FLIGHT MH370 | What Really Happened

We all know reality can often be stranger than fiction so here I back this story up with real life evidence and reveal the possibility flight MH370 was purposely brought down by the owners of Freescale Semiconductors, the debt riddled company that lost 20 of it's senior staff and engineers on the missing flight.

In September 2006 a consortium of investment groups completed the takeover of Freescale Semiconductor for $17.6 billion, which at the time was the largest ever leveraged buyout of a technology company. Shortly after the deal was finalized chip sales to Motorola and the automotive industry dropped sharply during the 2008-2009 recession putting the company under great financial strain.

Since the takeover Freescale debt has increased dramatically due to a variety of reasons so the investment companies needed a way of recouping their investment. One way they did this was to use Freescales patent IP as financial assets against loans given to them by banks they worked for. In the year 2014 - 2015 Freescale performed nearly twice as many IP transactions than any of their rivals in the semiconductor sector.

Here we look at the motive for taking down flight MH370, the businesses involved in the takeover of Freescale, and the people behind the financial decisions.

On March 8th 2014 a Boeing 777 carrying 239 people en route from Kuala Lumpur to Beijing went missing. Included among the missing passengers were 20 employees of a Freescale, a semiconductor design and manufacturer company.

Freescale Semiconductor

Freescale Semiconductor, Inc. was an American multinational corporation headquartered in Austin, Texas with design, research and development, manufacturing and sales operations in more than 75 locations in 19 countries. The company employed 17,000 people worldwide.

In 2006 the Carlyle Group and the Blackstone Group both bought majority equal shares in Freescale.

Blackstone Alliance to Buy Chip Maker for $17.6 Billion | NY Times - SEPT. 16, 2006

A Blackstone-led alliance that includes the Carlyle Group, Permira and the Texas Pacific Group announced yesterday that it had won the bidding for Freescale Semiconductor, a maker of chips for cellphones and cars, with a $17.6 billion deal. It is the largest leveraged buyout of a technology company ever, surpassing last year’s $11.3 billion buyout of SunGard Data Systems.

The Blackstone Group

The Blackstone Group L.P. is an American multinational private equity, alternative asset management and financial services firm based in New York City. As the largest alternative investment firm in the world, Blackstone specializes in private equity, credit and hedge fund investment strategies.

The Carlyle Group

The Carlyle Group is an American multinational private equity, alternative asset management and financial services corporation. As one of the largest private equity and alternative investment firms in the world,

Jacob Rothschild, 4th Baron Rothschild

Rothschild a member of the International Advisory Board of The Blackstone Group.

Freescale’s Debt War With Its Noteholders | NY Times - April 2, 2009

.... recently in the news are the debt restructurings by NXP of the Netherlands and Freescale.

These are both troubled private equity acquisitions in the semiconductor industry. Freescale is owned by a consortium that includes the Blackstone Group, the Carlyle Group, Permira Funds and the Texas Pacific Group. NXP’s owners include Kohlberg Kravis Roberts, Silver Lake Partners, Alpinvest, Bain Capital and Apax Partners.

A little over a 2 month after the disappearance of MH370 Freescales outlook improved.

Should You Take Advantage of the Dip in Freescale Semiconductor's Price? | The Motley Fool - 05/18/2014

Freescale Semiconductor has had a curious history of two IPOs, a private buyout, and close to $10 billion in debt. After a long time, the company seems set to move to profitability.

The debt has been a major factor behind Freescale's net losses in recent years. For example, in 2013, Freescale recorded $531 million in operating income on revenue of $4.17 billion.

In 2015 Freescale merged with NXP, a Dutch semiconductor manufacturer, which made Freescale shareholders debt free.

NXP Semiconductors

On December 23, 2013, NXP Semiconductors was added to the NASDAQ 100. Finally, on March 2, 2015, it was announced that NXP Semiconductors would merge with chip designer and manufacturer Freescale Semiconductor in a $40 billion US-dollar deal.

Freescale-NXP merger will create semiconductor powerhouse | AZ Central - 03/03/2015

Under the terms of the deal, which was announced late Sunday and is structured as part cash and part stock, Freescale shareholders will receive $6.25 in cash and 0.3521 of an NXP ordinary share for each Freescale common share held at the close of the transaction.

Moody's affirms NXP's Ba2 CFR and reviews Freescale's ratings for upgrade; NXP's outlook raised to positive

| Moody's Global Credit Research - 02 Mar 2015

Moody's expects that the remaining $402 million of Freescale's 10.75% unsecured notes due 2020 will be repaid in 2015. Following this payment, Freescale will have $4.9 billion of debt outstanding (all secured; earliest debt maturity in 2020).

NXP Semiconductors About To Bag Freescale For $40 Billion | Guru Focus - March 03, 2015

NXP Semiconductors NV (NASDAQ:NXPI) is said to buy smaller competitor, Freescale Semiconductor, Ltd. (NYSE:FSL). The combined transaction value hereafter will be a whooping $40 billion. This merger will create a leader in the industry of mixed signal semiconductors and auto markets. Once the deal gets through, shareholders of Freescale Semiconductor Ltd. will have an ownership of about one-third of the combined organization.

The shares of Freescale Semiconductor Ltd rose 59% last year while NXP shares rose 51%.

What may not be a known fact is that Freescale Semiconductors have their chips installed in the Amazon (NASDAQ:AMZN) Kindles sold online across the globe.

NXP Semiconductors And Freescale Semiconductor Close Merger | RTT News - 12/7/2015

NXP Semiconductors N.V. (NXPI) and Freescale Semiconductor, Ltd. (FSL) announced the completion of the merger pursuant to the terms of the merger agreement. The merged entity will continue operations as NXP Semiconductors N.V.

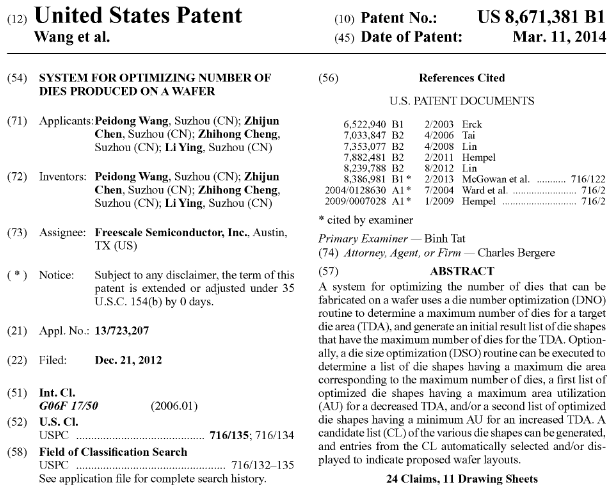

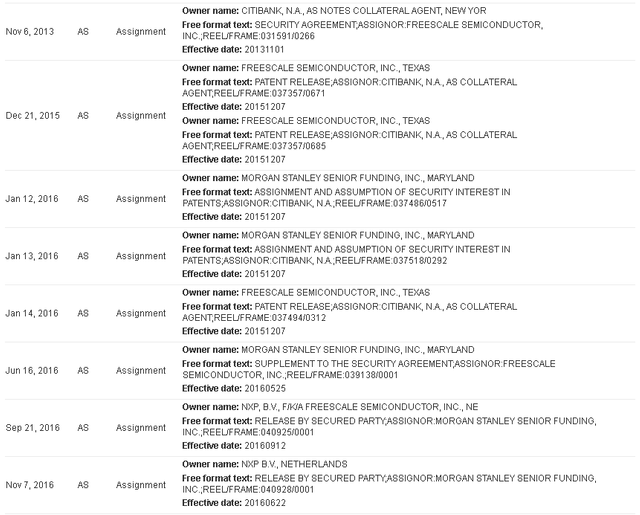

Patent Inventor vs. Assignee

The Constitution of the United States provides in Article 1, Section 8, that: the "Congress shall have power . . . to promote the progress of science and useful arts by securing, for limited times, to authors and inventors, the exclusive right to their respective writings and discoveries.” US law, unlike foreign law, requires a patent application to be in the name of the inventor. A company cannot be the inventive entity.

The assignee is the entity that has the property right to the patent. Patents are property. The inventor and the assignee may be one in the same but an employee will more than likely assign a patent to a company.

The assignment of a patent is independent from the inventorship. A patent may be assigned to a series of different entities but the inventorship, once properly stated, does not change

There was a lot of resistance to the merger at the time by senior Freescale staff and engineers because they knew the consortium only wanted it to go ahead so they could use Freescale patent IP's as assets to leverage funds through banks like Morgan Stanley and Citibank. After noticing what was happening a handful of Freescale employees voiced their concerns about the patents being used for financial leverage. Somehow these employees needed to be silenced.

Semiconductor patents have been among the most heavily transacted IP assets in recent years | I Am Market - 3rd October 2016

Patents covering semiconductors and related technologies are among the most widely transacted IP assets of late. Data from IP databasing firm ktMINE gives an indication of the chip-related patents that changed hands last year. The tables below rank entities according to the number of individual US-published patent assets they transacted during 2015:

Top 5 assignees of US patents by number of patents assigned 2015

| No. | Name of assignee entity | Number of patents assigned |

|---|---|---|

| 1 | FREESCALE SEMICONDUCTOR, INC. | 26002 |

| 2 | GLOBALFOUNDRIES INC. | 14791 |

| 3 | GLOBALFOUNDRIES U.S. 2 LLC | 14617 |

| 4 | HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP | 11774 |

| 5 | AVAGO TECHNOLOGIES GENERAL IP (SINGAPORE) PTE. LTD. | 11143 |

Top 5 assignors of US patents by number of patents assigned 2015

| No. | Name of assignor entity | Number of patents assigned |

|---|---|---|

| 1 | CITIBANK, N.A., AS COLLATERAL AGENT | 26747 |

| 2 | INTERNATIONAL BUSINESS MACHINES CORPORATION | 15260 |

| 3 | GLOBALFOUNDRIES U.S. 2 LLC | 14804 |

| 4 | GLOBALFOUNDRIES U.S. INC. | 14804 |

| 5 | HEWLETT-PACKARD DEVELOPMENT COMPANY, L.P. | 12226 |

The past few years have seen major upheaval in the global semiconductor industry. Economic pressures and changing technology demand has led to large-scale consolidation, with the sector seeing some of the biggest high-tech M&A deals in history (reports last week suggested that Qualcomm may be about to make a $30 million offer for IAM Market’s NXP).

This is clearly reflected in both tables above. By a huge margin, Freescale Semiconductor was assigned more US assets than any other entity during 2015, with its 26,002 patents dwarfing second-placed Globalfoundries Inc’s 14,791 (although much of this is accounted for by Citibank’s release of its security interest in collateralised Freescale patents in the run-up to the latter’s $11.8 billion merger with NXP).

Carlyle Group and Blackstone Group needed to silence the inventors of the various patents so they could leverage them for investment purposes.

Gregory Summe who now works for NXP used to work for Freescale and the Carlyle Group. 2 months after MH370 went missing Summe joined Freescale from Carlyle Group.

NXP Semiconductors NV Employees | Reuters

Gregory Summe

Mr. Summe was the managing director and vice chairman of Global Buyout at The Carlyle Group, a leading global private equity firm, from September 2009 to May 2014. ..... and also was a director of Freescale from September 2010 until its merger with NXP in December 2015; Mr. Summe served as Chairman of the Freescale board since May 2014 and was also Chairman of the Compensation and Leadership Committee of the Freescale board.

Peter Bonfield is on the NXP board of directors and is an advisor to Rothchilds and Citigroup.

Sir Peter Bonfield has been involved with a diverse portfolio of companies including director and non-executive directorships at Dubai International Capital, Actis Capital LLP, Sony Corporation, Ericsson, AstraZeneca, BICC plc, and adviser to Rothschild London, Apax Partners LLP and Citigroup. He also currently serves as chairman of NXP Semiconductors.

Sir Peter L. Bonfield is Non-Executive Independent Chairman of the Board of NXP Semiconductors N.V. Sir Peter has been appointed as a non-executive director and as the chairman of our board of directors in August 2010. Prior to that, Sir Peter was the chairman of the supervisory board of NXP B.V. from September 29, 2006.

Both groups had interests in getting rid of Freescale employees so they could move their own people in to engineer the take over of Freescale by NXP.

FREESCALE EMPLOYEES

Here is a list of half of the 20 Freescale employees I could find that went missing.

- HUAJIN GUAN - Malaysian - 34

Malaysian senior engineer.

- WENJIE GUAN - Chinese - 35

Staff engineer.

- YI HUANG - Chinese - 30

Top engineer.

- LEE KAH KIN - Malaysian - 32

Staff engineer.

- SUHAILI MUSTAFA - Malaysian - 31

Senior engineer.

- SAFUAN RAMLAN - Malaysian - 32

Senior planning manager.

- TONG SOON LEE - Malaysian - 31

Senior engineer.

- YAP CHEE MENG - Malaysian - 39

Systems engineer.

- MUZI YUSOP - Malaysian - 50

Malaysian production manager.

- Huan Peen Chan - Malaysian - 46

Malaysian senior engineer.

CONCLUSION

Cross referencing the names of the inventors with the passengers on the flight manifesto we see no matches. This means either they weren't on the plane and are still alive, or the manifestos been altered. Even if they did die Freescale would still own the rights to the patents regardless.

Among the 20 Freescale employees that died a handful didn't want the merger between Freescale and NXP to go ahead. They were concerned the investment groups would break apart the company they worked so hard to build up over the years. They expected a large amount of job loses and thought the merger was only good for the share holders and not the company itself.

Since Blackstone and Carlyle etc bought Freescale in 2006 it has been losing money. It looks like from the reports that it really only started to make money after the disappearance of MH370 in March 2014 and then again with the NXP merger in later 2015. The merger talks started in May 2015, 1 year after the disappearance of flight MH370 and has leveraged more IP than anyone else in the field. This is why I think MH370 disappeared.

Alright! Nice to see you made an entry! I'll be announcing the winners and prizes tomorrow. Great stuff here. True detective work, honestly I didn't know most of the company's history.

Thanks. It's just what I do. Can't write any other way :)

Great article, I did some research a few years back which compliments your post quite well (your post covers the "why" quite well, while my post covers the "how").

MH370: Ask Yourself, Who Has The Means & Motive To Take A Boeing 777 Full Of People And Make It Disappear?

https://steemit.com/conspiracy/@budz82/mh370-ask-yourself-who-has-the-means-and-motive-to-take-a-boeing-777-full-of-people-and-make-it-disappear

Great stuff. Nice and long. I've bookmarked it so i'll have a proper read later.

Yes the why seemed pretty obviously to me really. It's always about the money.

Seems legit to me! Nice entry

Thanks. It's a bit long but there was a lot of research to include.

With all these types of conspiracies involving high ranking elites you always have to follow the money.

Interesting theory! So far the most convincing theory about MH370's disappearance is written by Steve Pieczenik, he had 20 years of experience handling international crises for 5 US administrations, since Nixon.

if you haven't read it yet, i highly recommend it: http://pieczenik.blogspot.sg/2014/05/lets-try-this-again-your-comments-while.html

His theory is also confirmed by the fact that one of the MH370 passenger, a technical storage executive at IBM called Phillip Wood who sent a photo, along with a brief voice activated text, from GPS coordinates that put him (and possibly other MH370 passengers) only a few miles away from the U.S. controlled Diego Garcia military base .

Thanks. I did stumble across this when I was doing my research. Apparently there are eye witness accounts from islanders that saw the plane land on the island.

It's all about the money...

ha yes.

Follow the money...

Resharing @phibetaiota

Great insight and investigation.

Thank you as always.

As we all know...follow the money.

Really interesting reading. Thx for sharing

Big money