Crypto Academy Week 7 Homework Post for @yohan2on: Stablecoin - TrueUSD (TUSD)

Stablecoins

We have previously discussed what Stablecoins are from our last week's article: Stablecoin - Steem Dollars (SBD). For this new article, we will be talking about another Stablecoin called TrueUSD (TUSD).

TUSD graphics. Source: Trusttoken

What's TrueUSD?

It is a stablecoin designed pegged to be pegged to the USD at 1:1. It was first launched only to a limited investor base back in 2018, after that TrueUSD has since seen growth that enabled them to incorporate almost 400 million USD worth of backed tokens as of late last year.

Trusttoken website screenshot. Source: Trusttoken

TrustToken is the platform that administers TrueUSD, among other Stablecoins. TrustTOken is a platform for tokenizing real-world assets.

Same with other stablecoins, TUSD aims to enable users to increased liquidity and provide traders and common users with a nonvolatile or less volatile cryptocurrency asset (vs most cryptos that are highly volatile) like Bitcoin or Ethereum.

Other Stablecoins handled by Trusttoken. Source: Trusttoken

What makes it unique?

The main use cases of stablecoins are stability and utility and TrueUSD aims to balance them with security in the form of regular attestations.

TrustToken has aimed to underscore the importance of USDT's independent verification, because of this, TrueUSD's appeal is aimed towards big investors who are after risk reduction, but also smaller traders.

The company describes TUSD as “the first regulated stablecoin that's fully backed by US Dollars”.

TrustToken was able to enter into various corporate partnerships. This is an integral part of their business activities, enabling some options for the stablecoin TUSD holders to somehow increase their annual passive income returns.

TUSD Graphic. Source: Coinannouncer

Security & Usage

The company behind TUSD, TrustToken, wanted to deliver maximum possible transparency by delivering methods like real-time auditing backing and reliability of TUSD. Other than the validity of how it's pegged to the US dollar, the other common security issues that may affect TUSD are just the same issues that may affect any ERC-20 issued token.

Who is TrueUSD for?

- Financial Services: TUSD is a way for finance to trade with USD's value without using actual USD.

- Exchanges: A stablecoin is always good for exchanges because users do not need to pull out money in a fiat bank account just to avoid volatility.

- Crypto Traders: Stablecoins like TUSD gives hedges against volatility crypto markets.

- Commerce: Salaries, loans, escrow, and purchases can definitely use stablecoins - because the value of it may stay the same as with fiat USD. Using it as a primary means of exchange is better than using highly volatile cryptocurrencies.

Where to get TrueUSD/TUSD?

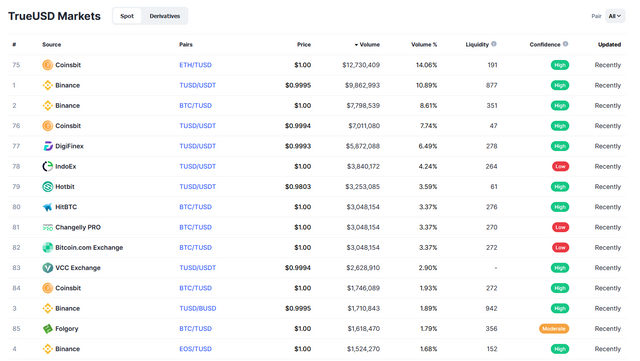

TUSD is available in major cryptocurrency exchanges. The top exchanges for TrueUSD are:

- Coinsbit

- Binance

- DigiFinex

- IndoEx

- Hotbit

Coinmarketcap market listings/trading pairs for TrueUSD screenshot. Source: Coinmarketcap

I based this on trading volume from coinmarketcap's website. However, there are other exchanges where you can trade TUSD, you can simply drop by some market sites like coingecko or coinmarketcap to see where this certain cryptocurrency stablecoin is traded.

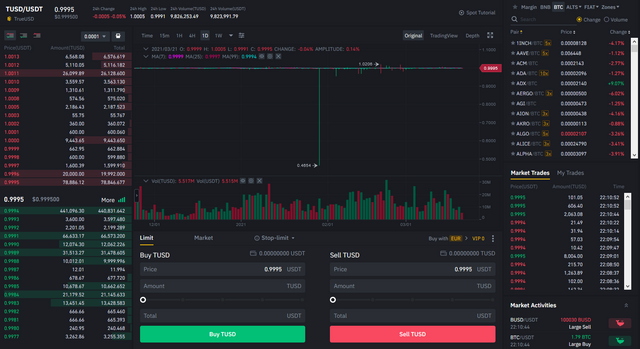

Sample UI for a trading pair with TUSD in Binance. Source: Binance

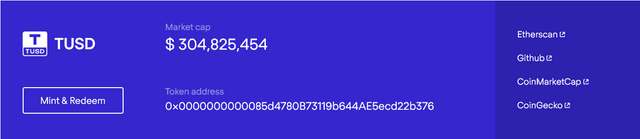

Another way to get TUSD is by minting them yourself. Simply head over to Trusttoken's main page and go to their product list.

Trusttoken product list, where to mint and redeem their stablecoins. Source: Trusttoken

Once you are done setting up a TrustToken account, you can mint or redeem TrueUSD and other TrueCurrencies.

Process of minting TUSD. Source: Trusttoken

- For minting, you simply have to send a wire transfer to their banking partner by using the minting instructions displayed in the app or site.

- Once they receive it, TrueUSD will be minted and will be transferred to the wallet address you provided in the app or site.

Redeeming TUSD means the reverse of minting them.

Process of minting TUSD. Source: Trusttoken

- Just head over to the Trusttoken app or website and provide your bank info and you will be provided with a unique redemption address.

- Then you send the TrueUSD you want to redeem to the redemption address.

- The banking partner will then issue the wire transfer to your chosen bank account within 1 business day of confirming you have sent the TUSD to the redemption address.

Hi @deveerei

Thanks for attending the 7th -Crypto course and for your effort in doing the given homework task.

Feedback

This is excellent work. Well done with such a detailed research on TrueUSD

Homework task

10

Thanks a lot @Yohan2on really appreciate it!