All Golden Eyes On The Fed

The next US central bank interest rate announcement is scheduled for tomorrow afternoon. Gold and related assets are now in “pause mode” against most fiat currencies.

Gold has a rough general tendency to decline ahead of a rate hike, then rally strongly after a hike is announced.

That has happened in textbook fashion with the first three rate hikes in the current hiking cycle.

There’s no guarantee that it happens again this time. However, if it does gold should take out the weekly chart downtrend line that has the attention of institutional technical analysts.

This is the fabulous monthly gold chart.

Note the buy signal flashing on Stochastics oscillator at the top of the chart. It’s happening in the 50 area, which indicates strong momentum. Also, the TRIX indicator at the bottom of the chart is about to cross over the zero line. This is extremely positive technical action.

Technical breakouts that are produced by fundamentally important events are significant.

The bottom line is that a breakout on the monthly gold chart that occurs in the days following tomorrow’s Fed announcement could be a gamechanger for gold market investors.

This is the weekly chart of the US dollar versus Canadian dollar.

The dollar already looks like a train wreck against both the Japanese Yen and Indian rupee. Now it’s poised to go off the rails against the Canadian dollar. I’ve set an initial target zone in the $1.25 area.

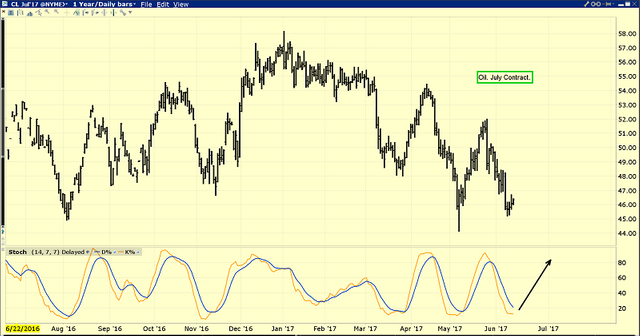

This is the oil chart.

Oil is by far the largest component of the major commodity indexes. A rally in the Canadian dollar tends to coincide with a rally in those indexes.

That’s inflationary, and more good news for gold.

Good news for gold is happening around the world, and when it’s coming from India, commercial traders tend to buy long positions in size on the COMEX.

After years of gold-negative policy announcements, India’s government has begun to make announcements that are cheered by the gargantuan gold jewellery industry.

Millions of industry workers have been sidelined by the barbaric legislation of the government in recent years. I’m predicting that most of them will be back at work within twelve months.

India’s gold jewellery market will be in expansion mode very quickly, which means the COMEX gold price will be in upside expansion mode even more quickly!

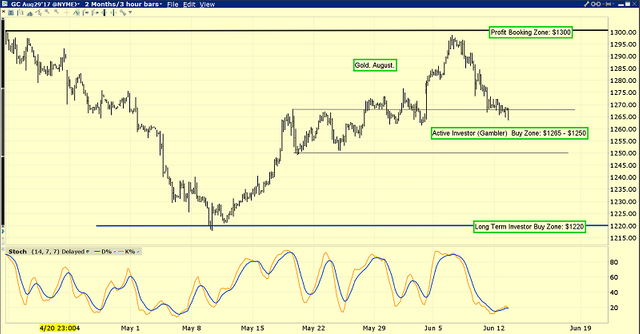

This is the gold chart. Active traders can take action on the buy-side right now to capitalize on a potential rate hike rally following tomorrow’s Fed announcement. Long-term investors can place buy orders in the $1220 price zone.

My personal focus for fresh precious metals sector buying is GDX, the gold stocks ETF.

This is the GDX versus gold chart.

There’s not much point in buying a high-risk asset class like gold stocks if they are not poised to outperform the underlying low-risk asset class of gold bullion. The good news is that gold stocks are technically poised to do so right now.

Most of the gold stocks pipeline news flow is now positive. More rate hikes are needed to reverse the multi-decade bear cycle in US money velocity, and Fed-focused economists have assigned roughly a 95% chance of a rate hike tomorrow.

GDX has been drifting sideways to lower against gold bullion since February. I’m a very aggressive buyer on any price weakness between now and tomorrow’s Fed announcement. There’s no guarantee that the Fed’s fourth rate hike will be followed by a fourth glorious gold rally against global fiat. Nonetheless I will suggest that all investors should be poised to profit, if it happens!

Stewart Thomson, Gold-Eagle

13th June 2017

So lets say the decide not to rate hike, then what happens? My guess all hell will break loose. Thanks for the share.

See comment below, cheers

Great informative article.

what happens if they dont raise rates, because everyone seems to think its guaranteed?

The consensus seems to be if they don't raise rates the metals will surge even more, seems like a win-win but we'll see..

agree

Very insightful post! Thank you