Student Loan... Is It Worth It?? Part 1

Think About It….

Part 1

Colleges are built as a business at the fortunes of respected individuals who make per week, what we make in a year. It is year after year, that we continually have the desire to send our children to private colleges at the average cost of $33,480 per year. Some fancy the title, others fancy the college degree and others simply have been force-fed generation to generation that a doctor, lawyer, engineer, architect or computer specialist is what makes the world go round.

Today, according to Forbes -- Engineers, Human Resource, Information Technology & Accounting hold the throne for the most jobs in the United States. With each bolstering an average pay of $50,000- $95,000, it seems as if all is well in the world.

Yes, jobs have been created, unemployment is down, but what about student loan debt? The average student loan for a four-year education stands at a borrowed income of $120,000 in total. With a beautiful algorithm we like to label compounded interest, a fresh grad would be paying about $1500-1600 PER MONTH. If you live in a major city, you will be on the high end of the pay grade I mentioned above. But, you also would have the highest cost of living if you fall into that scenario. For calculations sake, let’s gauge your monthly rent at $1000 with food and transportation costs totaling at another $500. Now let’s take that beautiful student loan payment (if stretched out to 12-year payment plan) and see how much we actually have left.

$1500 (Loan Payment) + $1500 Living Expense = $3000. If you happen to have a car or ride a local subway, your monthly expenses to simply SURVIVE are between $3000-$3200 with your student loan.

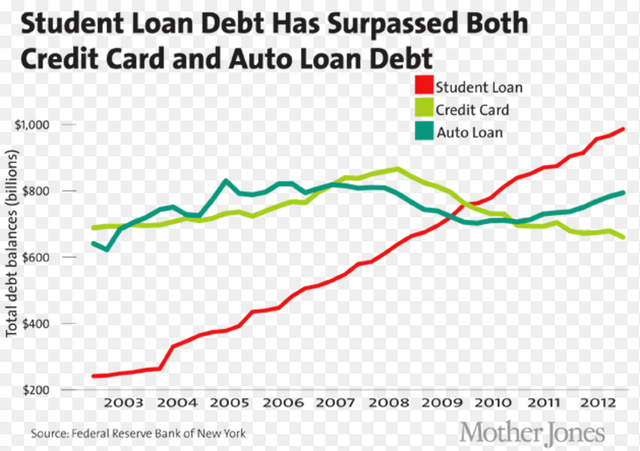

With a $70,000 annual salary, each month you are left with about $500 if you do not go out for a drink, do not have cable in your home, or engage in any form of entertainment that a “normal” individual would routinely take part in. So, what exactly happened to our American Dream? With less than half of our college graduates earning less than $70,000 USD, what exactly are we building for the future of America? Perhaps, the American dream got lost in translation and here we are today-- 2017, The beginning of the century where Student Loan Debt surpasses both Credit Card and Auto Loan Debt.

Let’s examine how and why we've got here in the first place. The financial counseling necessary for each college graduate is a class that unfortunately no bank, school counselor or college provides. Why is that? Isn't it the job of our high school and colleges respectively to put us in the best possible scenario to earn a proper living? Because the average institution we call “College” expects 1/3 of us to graduate and attain a job, the other 1/3 to drop out and the final 1/3 to do poorly in an area of concentration that rarely employ's a graduate in the first place….

But banks, colleges, trade schools and tv commercials still sell a college degree.. And most salaried jobs also ask for a college degree of some sorts-- so why are we being under paid or overcharged by the institutions built to put us into a better place.

What are some very reasonable possibilities/alternative routes we can take to keep the overhead cost of college cheaper?

- Figure out what you naturally like to do, that feels effortless. Find out the cost of a PROGRAM BASED college degree that gives you the necessary classes towards graduation.

- Find local in-state college's that serve your needs without spending a fortunate. Consider public state universities that are beyond affordable.

- Go to the department of Labor website. Look up your designated profession and see their earnings by the city, locality, and by the hour. DO NOT LISTEN TO YOUR COUSIN, UNCLE, FATHER Or RELATIVE that have told you otherwise. Times change, Things Change and consequently Money Changes.

- Ask about tuition payment plans to help pay for part of your college education as you go.

- Plan your finances and start a 401k. Estimate the cost of your education from start to completion. Estimate payments, savings, and ask your employer about contributing to your 401k fund.

- Go to your local bank and clearly get it in writing how much a loan would cost you with a principal and interest breakdown.

Among other things, long-term planning and career choices can make or break your life. Lifestyle choices, After all, if your career cannot help you break even, it's a good idea to start considering alternatives.

Stay Tuned for Part 2.