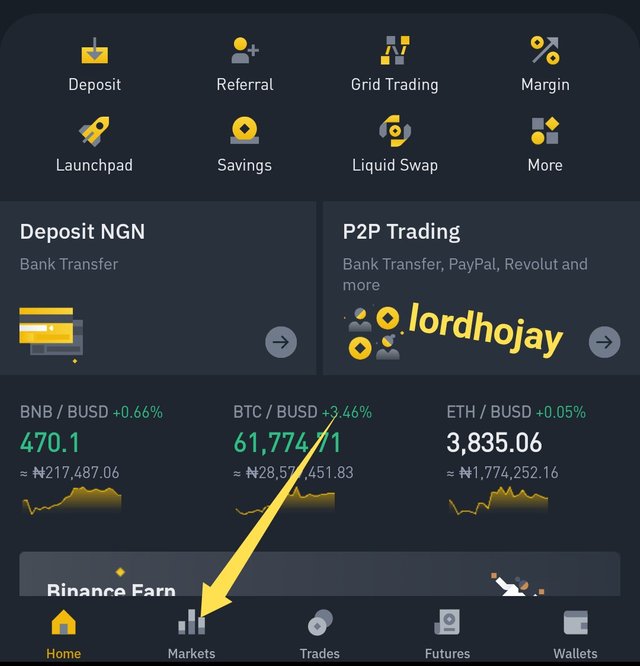

Step 1: Go to your Binance account and click on Market.

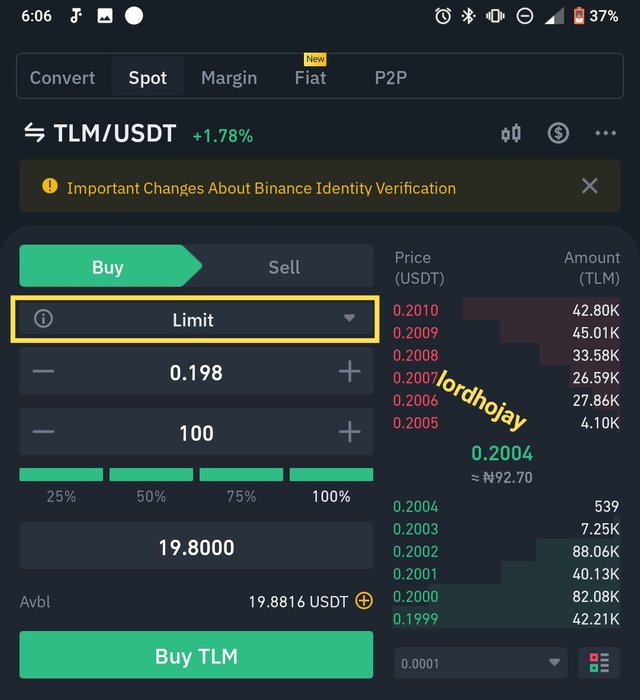

Step 2: Click on the search bar and type in the cryptocurrency pair you want. For this article I will chose TLM/USDT

Step 3: Click on buy

Step 4: It then takes you to the order page, where you choose the order on which you want to execute the transaction, and then select limit order. I place my limit order at $0.250, while the current market order is $0.2004, in order to acquire a volume of 100 $TLM coins for $19.8.

Step 5: My order is pending and will only be executed when the market price meets my set price. My order has been classified as an open order.

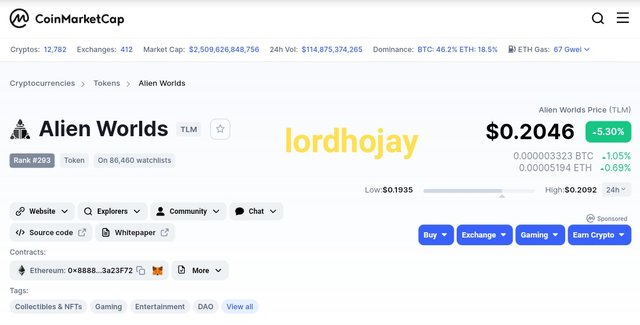

i)Why you chose the crypto asset

The crypto asset I have chosen to invest in is the Alien World (TLM) token.

Alien Worlds token (TLM) is the native token of Alien Worlds, one of the fastest-growing NFT DeFi metaverses that replicates economic collaboration and rivalry among participants. Alien Worlds (TLM) is a digital asset with a market valuation of $259.24 million. With an average daily trading volume of $57.16 million, Alien Worlds is ranked 179 in the worldwide cryptocurrency ranking. It is now priced at $0.2. The price has increased by 5.71 % in the last 24 hours. There are 46.6K followers on the dedicated Twitter account.

I've been watching this coin since the bearish season began in May. TLM has had a good run recently.

ii)Why you chose the indicator and how it suits your trading style.

For this class I will be chosing the KDJ Indicator. It is a trend follower. It has three lines that are referred to as the K, D, and J. The KDJ indicator is calculated using the lowest, highest, and closing prices during a certain time period.

The KDJ fluctuates in value between 0 and 100. With the KDJ, it is possible to detect whether an asset is in oversold or overbought territory. When the indicator goes below or above the 20 and 80 horizontal lines, it indicates that the trend will most likely reverse shortly.

Because it is so simple to comprehend, the KDJ is one of my favorite indicators.

iii)Indicate the exit orders. (Screenshots required).

As you can see in the screenshot. The J line has crossed the K and D lines, signaling an overbought condition.

At 0.1958, I entered a buy position.

I'm going to set my take profit at 0.2110.

My stop loss was set at 0.1953.

Cryptocurrency trading is not a new concept. Depending on our level of knowledge and the type of deal we wish to make, we can all trade cryptocurrencies. We should also keep in mind that trading properly necessitates thorough analysis and market research, not just guesswork and incorrect signal forecasts. We are certain to make money if we conduct the necessary technical analysis.

Thanks for the class prof @reminiscence01 for this class.

nice job this artical is fantistic

i am new user upvote and follow me

Hello @lordhojay , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.