Crypto Academy Week 6 Homework Post for @yohan2on Explaining Stablecoin Tether

The Homework!

Homework task: Write about any one of the following stable coins;

- Tether(USDT)

- Steem backed dollar(SBD)

- DAI

Homework task: Write about any one of the following stable coins;

- Tether(USDT)

- Steem backed dollar(SBD)

- DAI

Tether Coin - Image. From Coindesk

Tether

Tether Limited is the creator of the first and most widely used cryptocurrency stable coin. It is a platform issuing assets that are based on the blockchain and are linked to price of government currencies.

Tether currently has 4 stablecoins for different currencies/assets, namely:

- USDT for the US Dollar

- CNHT for Chinese Yuan

- EURT for the Euro

- XAUT for 1 oz. of Gold

They first launched USDT back in 2014 with the idea of making a government currency more compatible with cryptocurrencies that is circulating the market.

Tether Limited holds a number of US dollars whereas the whole reserve that they have is said to be equal to the USDT that they produce and is redeemable based on the reserves.

Tether website - screenshot. From Coindesk

USDT = 1 USD

After a USDT has been minted and issues, it's possible to transact it like cryptocurrencies - users can transfer it, store it, or spend it using services (e.g exchanges, finances). It is particularly useful for traders who want to avoid the volatile cryptocurrency markets.

As of last year, USDT has been remaining to be the largest and most widely used crypto stablecoin.

Stablecoins like USDT has value because they offer crypto traders a tool to avoid the extreme volatility of the markets.

Tether graphics. From Coindesk

For example, a trader might reduce their risk to a bearish movement in the price of a cryptocurrency if they move their funds to USDT. Having to use USDT also minimizes costs for transaction and delays.

Exchanges have also found Tether to be a tool that allows them to increase the trading pairs they offer while making it possible for some places (countries) to do trading in case fiat trading is not an option.

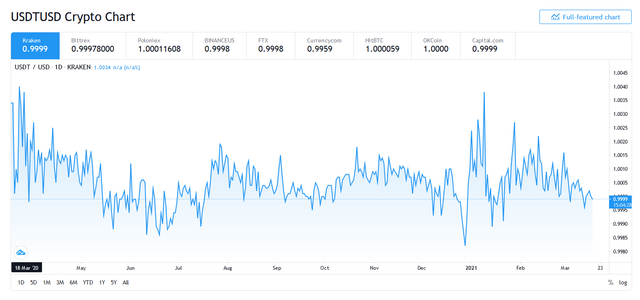

Tether/USDT trading chart. From Tradingview

It is important to know though, that USDT’s value has also fluctuated above and below its desired peg of 1 USD. Like when there were doubts and false accusations that it's not actually backed by actual dollar reserves, its price fluctuated downwards.

As of the moment, stable coins like Tether's USDT has been emerging in the market and has been very useful beyond the trading world, especially when it comes to making payments and transfers between countries/borders. It has gained traction that even bluechip companies like Facebook has sought competition in the market by trying to make their own stablecoin (see: Libra).

Thanks a lot for reading this new article about a stablecoin called Tether/USDT. This article is made possible by the homework task given by @yohan2on empowered by the assignment of @steemitblog. Till my next information article. Have an awesome day readers!

Images used are from Chrome Webstore, metamask.io website, sushiswap website, and my own screenshots of the MetaMask wallet. Thank you so much for this task @besticofinder, @steemitblog, @steemcurator01, @steemcurator02!

Hi @grazz

Thanks for attending the 6th -Crypto course and for your effort in doing the given homework task.

Feedback

This is good work. Well done with your research study on Tether.

Homework task

8

Thanks a lot for the feedback, I really appreciate this prof!