Inflation on EOS: What do I Need to Know?

Inflation of EOS tokens drives the entire system - funds the Block Producers, the Worker Proposal Fund, and allows for free transactions for users. The launch of the EOS network is fast approaching and we still see a lot of questions surrounding the inflation system. We would like to clear up a few things.

How Much Inflation is There on EOS?

Let’s start with defining inflation in regards to the EOS blockchain for those who are unaware. When the mainnet of EOS launches, there will be 1 billion tokens in circulation. This amount will inflate by 5% per year, bringing another 50 million tokens into circulation one year after launch.

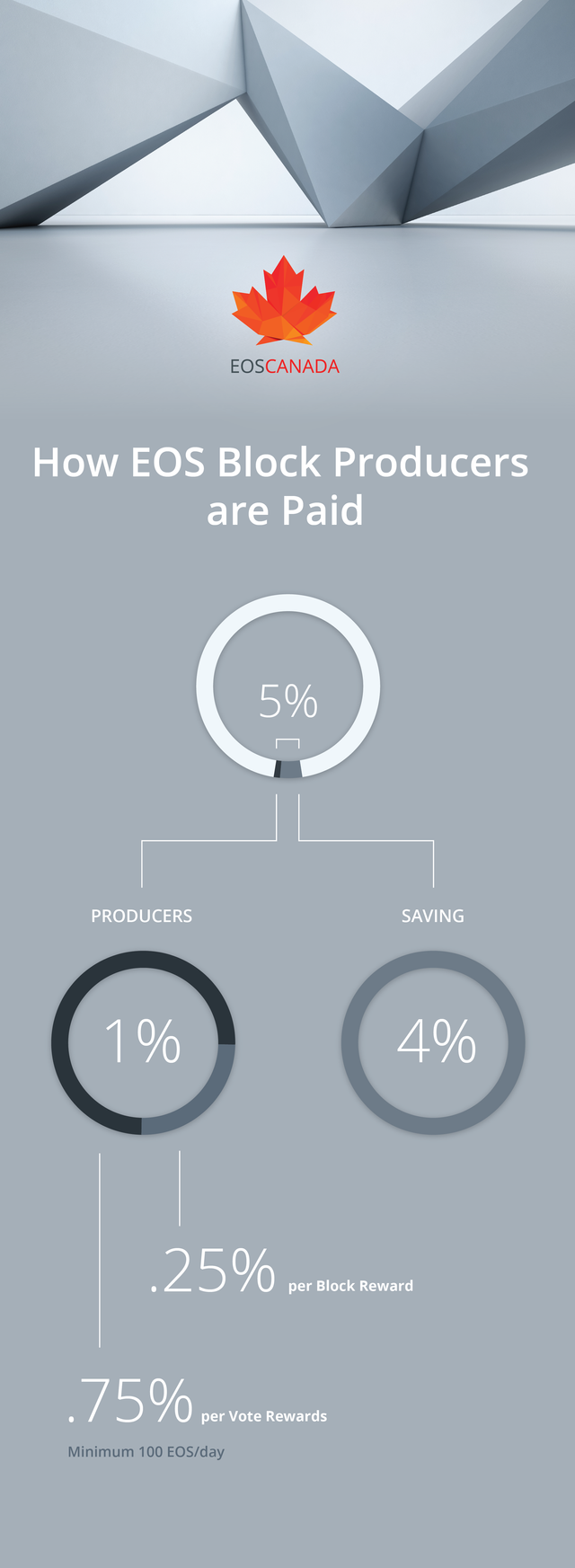

Those 50 million tokens will be split up into two places. First, we have a Worker Proposal Fund, which receives 4% of the 5% inflation. This will be used to create public goods that token holders would like to see created for the EOS platform. The remaining 1% will be used to fund Block Producers and Standby Block Producers.

The details around the Worker Proposal Fund are currently being worked out. The basic premise is that any improvements to the EOS chain can now be funded through the chain itself, rather than requiring outside investment or private companies to create those tools.

The payments for Block Producers will allow them to maintain and increase their infrastructure so that they can offer reliable service to the network, increased capacity of RAM, and ample storage once the IPFS (InterPlanetary File Storage) system becomes integrated. The EOS network will require enterprise-level infrastructure, and strong teams behind it to ensure 100% uptime.

How do I Benefit From Inflation?

Since Block Producers will be funded through the system itself, it puts EOS among the first self-funded blockchains. There are no transaction fees. This is revolutionary for decentralized applications - or dApps - that wish to build on top of EOS. They will be able to offer free services to their users without the need to integrate other monetization methods to fund their operation. Gone are the days where you would have to worry if you allocated a high enough fee for a transaction you wanted to push over a blockchain, it’s always free now.

Unlike some other major blockchains, there is no way for a single user to receive a portion of the block rewards. Only Block Producers and Standby Producers will be entitled to these rewards. Within a Delegated Proof of Stake system, there are no mining pools you can join or hashing power you could point towards the network.

Deflationary Forces

The opposite side of inflation is deflation. That is when EOS tokens are removed from the liquid supply. Recently Dan Larimer, the visionary behind EOS, announced the introduction of a 1% fee attached to both buying and selling of RAM on the EOS network. This fee will be held alongside the Worker Proposal Fund, effectively being removed from the liquid supply until these funds are attributed to projects by the community.

Another deflationary force will be the purchase price of namespace domains for EOS account names. This is similar to “.com” or “.io”. Similar features will be possible within EOS account names. They will be sold off through an auction system.

Why Don’t Other Blockchains Have Inflation?

All blockchains have a form of inflation in place. In Bitcoin and Ethereum, it comes in the form of block rewards (alloted with each new block that is mined) in addition to transaction fees that users pay to miners for use of the network.

On Bitcoin, if we take an average of 10 minute block creation time, one would expect to see 657,000 new tokens created in a year (at the current block reward level of 12.5 Bitcoin per block). With its current circulating supply of approximately 17 million Bitcoin, that implies an inflation of almost 4%. So while some fear that inflation will drive down the value of their token, we have seen that this hasn’t been the case on other networks.

If you look at the Steem token, and how it is used on the SteemIt social media platform, you’ll see that the inflation allows the system to operate through self-funding. The inflation goes to fund the witnesses who create the blocks in the blockchain, to pay content creators for their contributions to the community, and to pay users who engage the community through upvotes and commenting. This could be a spark to the revolution that will take over social media platforms, removing the need for advertising and monetizing of users’ data.

While many perceive the concept of inflation negatively, it is important to understand what it can offer you and how you can benefit from it as an EOS token holder. At EOS Canada, we believe that this inflationary system is extremely well thought out and could revolutionize how blockchains of the future are designed.

Great article, well explained as always, thanks guys

How do the Worker Proposal Fund get allocated isn't set yet? Will it be set before EOS get's launched?

Won't BP like to share some portion of their rewards with their voters at some point? 😜

Coins mentioned in post: