Warren Buffett Is the Latest Billionaire To Jump Ship From The Markets

Right now the market is perceived to be so dangerous that it’s even chased the most fearless value investors to the sidelines.

Just this evening, in the Presidential debate, Trump warned that the stock market was a bubble “about to pop”.

Now, the bearish billionaire circle has grown even wider with the addition of Warren Buffett.

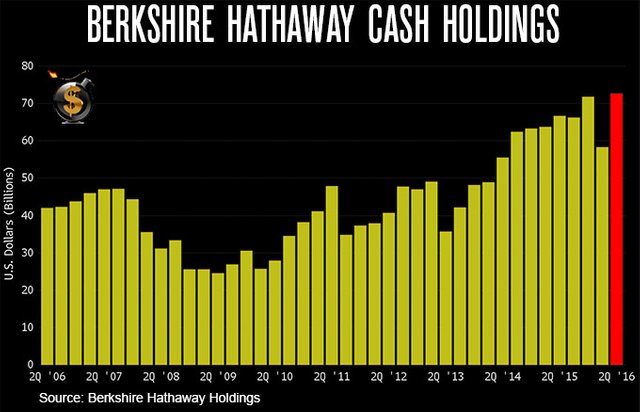

The “Oracle of Omaha” as he’s known, currently has more money outside the markets than ever before in his five decades running Berkshire-Hathaway.

This is a striking fact considering that Buffett is very well known for his long-term investment strategy - an approach that requires one to constantly have most of their capital tied up in order to generate consistent returns.

That’s right, as the S&P 500 is near record highs, Warren Buffet is more out of the market than he has ever been and waiting for a collapse.

That the 86 year old has so much dry powder, shows his anticipation of a massive market crisis and quite possibly the biggest buying opportunity of his life. Just like us, Buffet is ready to survive and prosper through this calamity.

And with asset prices at all time highs and CNBC and Fox business puppets still perpetuating the great recovery myth, you might expect all these smart money billionaires to be piling into stocks to ride the upside. Instead they obviously know the “goldilocks” recovery holds true to its name’s fairytale origin.

They say “follow the smart money”… and Buffett is known as one of the smartest!

And even more multi-billion dollar fund managers are coming out and warning.

Tad Rivelle, the chief investment officer of TCW’s $195 billion investment fund, is yet another outspoken multi-billion dollar fund manager who’s expressed concern about the economy and monetary policy gone awry.

Rivelle mentioned in a Bloomberg interview last week that he thinks it’s “Time to leave the dance floor” because, to paraphrase, corporate debt is piling up faster than income is increasing.

In a note to investors Rivelle argued, “Face it: the central banking Emperors have no clothes.” he continued:

“...The Fed could continue to use its printing press to falsify capital market signals, but to what end? When a central bank buys an asset with an electronically printed dollar, a “something for nothing” trade has taken place. Unless everything we understand about economics is plain wrong, the Fed cannot go on blithely adding printing press dollars to the system and expect no ill effects.”

The letter continues:

“Our counsel remains as it has been: avoid those assets that will be broken in the coming de-leveraging while keeping a ‘steady as she goes’ attitude towards the future purchase of those assets that will merely bend when the flood comes.”

He actually called the coming de-leveraging, “the flood”. Even the language of these top money people is biblical in nature.

When we first began ringing the alarm bells about an impending financial crisis last summer, we were nearly the only ones doing it. Then, month after month, some of the biggest names in money and finance have not only climbed aboard our bandwagon, but have practically stampeded past us.

Now, we can barely keep up with the amount of people warning of impending doom.

Last summer we made a call for subscribers that earned 4,500% in just three days by calling the market crash in late August correctly.

And, our Senior Market Analyst, Ed Bugos, has just reissued a very similar play in an alert to Premium subscribers on September 16th.

There is no guarantee we’ll make another 4,500% gain in a short amount of time, of course. But it is virtually the exact same investment play we made last summer which made a fortune.

And, that was before we had the likes of Soros, Trump, Rothschild, Jim Rogers and numerous other billionaires, also feeling the same way as us.

We are now less than a week away from the end of the Jubilee Year and if our call is right, we could again make mind boggling returns in just the next few weeks or months.

And, the best part about this type of an out-of-the-money shot is that you can put a small amount of money into it and possibly make large returns… and if it is wrong, you lose just a small amount of money.

Subscribe to TDV Premium and get immediate access to Ed Bugos’ pick in his alert of September 16th.

If the ship’s going down, and soon, it’ll be much more enjoyable making a massive investment return off of it than going down with everyone else.

LOL. So what you're saying is everything is going to be fine and Buffet's just preparing to invest. So a recession might be coming (it's like the market is cyclical or something!)

Yet you peddle doom, and try to make this look special even though he did the exact same thing a year ago and then bought back in massively?

Jesus why does anyone listen to a word you say...

Their total holdings are at a record high. They have $160M in the market right now which is double the amount of that cash reserve he's making such a big deal about. As a ratio of total holdings to cash they were holding more cash a year ago.

Of course he didn't include any of this contextual information because that would shit all over his fear mongering narrative.

I'm investing in food . I buy myself some really nice farm , got chickens , got cows and some bulls,goats, sheeps. I will be able to eat , what will you do.?When all this money shit goes down what will you eat? Take a bite of your silver and gold bars .

Actually you can eat silver and gold, colloidal silver can be made at home with a low voltage power source in relative ease, and a pure silver coin dropped in a carton of milk will preserve it, there are also many other practical low tech uses the average person can replicate and use at home which are easily researched on the internet. Gold can be converted to its mono atomic state and consumed for untold health benefits but this is a much more complicated process known anciently which is only now becoming better understood and utilized.

Smart,

Food!

I Am Reading On

The News That

Ramon Noodles

Are Being Traded

In Prisons In USA.

This is a very powerful article underlining how the top doesn't wear anything! Great job, namaste :)

Remember when Buffet had a bunch of silver? He should buy some again.

If Warren Buffet were to attempt to invest 10% of his net worth in physical silver bullion he would not be able to. There isn't enough above ground silver at current prices to fill such an order.

Absolutely. But I would sure like to see him try :)

All these billionaires know what is happening because they designed the systemic collapse. It is the Hegalian dialectic, problem reaction solution.

They create the problem (stock market crash)

They let the people react (mass panic)

They provide the solution (global currency, cashless, with a side of microchip implants)

Or something along those lines. It has been this way forever and will continue as long as people let it.

I personally think we should have something akin to the Salem witch trials except with the bankers and Bildeburgers as the witches.

I doubt we would have to publicly press too many before the rest just up and disappeared.

Then we could have a freedom based borderless society practicing the Golden rule of do no harm.

We have all been attacked by these "people" and it is our right to fight back. It's peachy to think of a peaceful solution, but not practical.

Read this closely:

It's not collapsing, even TDV knows and told you that.

That's an interesting graph of the Berkshire Hathaway cash holdings.

Does anyone know what the graph of the Berkshire Hathaway stock holdings looks like?

Maybe they have more of both?

You nailed it. As usual TVD is just fear mongering. Check my reply to the top comment. They are at record everything as far as holdings go because they are also at a record valuation.

Another brilliant piece and thanks for sharing. Happy to upvote and share this on Twitter✔ for my followers to read. Cheers. Stephen

Sharp and direct as always. Thanks for the information. For those still skeptic about the coming crisis, this article should be an eye-opener.

excellent information could not expect less coming from ud congratulations

Very interesting excellent information but I feel people have been warning of impending doom for a good while now.