Crypto Assets Diversification - Crypto Academy / S4W4 - Homework Post for @fredquantum.

Hello Everyone,

A wonderful and insightful lecture. Hope I get to learn some few things and able to answer the questions as expected.

lets get started…

Question 1

A Crypto Asset diversification is the act or way an asset is managed to avoid or lower the risk that is associated with the investment into the crypto market volatility. This is done by splitting the crypto asset into 4 or more parts into difference tokens to help reduce the loss incase the market doesn't go the way it was predicted through your technical and fundamental analysis. It is a great way to balance between risking and protecting our money at the same time.

The main reason we try to split our investment is to protect ourselves from market volatility. Different tokens performs differently which solely rely on what's happening in the market. So splitting ones asset means that, as one token is in bearish other will be in bullish. There is also a possibility that all tokens falls or rise. Although as asset diversification is to mitigate risk involved, the main goal is to maximize our gain.

Lets consider this scenario where a trader invest all his crypto asset worth $10,000 in one token lets say Binance Coin. In some few weeks or months the token makes a bearish fall of 50%. This means the investor will loss 50% of his investment which will be $5000. Also on the other hand if he had diversified his investment into 4 different tokens lets say **Bitcoin, Etherium, Steem, and Binance Coin, splitting 25% of the total into each token. In this scenario, the investor only looses $1250 of the total amount instead of $5000.

Ways On How To Diversify Crypto Assets

When diversifying our crypto assets they are some strategies we need to consider to mitigate our risk of loss. There are two main startegies involved which are the Analysis and the 1 - 4 Rule

ANALYSIS

Analyzing an asset is essential in diversifying our asset. It is advised to get prepared with so much information before getting into the market. It involves a close look into an asset to look for weakness or leaks an investor can capitalize on to make profit. Below are the two main types of crypto market analysis:

Technical Analysis: It is the prediction of the rise or fall of an asset base on its past and present pattern and other available information such as the trading volume. Supply and demand is used in the technical analysis. When in bullish, supply is reduced and demand increases which pushes the coin price up and vise versa.

Fundamental Analysis: The fundamental analysis deals with the assessment of its intrinsic value such as financial statements, trends and also influences. The team behind the asset is also a point to consider to identify the potential of their project that makes it different from other projects.

The 1 - 4 Rule

This is a rule that advices investors to split their crypto asset into at least 4 different parts into different tokens. This act is to reduce the risk involve in investing into the volatile crypto market. To apply the 1 - 4 rule , we need to allocate 25% of the total into each of the token to make an investment.

Question 2

As it is a good strategy to use, it still has some problems associated with it. Being aware of both the pros and cons of diversifying your asset is vital and may prevent you to make unaware mistakes.

- Reduced Risk

Reducing risk is one of the major way to diversify ones portfolio to reduced the overall risk involved in the volatility of the market. Incase an investor invest in a particular token and it isn't doing well, the overall portfolio of the investor will represent the the loss made. So therefore having several crypto investments, the losses in one asset will be replaced by gains of another asset. This way the investor portfolio is more stable and less prone to losses. And again that doesn't mean all the asset in ones portfolio cant fall at the same time but its only more unlikely to happen.

- High Opportunity

Investing into different crypto tokens gives you high chance of not missing out the high rise of an asset. If an investor invest into one token lets say steem, he or she doesn't get profit until that particular token rises and on the other hand if the investor investor into several tokens, the investor has the chance of one of the token to make a big rise and bringing in more returns.

- Reduce Overall Returns

Yes, it reduces your overall returns in your portfolio. Lets assume an investor uses the 1 - 4 Rule, investing into four different tokens. At some point in time, some of the tokens will do well and others wont so they tend to draw or weigh down the high performing tokens. This gives you an average returns limiting the potential gains of the overall portfolio.

- Difficult To Manage

An investor has soo much time to analyze and make a research if he or she invest into one token. Investing into one token is simple and easy to manage but investing into several tokens can be difficult which require alot of time. Investing into crypto require an investor to keep an eye onto the market, which will be quite difficult for a person who invest into several tokens and even more difficult if he or she has invest with different exchanges.

Question 3

As already explained earlier in this post, it is a rule which has to do with the diversifying ones portfolio. The capital is being divided into four equal parts which is 25% of the total capital each.

1. Bitcoin (BTC)

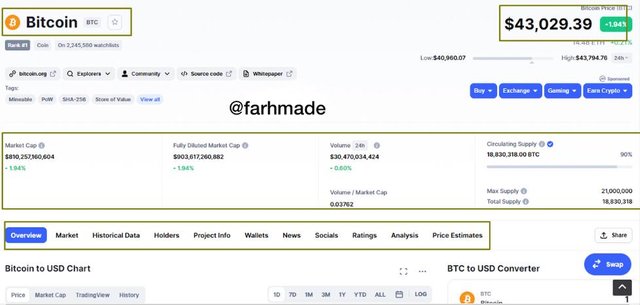

Bitcoin is the first cryptocurrency to ever be developed by an unknown group of individuals using the name Satoshi Nakamoto. It is decentralized which means doesn't not require an intermediaries to make a peer-to-peer transactions.

It was developed inthe year 2008 not until january 2009 that it got launched. It was developed with the intention to replace the centralized system of banking and payments. Bitcoin is the number one most ranked token based on its market cap by the coinmarketcap.

Bitcoin has a current price of $43,029 and it has about 42% market dominance which is the highest of all coins so the small change of bitcoin price affects the price of other tokens.

Currently bitcoin has $809,905,913,251 market cap and Volume of $30,493,346,151 and also circulating supply of $18,830,318.

Technically the price of bitcoin is currently moving in range and if it happens to break through the resistance its expected to hit at $50k. To invest at the current price, i will wait for the price to hit the support before i get into the market.

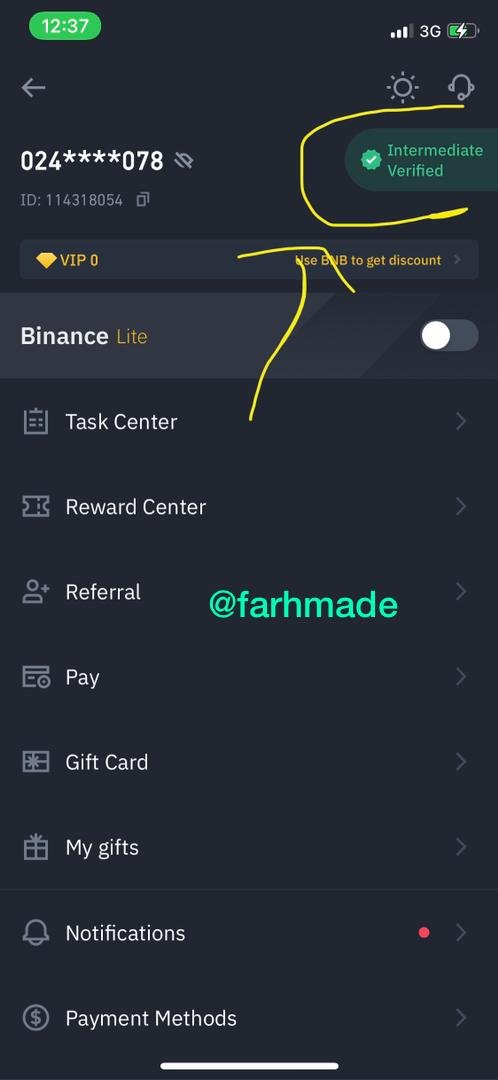

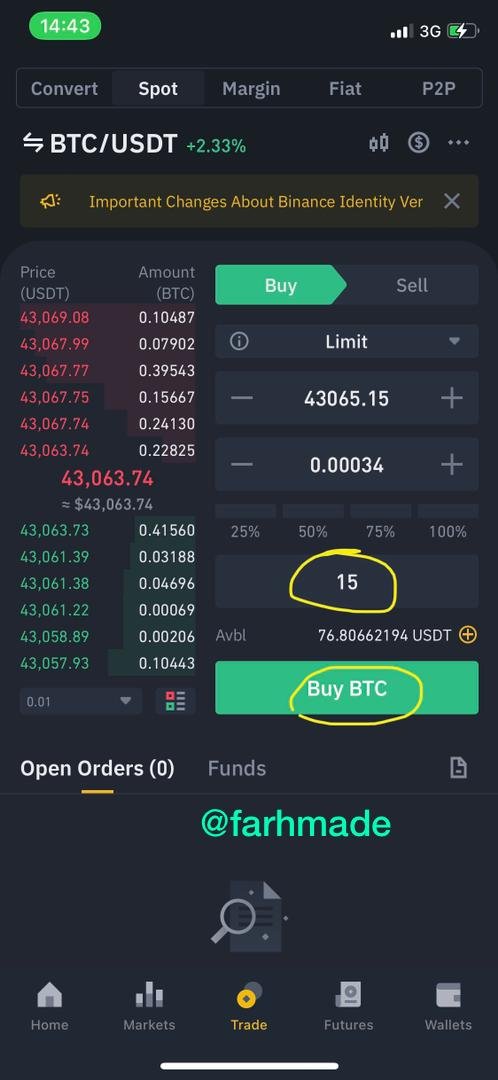

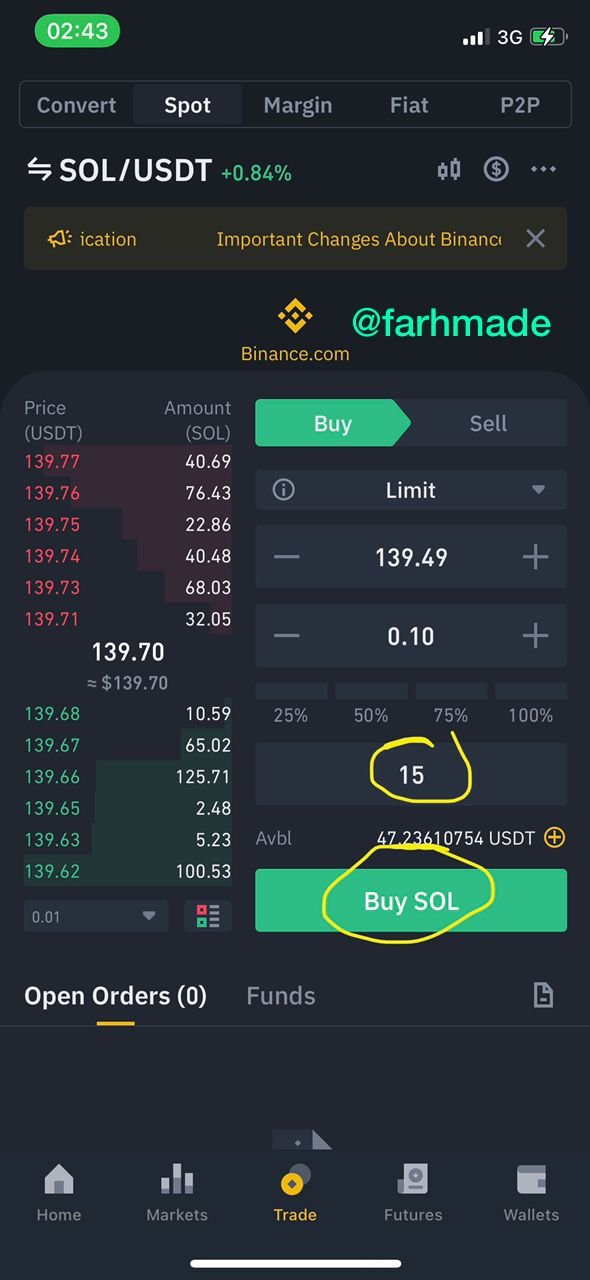

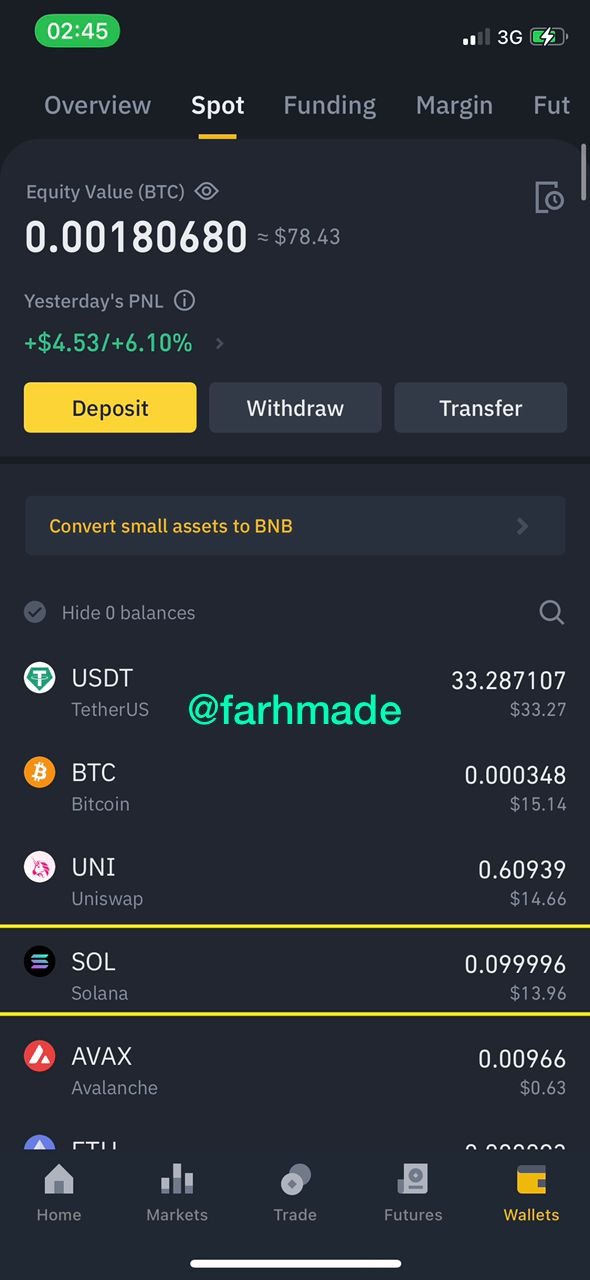

I bought 15USDT worth of Bitcoin on the binance exchange. I did this by searching for the pair BTCUSDT on the trade section and executed the trade. Screenshots showed below;

Reason For Choosing Bitcoin

Bitcoin is more stable than the other tokens and also it has the greater liquidity

Most rich people prefer to buy bitcoin than the other cryptocurrencies and as a result has the chance of bicoin price skyrocketing.

A stop-loss sell order was placed at $40800.00 slightly below the support level, and a take profit was set at $44200 just slightly below the resistance.

2. Litecoin

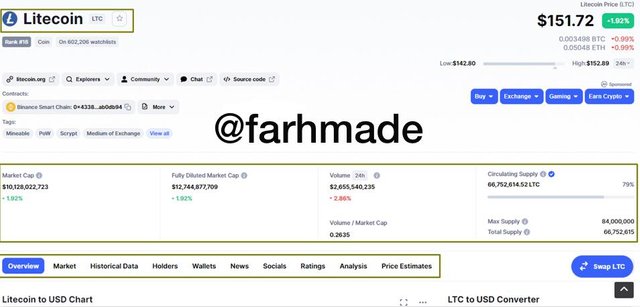

Litecoin is a peer-to-peer crypto asset and an open source software. In the month of October 2013, Charles Lee who was the former Google engineer introduced Litecoin to the world. It main aim was to solve most of bitcoin problems

Just few weeks ago, a fake press released was published which announced a partnership between litecoin and walmart. This increased the price up by 30% at that time

From the screenshot below, i used the RSI indicator on a 4hour LTCUSDT on my technical analysis. We can see it indicates the price moves up into the overbought area telling us that the price will shoot up. With this information, lets get to mark our resistance and support level. From the 22nd of September we seen that the price moved in a range which built it up to either go in strong bullish or strong bearish but our indicator has told us what it is already. If it goes in bullish, the highest we can imagine it could go is up to the resistance level and probably break through or bounce back. So this is where where we set our take out profit just below the resistance level.

A stop-loss sell order was placed at 138 just below the support level, and a take out profit was set at 160.

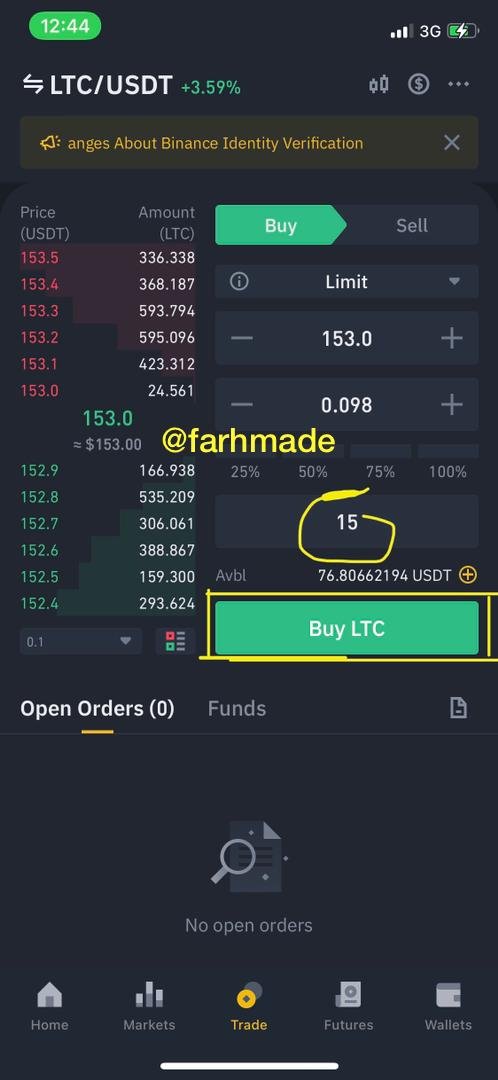

I bought 15USDT worth of Litecoin on the binance exchange. I did this by searching for the pair LTCUSDT on the trade section and executed the trade. Screenshots showed below;

Reason For Choosing Litecoin

Through my technical analysis, i saw an opportunity to take advantage of the volatility of the market to make some profit.

Litecoin has a more fast transaction time and a low fees. As at now the litecoin is 4 times faster than that of bitcoin per transaction. And also the fees charged by the litecoin network is about 1/50th compared to bitcoin.

3. Uniswap

Uniswap is one of the leadig decentralized exchange which is run on the etherium blockchain.. It was developed in 2018 on November 2nd by Hayden Adams who is a former mechanical engineer. As of October 2020, uniswap had a daily trading volume of $220 million. Due to its usage in DeFi, investors made good use of it.

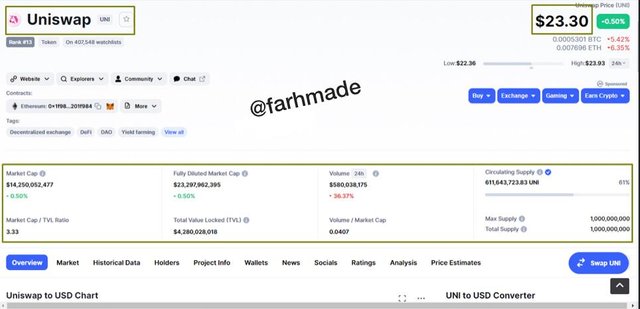

As at the time of writing this post, Uniswap current price is at $23.30, its market cap is $14,199,983,262, its volume per 24 hour is $579,676,325, and its circulating supply at 611,643,723.83 UNI

In this analysis i used the RSI indicator which indicates that the asset is been overbought so the price has the tendency to go in the bearish trend. It was able to breakthrough the first resistance heading to the second resistance. Its shooting up if incase it gets pass the second resistance to $28.

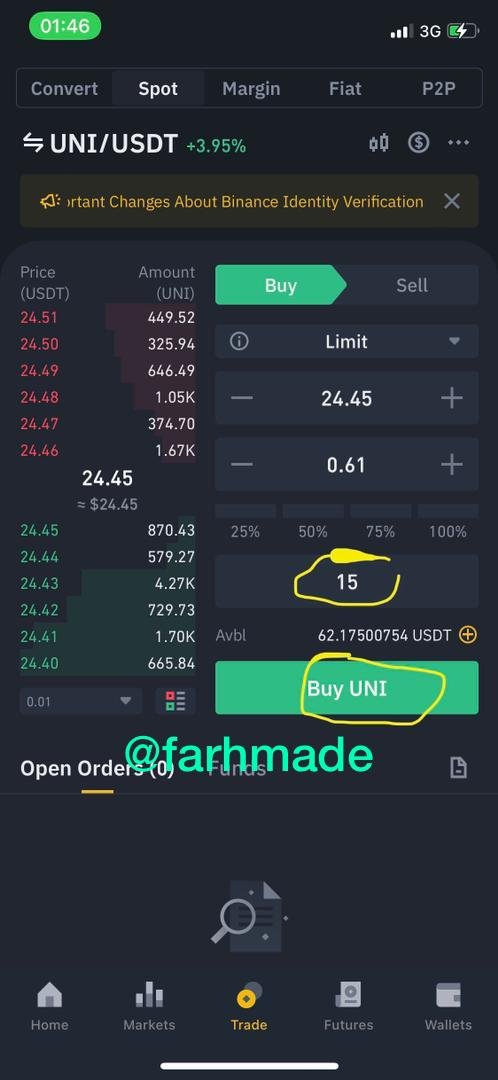

I bought 15USDT worth of Uniswap on the binance exchange. I did this by searching for the pair UNIUSDT on the trade section and executed the trade. Screenshots showed below;

Reason For Choosing Uniswap

1 . Uniswap gives me the control over gas fees and that depends on how fast i need the transaction to be executed. The faster the transaction the higher the gas fee. If in case im not in hurry to make a transaction , i decide to go with the medium or slow option. Reduces cost.

A stop-loss sell order was placed at $24 slightly below the first resistance level, and a take out profit was set at $24.8 just slightly below the second resistance level.

4. Solana

Solana was launched in 2017 by Anatoly Yakovenko which was an open source. It is a proof of stake project. The mission of solana is to support all high growth and high-frequency blockchain applications. It also tend to democratize the world finance system to make it suitable for all.

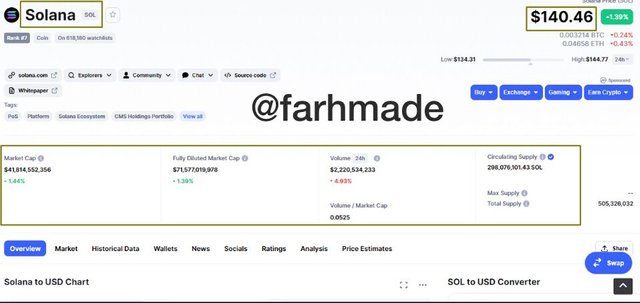

As of the time of writing this post, the price of solana was $140.46 with its 24 hour volume of $2,223,394,743 which has seen a decrees of 4.96% . It has a circulating supply of 298,076,101.43 SOL with a market cap of $41,724,131,223.

from the technical point of view, the RSI indicator shows that the token is been overbought and hence there is a chance of the price of solana making a bearish trend. The price was able to breakthrough the first resistance heading to the second resistance. The price might bounce back upon hitting the second resistance and thats where we set our take out profit.

I bought 15USDT worth of Solana on the binance exchange. I did this by searching for the pair SOLUSDT on the trade section and executed the trade. Screenshots showed below;

Question 4

Arbitrage Trading

Arbitrage trading is a type of short-term investment that capitalizes on price variations of an asset in different market to gain some profit. This is done by buying and selling an asset simultaneously to gain profit due to the difference in price of the crypto market in different exchanges. The investor buy from the cheaper exchange and sell in the expensive Exchange.

Benefit Of Arbitrage Trading

- Low Risk

The arbitrage is a fast trade with low risk exposure as buying and selling is done simultaneously to take advantage of the price difference to gain profit.

- Sure Profits

This type of trading is one of the safest and the most efficient way to invest into the crypto market. Large amount are used to invest due to the small price difference between the exchanges .

- Multiple Trade Opportunities

It is common to see a difference in price of an asset in different exchanges by small margins, this gives traders more opportunity to trade the arbitrage trading to gain some profit.

Question 5

Exchange Arbitrage

Different Exchanges have different prices for a particular token or pair, with this lets get to illustrate how to take advantage of the market.

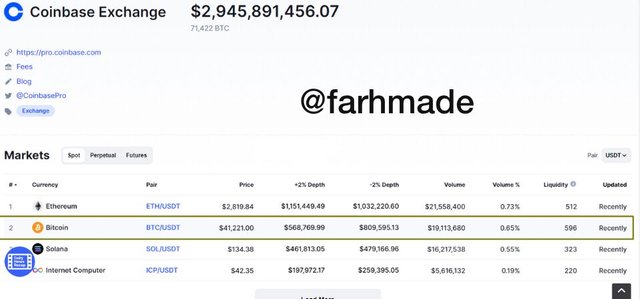

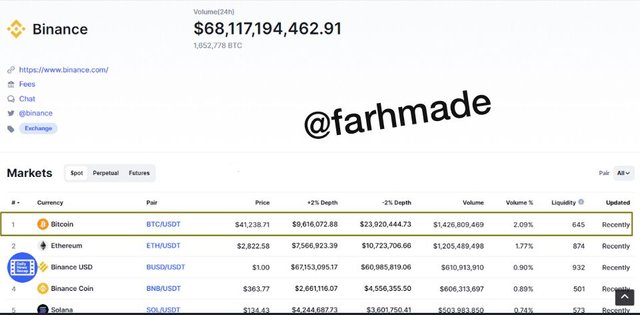

Lets take the BTC/USDT pair in our illustration. From the screenshot below we can see that the prices in both exchanges differ. The price of the pair in coinbase exchange is $41,221.00 and that of the binance exchange is $41,238.71. The idea here is to buy low and sell high to make some profit. An investor who notice this difference in prices will quickly get on to their coinbase account to buy low at $41,221.00 and sell it high on binance at $41,238.71. The investor makes a profit of $17. The investor can repeat the proceedure as long as the difference of the pairs still stands.

Question 6

Triangular Arbitrage is a type of arbitrage trading whereby investors take advantage of the differences in prices of cryptocurrencies in different exchanges. The investor sells their crypto asset for another crypto asset, and the second asset is being sold for another asset and the third asset is being sold for for the first asset and then profit is made.

For instance an investor spotted a triangular arbitrage between SOL, DOGE, and UNI. Assuming the investor invest 1 SOL and trade it for DOGE coin whcih is equivalent to 699 dogecoin. The dogecoin is then traded for Uniswap and gets 6.2 of uniswap. We now then convert back to Solana and get 1.05 Solana. From this the investor earns 0.05 solana. This is why the investor needs alot of funds for this trade because the difference in prices are minimal.

Factors to consider in Triangular Arbitrage

Identifying difference in prices: This is the most important part in executing this type of trade. It determines if the investor makes profit or not. Before the investor invest they should check and make sure of the prices differences before using this strategy.

Repeat the process: Since the differences in prices are usually not huge, its advice to repeat the process till the difference in prices are corrected then you proceed to different pair of coins.

Triangular Arbitrage Risk

Triangular strategy have some risks that comes with it. They include;

Low liquidity in exchanges affects the prices of assets. Asset with less liquidity are extremely expensive which reduces the anticipated profit of the investor

The prices between exchanges are very minimal so to make huge profit an investor needs to invest huge some of money to make profit.

The transaction fees between exchanges are high, if caution is not taken the transaction fees might take up the profit.

Crypto asset diversification is a great way to balance between risking and protecting our money at the same time. The main reason we try to split our investment is to protect ourselves from market volatility.

Arbitrage strategy needs an investor to invest huge sum of money since the difference in prices of assets are minimal