Crypto Academy Week 6 Homework Post for @yohan2on Stablecoins

DAI image: https://blog.makedao.com

Dai Stable Coin

What is DAI?

DAI is a cryptocurrency on the ETH ERC-20 protocol that has been designed to function like a stable coin, meaning its value is tied to the dollar.

Its value is 1:1 to the US dollar, because of this DAI became one of the most relevant crypto projects in the world of DeFi.

DAI was designed by MakerDAO which is a very transparent project that offers great technicality and economic quality. Due to the success of MakerDAO, DAI has been made into a collateralized stablecoin.

Maker image: https://cryptocurrencyfacts.com

Dai History

When did this start?

This cryptocurrency was made back in 2014, aiming to get a stable currency inside Ethereum's blockchain. It is very new so they had to be really careful in planning this idea.

At first, this crypto was called SAI. Everything was controlled by smart contracts on the blockchain so no governing body was needed. Changes were handled by a DAO (decentralized autonomous organization) that votes on them. At its very early stages, it was able to give a boost to the rising popularity and trust gained by DeFi projects in the crypto world.

DAI was created as a solution to the use case issue of getting loans, saving money, transferring it - because of volatility in the market.

They implemented a collateral guarantee system that uses other cryptocurrencies and not fiat, making it possible to stabilize DAI. Their implementations make the value generated stay the same and have guarantees in place to avoid loss of value.

There are different elements that enable DAI to be a stablecoin.

First is the Maker protocol from MakerDAO, which works on different smart contracts in ethereum and is the backbone of the DAI operation and the DAO behind it. It is responsible for making the value stable to 1:1. It also controls the rates on interests, stabilization rates, auctions, penalties, governance/voting, and decision-making aspects - making Maker the heart of DAI.

Another thing is the Maker Vaults, which allows interaction to the Maker protocol - making it possible to generate DAI by depositing cryptocurrency as collaterals.

When someone makes a deposit, the vault informs us of the variables, interest, stability, and liquidation info depending on the token we deposited. Maker Vaults is the gateway to DAI issuance. Everything is decentralized and automated by smart contracts. Maker Vaults also take care of the process in reverse: when paying back loans and getting the collateral back.

Cryptocurrency image: https://mlsdev.com

Dai Creation

Creating DAI depends on 2 things: the collateral the user deposits, and the Maker Vault.

A capital is certainly needed to generate DAI, and has to be acceptable by the Maker protocol. Currently, Maker accepts the following:

- BAT

- WBTC

- USDC

- TUSD

- KNC

- ZRX

- MANA

- ETHER

All of these are ERC-20 tokens that you can use to interact with the Maker Vaults.

To use a Maker Vault, you simply have to go to a built-in app called Oasis. Using ERC-20 compatible wallets Oasis lets users create vaults to use. Access Oasis here: https://oasis.app/.

Getting DAI using the Oasis Dapp: https://oasis.app

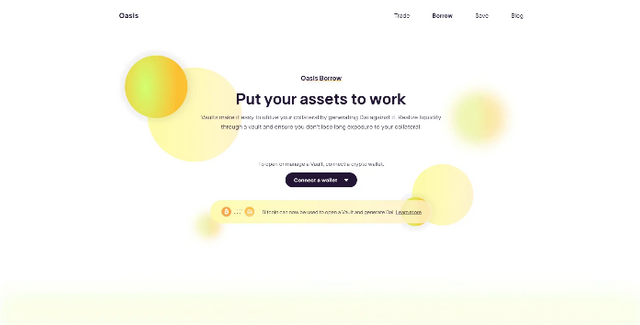

When you're on the dapp, simply select the option and connect it to your wallet. We can use MetaMask for this and choose Borrow as an example:

Navigating through the Oasis Dapp: https://oasis.app

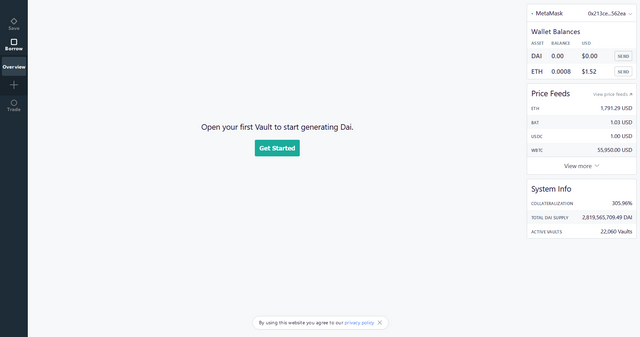

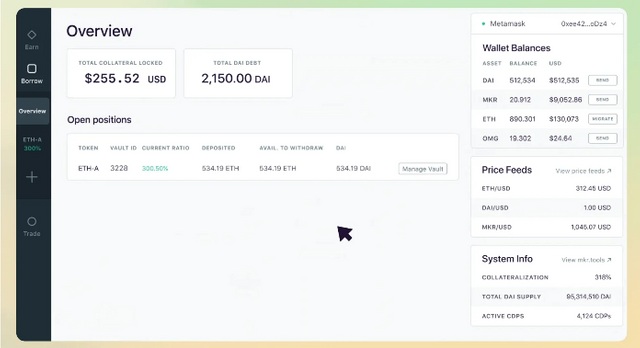

This is what the system looks like:

Oasis Dapp borrow feature: https://oasis.app/borrow

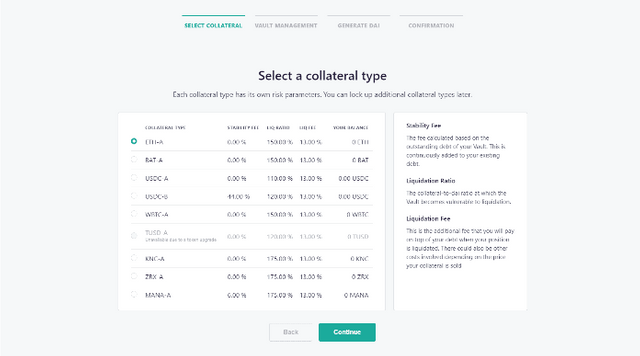

Just click on Get Started to start generating coins. A new page will be asking you to choose collateral to generate DAI. There are many different options provided depending on the user and wallet - they would have different levels of collateralization and commissions that are deductibles.

Oasis Dapp borrow feature, choosing collaterals: https://oasis.app/borrow

After choosing the collateral, you can start the Vault, the deposit will be made and you have to accept the data. After this, the DAI will be transferred to your own wallet.

Oasis Dapp, finalizing DAI generation sample: https://bit2me.com

Closing Remarks

I hope that you were able to learn a lot in our discussion about stablecoins, particularly DAI - what is it, how it was created, its uses; and how to get DAI. Thanks a lot to @yohan2on for creating this homework task for us. To @steemitblog for the initiative, and to @steemcurator01 & @steemcurator02 for the support!

Hi @lihaytorres

Thanks for attending the 6th -Crypto course and for your effort in doing the given homework task.

Feedback

This is very good work. I was glad to learn how to get DAI. Well done with your research on DAI. Your explanations were precise and clear. Keep it up!

Homework task

10

Thanks a lot @yohan2on! I really appreciate that you liked my article a lot!

Hi @ljhaytorres

Thanks for attending the 6th Crypto course and for your effort in doing the given homework task.

Feedback

Is that true?

DAI is rather a collateralized Stable coin. In fact, it's over collateralized by combining coins like $Eth and $MKR in order to ensure its price stability.

Otherwise, this is good work. Well done with your research study on DAI

Homework task

7.5

Thanks a lot for the review! I guess that was a mistype, should be collateralized and not "non". Thanks for the guidance!