Curious how BTC gets to $100k? Jerome Powell is going to get us there...

Bitcoin was made for times exactly like this...

I remember looking at models and past patterns back in 2018 after bitcoin had initially peaked around $20k and remember thinking to myself, this all makes a lot of sense why bitcoin tends to do what it does around halvings.

I mean it is basically supply and demand 101...

However, one thing that always kept popping up in my head was this...

Ok, getting to $20k is one thing, but getting to $100k or $200k, that is a whole other ball of wax.

Yes yes I know that compared to other markets bitcoin is still relatively small, and it wouldn't even be THAT large in the grand scheme of things at those larger numbers, except that the only way that remains true is if you are comparing it to some of the largest asset classes in the world.

I remember racking my brain thinking, at some point something is going to have to change for bitcoin to get to those types of numbers, there is going to have to be major change from how things look right now in the world.

I couldn't foresee bitcoin being worth north of $100k and everything else relatively staying the same (this was still 2018 @jrcornel by the way).

But then something did happen...

The coronavirus happened.

And it's not so much that a pandemic happened, it was the world's response to said pandemic.

It was exactly the same response we saw back in 2008/2009, just throw money at it.

Only this time the problem would be more far reaching and require significantly more money to be thrown at it.

That is when it really became clear... Jerome Powell is how bitcoin gets to $100k.

As I type the interest rates are at zero and there is talk of them going negative, we have seen trillions of dollars in stimulus globally already unleashed with more likely on the way, and we have seen bitcoin's emission rate cut for only the 3rd time in its existence.

Add all that up and it becomes very easy to see how bitcoin could be worth $100k.

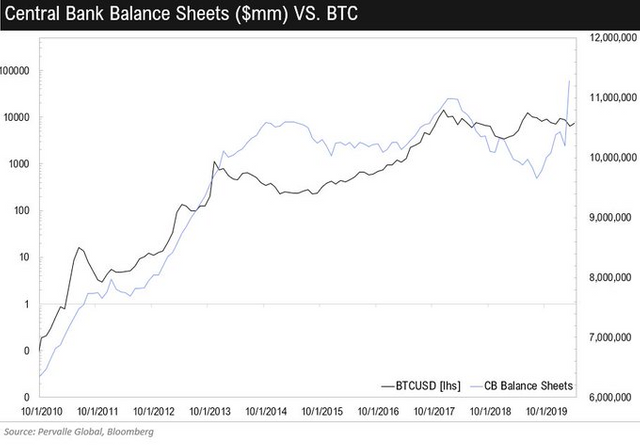

Central Banks balance sheets are continuing to swell and look how bitcoin performs in that environment:

(Source: https://twitter.com/TeddyVallee/status/1253330517061062656)

The inflation likely to come from the all the stimulus and money printing will push all assets priced in dollars up, and that includes bitcoin.

Not only that but with every crisis and subsequent ever bigger bailout, the world's confidence in the current financial system weakens, which further emboldens our good friend bitcoin.

In this environment it not only becomes easy to see how bitcoin eventually gets to $100k, it actually becomes difficult to see how it doesn't get to $100k...

Let that sink in for a moment...

Stay informed my friends.

Image Source:

https://twitter.com/Travis_Kling/status/1262219830611963906

-Doc

Like I've said before, it is more likely that USD and EUR drop against every cryptocurrency than that BTC goes up a lot against just USD and EUR... The world economy will collapse soon and that will make biggest FIAT currencies almost worthless.

By definition a drop of one against the other also means a gain by the second against said dropping currency...

When Bitcoin was performing like shit against USD, my currency went up a lot against USD even though its price is tied to Bitcoin price... That much I do understand...

yea but your currency has no liquidity, so it doesn't matter what the price says, you can't realize it....

Talleo is not about making profits in short term, it's all about learning how to make better cryptocurrency... If people want to buy it, they do it because they think it has more potential than the alternatives.

Sure, but I am just saying you can't really compare the price action against other much more liquid coins...

Same happens with Steem on HitBTC... Because there isn't many Steem users buying or selling on HitBTC, price fluctuates more there.

I'm counting on that when my coin gets more exchanges, the liquidity will increase.

More exchanges might also attract third-party developers that bring real value to the coin instead of just trying to scam us with high integration fees.

Again, that's not really comparable. Even with that exchange down, there are a handful of others that are operational processing hundreds of thousands and millions of dollars worth of trades let market forces set prices. Not comparable.

for now I do not believe in any collapse of the ordinary market, but in 2023 another collapse could take place that will put the world economy back in crisis, but then everything will resume, as always, as every time after a war.