Crypto Academy / Season 3 / Week - 8 | Homework Post for Professor @yohan2on

Assalam-o-Alaikum!

Marketing Execution Order

Pending Order

Buy Stop and Buy Limit

Sell Stop and Sell Limit.

In Marketing Execution Order we Buy and Sell trade within current value and time. It means that we Buy and Sell trade-in current time but in Pending Trade we Buy and Sell trade-in pending form it means that we wait for the value on that we want to Sell and Buy trade.

Question No. 1

Define the following Trading terminologies;

- Buy stop

- Sell stop

- Buy limit

- Sell limit

- Trailing stop loss

- Margin call

What is Buy Stop?

Buy Stop

Buy Stop is a trading order that is used to buy trades at higher prices than current prices. This is so well-known way to buy trades and this is a way to Pending Trading. But here is a question? When we buy anything from people around us, we try to buy the thing at a low rate, but here we are buying at a high price from current prices. The answer is when a trader plans to buy trade in the next coming days then firstly he analyzes the market exchange. He gets the result that the market will be up in the next few days so he plans to buy trade and the trader fixes a point to buy trade and the point is called "Buy Stop". Trader placed the buy stop order at that point. When the market crosses the point, a trade is executed automatically.

Stop Loss

If the market does not go to the point or come back to a low point then traders use the new term is called "Stop Loss". It means that if traders get any loss then this term will reduce the risk of loss. Traders specified the point in the case of loss and when the market will cross to the Stop Loss point and the trade will automatically turn off.

Take Profit

Traders use the term "Take Profit". This term is to give profit to the traders. For this, traders specified a point that the trade will turn off after starting to give them profit. This term is called "Take Profit".

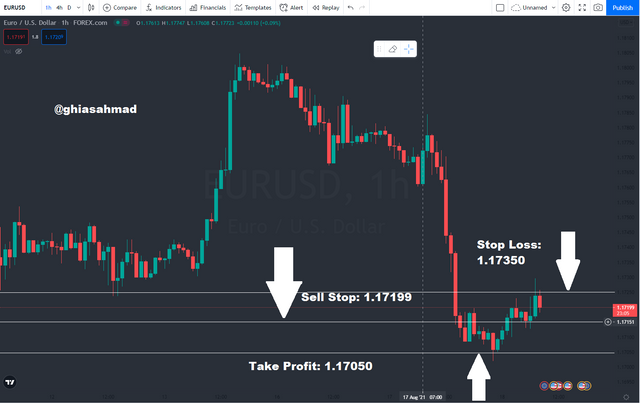

What is the selling stop?

Sell Stop

This is also so well-known trading order that use to sell trade and this is also profitable and this is a form of "Pending Trading". This form is like Stop Sell but this form is the opposite of Buy Stop. In this term, a trader sells this trade. A trader sells his trade to specify a point. In this trade, a trader sells his trade at a lower price than the current price. But here is a question: how does the trader earn profit by using it? A trader analyzes that the market will break down and it will move down so the trader specified a point to sell his trade and the point is called Sell Stop. So, the trader gets profit. This is also the most used term.

Stop Loss

Traders use the term Stop Loss to escape the loss. For this, traders use a specified point in the case of marketing up. The point is called Stop Loss. When the market crosses to the point then the point automatically finishes the trade so the trader faces minimal loss.

Take Profit

Traders use the term "Take Profit". This is a useful term for traders and it gives profit to sellers. Sellers use it to specify a point and on the trade. When the market cross to the "Take Profit" point then the trade will automatically be finished and the trader gets his profit.

Buy Limit

Buy Limit is a form of future trading used buy traders from below the current. When the market is in a downtrend then a trader analyzes the market first and points out a level where support can be seen. Trader placed the buy limit order at the support price with thinking the market go downwards at the support price level and then move back upwards sharply. Buy limit is also a useful order in the trading and sometimes it gives high profit to traders.

When the market moves downwards and reaches the support level, it bounces back upwards from this level. This support level should be strong for your buy limit order. The trader should place a buy limit order at this level and wait till the price touches this level and the trade will be executed.

A trader buys a trade and waiting for uptrends. When the market touches the Buy Limit then the trade starts and If the market goes on an uptrend then the trader earns his profit.

Take Profit

Traders predict that the market will grow up after touching Buy Limit so the traders use a specific point of Take Profit. As I've already mentioned, the trade will automatically be finished after touching this point and the trader will get his profit.

Stop Loss

And if the prediction proves wrong I mean that in the case of down marketing traders use "Stop Loss" term and by using this term a trader faces minimal loss. This term work like previous "Stop Loss" terms I mean that if the market will cross to the Stop Loss point then the trade will automatically be finished and the trader will face minor loss.

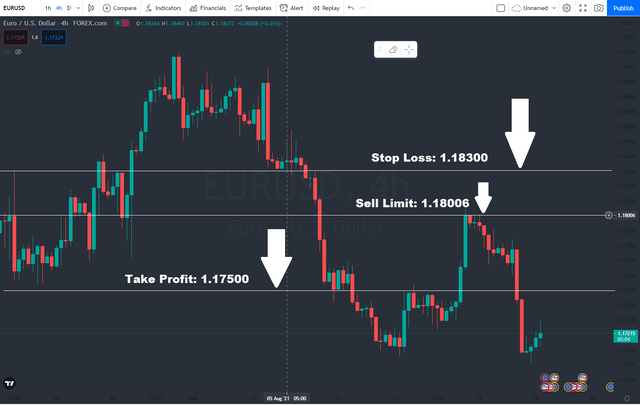

Sell Limits

Sell Limit is also a form of future trading used by traders from higher than the current price. If the market is upward, A trader should analyze the market first and point out a level where the order can be placed. So for this, a trader should find out the resistance level and placed the sell limit order at this level. In this case, the trader thinks that the market goes upwards of the resistance level and then pushes back downwards quickly. Thus, the sell limit order will be executed.

It means that when the market touches the Resistance Level then trade starts and if the market goes to a downtrend then the trader will get a profit and his trade will sell in the profit.

Take Profit

If the market will move down and touch to the profit point then the trader gives the Take Profit point then the trader will get profit and the trade will be successful.

Stop Loss

If the market will move up then the Stop Loss will finished trading and the trader will face minor loss and this process is like Buy Limits.

Screenshots are also given.

What is Trailing Stop Loss?

- First of all your Trailing Stop Loss will be moving. It means that this is not a freeze Stop Loss, this is a moveable stop loss that moves with the situation.

- It will move in your favor. It means that it will move traders favor and move just then when the mark moves.

- How much value would you want to move? You will decide.

Let's understand these three points with examples

- This is a moveable Stop Loss. It means that it will be not frozen like a simple stop loss. It will move up and down by the situation.

- It will move in the favor of the trader. It means that it will move in the favor of the trader. When the market will fall then it will move and by using it a trade will face minimal loss.,

- How much value do you want to move? It means that how much value that you want to move. It will be a shift for example I put a trailing stop loss of 1$ then when the market will up 1$ it will automatically up 1$.

Here is the most important question "Why do traders use Trailing Stop Loss"?

I use in the condition when the trader already gets profit but for more profit and unnecessary wait it can go in the loss, then Trailing Stop Loss will handle this situation.

What is Margin Sell or Margin Trading?

Margin Sell is the form of Margin Trading that every broker gives to customers and with its help, a customer can buy more shares in low money. For example, if a broker gives a margin of 10 times on a share then we can buy 10 shares on the price of one share. If a broker is offering 10 times margin or leverage on the stock of USD and the price of one share of USB is 100 PKR then we can buy 10 margins in the price of one margin of USD. It means that we can buy 1000 cost margins at the price of 100 PKR. But most of the brokers give margins for intraday trading there is a very low number of brokers who give swing margins but there is no broker who gives margins for long-term investing. It means that margin is a timely facility that brokers can take over anytime.

Question No. 2

2 - Practically demonstrate your understanding of Risk management in Trading.

Briefly talk about Risk management

Be creative (I will expect some illustrations)

Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

Risk Management

When a trader trade in the market or a businessman business on any business then trader and businessman face some problems and causes during trading and business. In trading and business, a huge risk is a loss. So, we can say that overcome or reduce risk or loss in the trading or business is called Risk Management. Actually, risk management is the real strength of trading and business which makes a trader and businessman the firm in this field. When we identify the risk, classify the risk, and prioritize the risk is called the Risk Management. This is a simple definition of Risk Management.

- Identification

- Planning

- Derive Safewards

- Monitor

- Identification means that we identify that how much risk. What is the form of risk? How loss that trader can face by it. This is called identification of risk and this is the first term of Risk Management. By using this term a trader or businessman can identity loss and risk.

- The second term of Risk Management is Planning. It means that a trader plants to reduce risk in the trading. For example, a trader notes that he is getting a 10% loss in his trading then he plans to reduce risk. He finds other risk-free and reliable sources to reduce his risk in trading.

- The third point is stopping more investing to reduce risk in the trading. It means that if you know that you will face 10% risk in the trading and it will be the same then don't invest more to reduce the risk. This is called Derive Safewards. It means that invest your money in risk-free sources and don't invest your money in trading to reduce the risk while you know that you will surely face it.

- The fourth point is Monitor Your Trade Every Minute. It means that to protect yourself from more risk, monitor your trade deeply that if you will face a 10% loss then monitor that it would not change in the ratio of 15% loss. This is called monitoring and this is also the most important point to reduce or manage risk.

Trading Style

This is so important for a trader that known fully that he is whom type of trader. Basically, there are three types of traders. Scalper Trader, Day Treader, and Long Time Trader. A trader should be fully known that whom the type of trading he belongs to. So, he should start his work according to his interest.

Take Profit

When trade starts, it is so important for any trader that he specified a point of Take Profit. This is so important point for trading and the point specifics the ratio of profit in trading. It should be at least of 1:2 ratio (Risk: Reward). It means that if trading will act according to expeditions then the trader will get 2 times more profit from loss. When trading becomes in the favor of the trader then on the specific point trading stops and a trader gets his profit. This is a point or place of profit and a trader gets profit just then when trading acts in the favour of the trader. Take Profit is also valuable order in the trading and this is also so profitable and it gives a lot of profits to traders.

Stop Loss

On the other hand, when trader entry in the trading and trading reacts against the expedition of the trader then the trader already specifics a point of Stop Loss. This is so important for any trader and it protects traders from any huge loss. When reacts against the expeditions of the trader then the trading moving to the downtrend but when trading touches the Stop Loss point then the trading automatically finished and the trader saves from capital loss.

Portfolio

A portfolio is a report or document representing the task and the people's performance in different fields. There are many kinds of portfolios i.e. Business Portfolio, Professional Portfolio, Company Portfolio and many more. But the portfolio that I am discussing here is so important and this can improve to Risk Management. A trader collects all of his sharing and trading that helps traders at any time. If a trace faces any loss and any disturbing situation then he sees his portfolio and works according to the portfolio. So, the portfolio improves for the trading.

Risk Money

Always trade with risk money. I mean that always trade on the money that you can bear in the case of loss. Don't trade on your all savings because in the case of loss you can not bear it so always trade on the specific money that you can bear in the case of loss.

Above the screenshot, you can see XRPUSDT 4h table and 100 EMA Greenline is crossing to 200 EMA Blue Line. Now I can enter the trade. So, I took entry on 0.7500 and I fixed Stop Loss on 0.6000. I kept my profit at 1.0565.

Buy Price= 0.7500

Stop Loss= 0.6000

Take Profit=1.0565

Risk = Buy Price - Stop Loss = 0.7500-0.6000= 0.15 Reward = Take Profit - Buy Price= 1.0565-0.7500= 0.3065 Risk : Reward = 0.15 : 0.3065= 1 : 2

Conclusion

After a long discussion, I come to the conclusion that Risk Management is one of the most useful terms in trading and business. By using this term a trader can handle all losses and overcome all risks. This may take profit to the trader. Risk Management is the best term that always keeps active traders in trading. This is a useful factor and by using uptrend and downtrend, it can predict values. It is hoped that it will be more useful in the near future and traders can predict easily market value.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

It is supposed to be Margin call and Not Margin sell

Your explanations were not clear to me. You need to go back and research the Trading Terminologies. Improve the quality of your explanations. Do enough research to understand the concepts so that you have the confidence to share

Dear Professor @yohan2on,

Good Bye

Hello @ghiasahmad, you tried in your homework. I like the way you set your content. Please, which markdown did you use to write the red texts?

Thanks a Lot of.

Thanks a lot. I'm grateful.