Crypto Academy season4 - week1/ The Bid-Ask Spread/ Homework Task by @iykewatch

Because of my own experience with market fluctuation, I recognize the great risks one takes on investments. This converts the Social Security safety net into a risky proposition many cannot afford to take.

~Grace Napolitano

HOMEWORK

1️⃣. Properly explain the Bid-Ask Speead.

2️⃣. Why is the Bid-Ask Spread important in a market.

3️⃣. If crypto X has a Bid of $5 and an Ask price of $5.20,

(a). Calculate the Bid-Ask Spread.

(b). Calculate the Bud-Ask Spread in percentage.

4️⃣. If crypto Y has a Bid price of $8.40 and an Ask price of $8.80,

(a). Calculate the Bid-Ask Spread.

(b). Calculate the Bid-Ask Spread in percentage.

5️⃣. In one statement, which of the assets above has the higher liquidity?

7️⃣. Explain positive slippage and negative slippage with price illustrations for each.

THE TASK

| 1️⃣. PROPERLY EXPLAIN THE BID-ASK SPREAD. |

|---|

The Bid Price is the highest price a buyer is ready to pay for an asset.

Also, the Ask price shows the lowest price that a seller is ready to accept for his asset.

Example: John has a piece of land to sell and he intends selling it at $22 and Lucky wants to buy the land from John, Lucky k asks for the price John says $22 Lucky on his part has a budget of $21. Therefore, the difference between the ask price and the bid price is KNOWN AS SPREAD.

However, the Bid-Ask Spread is the gap between the Bid price and Ask price.

| 2️⃣. WHY IS THE BID-ASK SPREAD IMPORTANT IN A MARKET? |

|---|

Furthermore, in a liquid market, the bid-ask spread will be small. The reverse would be verifiable,when the bid-ask spread is large, the market would not be liquid.

The importance of the Bid-Ask Spread in the market place is seen in the light that it clears the difference between the buyer's highest price and the seller's lowest price.

The spread stands for supply and demand. The Bid price represents the demand and the Ask price is the supply. Lastly, the bid-ask spread helps in decision making when buying or selling an asset.

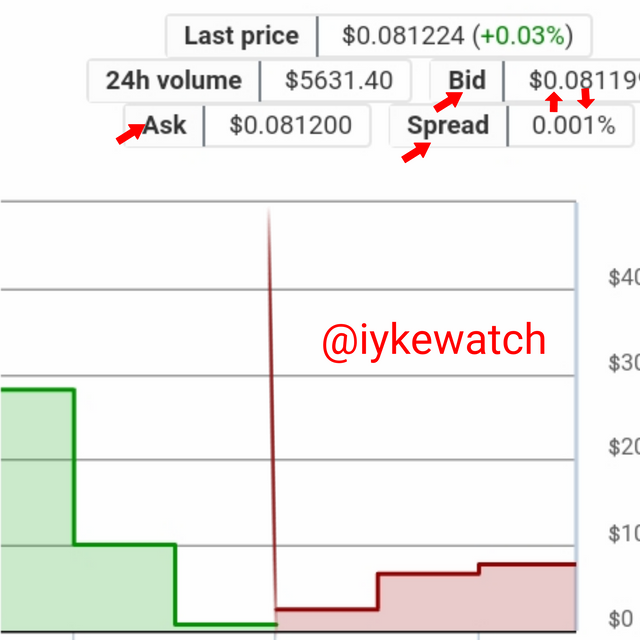

The screenshot is an example of a large spread.

3️⃣. If Crypto X has a Bid price of $5 and an Ask price of $5.20,

(a). Calculate the Bid-Ask Spread

(b). Calculate the Bid-Ask Spread in percentage.

In percentage the formula is:

%Spread=(Spread/Ask price)x100

Therefore,

(a).

The Bid price = $5

The Ask price= $5.20

Bid-Ask Spread = Asking price-Bid price

= $5.20-$5

Bid-Ask Spread =$0.20

(b).

%Spread= (spread/ Ask price)x100

=(0.20/5.20)x100

= 0.03846x100

Bid-Ask spread =3.845%

4️⃣. If crypto Y has a bid price of $8.40 and an ask price of $8.80,

(a). Calculate the Bid-Ask Spread.

(b). Calculate the Bid-Ask spread in percentage.

The Formula for calculating spread is: SPREAD=Ask Price-Bid Price.

In percentage the formula is:

%Spread=(Spread/Ask price)x100

HENCE,

(a).

Bid-Ask Spread= Ask price - Bid price

= $8.80 -$8.40

Bid-Ask Spread = $0.40

(b).

% Spread= (Spread/Ask price)x100

= (0.40/8.80)x100

= 0.04545x100

Bid-Ask spread= 4.545℅

| 5️⃣. IN ONE STATEMENT, WHICH OF THE ASSETS ABOVE HAS YHE HIGHEST LIQUIDITY AND WHY? |

|---|

| 6️⃣. EXPLAIN SLIPPAGE |

|---|

.jpeg)

As we have discussed above on bid-ask spread, it would be interesting to mention at this point that one aspect of the bid-ask spread is volatility. Volatility occurs naturally it also occurs even we have placed an order to purchase a commodity. Remember that when an order is placed it takes a process to execute such and within this period, there is the possibility of price increase or decrease. This change in price is known as "SPLIPPAGE".

| WHAT IS SLIPPAGE |

|---|

Slippage is that change that occurs in of a commodity between the period of order and execution of the order.

For instance, if Maxwell wants buy a mobile phone from X company and when he checks the price of the it is at 4 USD and he is comfortable with the price he places and order and when the order is executed, Maxwell sees on the receipt 4.2USD here slippage had occurred.

Slippage may occur in the following manner

- Is the positive slippage.

- Is the negative slippage.

- Is No or zero slippage.

Slippage risk can be checked by trading within commpetitive hours when activities are high and in low low volatility markets.

| 7️⃣. EXPLAIN POSITIVE SLIPPAGE AND NEGATIVE SLIPPAGE WITH PRICE ILLUSTRATIONS |

|---|

Tides do what tides do – they turn.

~Derek Landy

| Slippage do what slippage do - it changes. |

|---|

Positive slippage.

Positive slippage occurs when the executed price is better than the intended price. Example: Mr A placed an order for the purchase of a commodity at $57 and at the execution of the order the price of the commodity has reduced to $56. This is a positive slippage.Negative slippage.

Negative slippage occurs when the executed price is higher than the intended price. Here the trader losses some point value.Example: A trader placed an order on his steemit wallet to buy 14 steem for 1sbd and when the order is executed instead of receiving 14 steem for 1 sbd he receives 12.9 steem. This is a negative slippage.

Zero / No slippage.

No slippage means that there is no changes between the intended price and the executed price.Example: A trader places an when the price is at $2 and at the execution the price remained $2. No increase nor decrease in price.

CONCLUSION.

In buying and selling, the seller has the price he wishes to sell his asset and the buyer has the limit to the amount he can spend on the said asset that difference between the seller's price and buyer's price is known as spread. The bid-ask price represents supply - demand relationship. The change in price of a commodity after an order had been placed is not fraud, nor anyone's making it is a natural occurance that happens at some point in trade. It is a called slippage. The slippage should be tolerated because it is anyone's making.

Thanks all.