Crypto Academy Season 2: Week 2 || Homework post for @kouba01||

Hello all, and welcome to Week 2 of Season 2's homework post. Professor @kouba01 has given an excellent and thorough lecture, and I am grateful for that. In this Crypto Academey, this is how I am learning a lot of new things.

What is the difference between a cryptocurrency CFD and a cryptocurrency futures contract?

First and foremost, let me define cryptocurrency. Cryptocurrency is a type of digital currency that does not exist in the physical world. It means that it does not exist in the physical sense and can only be used digitally via the internet.

Contract for Difference (CFD) is abbreviated as CFD. It's a type of trading where you don't have the crypto asset in your wallet or account when you do it. The trader does not own the crypto asset and only trades on the price of the crypto asset.

Cryptocurrency is extremely volatile, and when a trader expects the value of an asset to rise or fall, he can open a Buy or Sell position. In other words, the trader will take a Long or Short position based on the price fluctuations of an asset. In CFD trading, a trader can profit from both the upward and downward movement of the asset. Traders can profit from price movement in both directions, whether it is an increase or a decrease.

A trader gains money at any point at which the commodity moves in the direction that the trader has set in his trade, which is multiplied by the number of units the trader purchased or sold. In the event that the market moves in the opposite direction, the loss will be calculated in the same manner.

What criteria should I use to determine whether cryptocurrency CFDs are appropriate for my trading strategy?

Before beginning to trade Cryptocurrency CFDs, it is necessary to do some research and investigation. To determine whether cryptocurrency CFDs are appropriate for one's trading strategy, one must consider the following factors.

Trading cryptocurrencies is extremely risky, and it can only be done with money that you can afford to lose.

Short-term trading is ideal for CFD trading.

Only put money into investments that you can afford to lose. Cryptocurrency is a highly volatile market in which a trader can easily lose all of his money.

If a trader has a small amount of money and wants to use leveraged trading, Cryptocurrencies are extremely expensive, and not everyone can afford to buy them. As a result, CFD trading allows traders to trade with a small amount of money.

Through regulated brokers, you can trade in a safe environment.

This type of trading necessitates a thorough understanding of margin and leveraged trading.

Is it true that CFDs are high-risk investments?

Yes, CFDs are extremely risky financial instruments. Cryptocurrency, as we all know, is extremely volatile, and it can move in any direction, short or long, very quickly. As a result, if the market moves in the opposite direction of the trader's price forecasting, the trader may suffer a significant loss. Margin and leverage are part of CFD trading, which increases the risk. Proper knowledge of such trading is essential; otherwise, it can be extremely dangerous, and a trader could lose all of his money. As a result, every broker's website includes a disclaimer on the home page stating that trading entails a high level of risk. It is possible that it is not appropriate for all people. As a result, cryptocurrency CFD trading is extremely risky and should only be undertaken with risk capital.

ffering services to the traders. The list is given below and they are top rated brokers that are offering cryptocurrency CFDs.

BitMEX

eToro

TIOmarkets

PrimeXBT

XBTFX

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

eToro is not available in Pakistan. So I opened my account in PrimeXBT. After opening account and verification, I opened Demo account and opened my first trade on BTC/USD. I have given screenshots below.

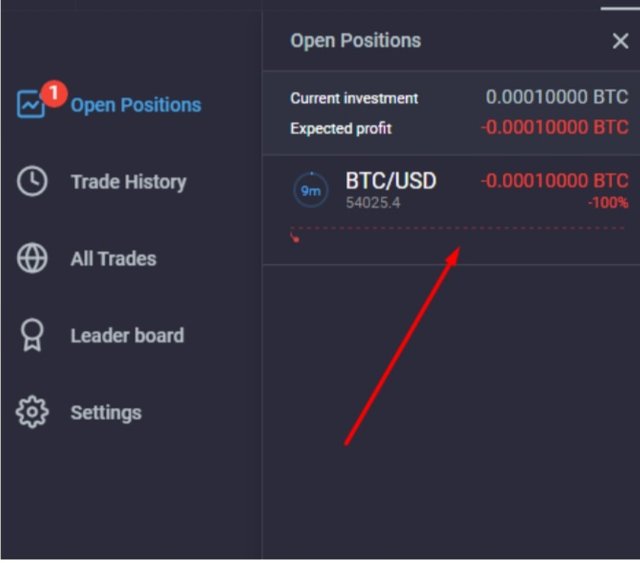

I opened a trade by clicking on up. I have opened buy trade. By confirming, a trade is opened.

It can be seen in the below picture that a trade is open. I have clicked on Open Positions and it has given list of trades I have taken.

At the end of the day,

To summarise, traders with a small amount of capital can trade Cryptocurrency CFDs through a regulated broker. Because such trading entails a high level of risk, risk capital must be invested in such a way that a trader can easily afford to lose it.

Thanks in anticipation.

Regards,@hamidsab

Hi @hamidsab

Thanks for your participation in the Steemit Crypto Academy

Feedback

This is fairly done. Kindly put more effort into your work.

Homework task

6