TIB: Today I Bought (and Sold) - An Investors Journal #469 - European Financials, US Banks, Semiconductors, US Technology, Wheat

Markets are in a divergent mood with investors looking for value. A beneficiary is banking stocks and I am making a contrarian call here off the bottoms. A little profit taking to fund the purchases and a call on Apple's product launch. Agriculture prices may bottom with the China trade talks.

Portfolio News

Market Flip Flop

US markets opened fairly even and traded that way all day.

The divergence continues - the talking heads like to call it rotation as investors move out of momentum stocks not into defensive stocks but into other growth areas. The John Bolton resignation/sacking takes some of the pressure off the Iran story - might move oil prices. Treasury yields continue to rise after the massive overbought situation last week.

Biggest beneficiary of the move in yields are financial stocks, especially banks. Bank of America (BAC) rises 2.5% in my portfolios and Huntington Bancshares (HBAN) 1.4%.

Biggest surprise is JC Penney (JCP) making another double digit gain up 19%.

JC Penney did announce a new outdoor brand and a new outdoor shop format in 100 stores. Market view is that this is more to do with the stock being oversold and the shorts getting squeezed. My averaged down purchase made 18 days ago is already up 66%. Price is back above $1 closing at $1.01. That takes it off the NYSE naughty stocks list - price is supposed to stay above $1 or face suspension

https://www.cnbc.com/2019/09/10/jc-penney-will-lean-into-the-outdoors-to-try-to-boost-sales.html

European stocks also show this divergence with banks leading strongly, especially Italian banks.

Bought

European banking stocks have been moving off the lows based on a view forming that rates may not go much more negative in the upcoming ECB stimulus package. The chart shows a European banking ETF (EXV1.DE)

Based on that bounce off lows, I did some averaging down in Europe

Banco BPM Società per Azioni (BAMI.MI): Italian Bank. Averaging down. The chart shows the way price has tested down to a bottom 4 times - this is "break or bust" time for this bank.

Commerzbank (CBK.DE): German Bank. Bought a parcel of shares to replace shares that are likely to be assigned on covered calls in September expiry. I have been writing covered calls for months on this stock and have recovered all the capital losses.

Intesa San Paolo SPA (ISP.MI): Italian Financial. Averaging down.

Huntington Bancshares Inc (HBAN): US Bank. Adding a new position in one portfolio - this would be an averaging down in the one portfolio I am holding.

Apple Inc. (AAPL): US Technology. CNBC Options Action idea to buy options into the iPhone product announcements. Their trade idea was to buy one strike out-the-money call (215). I chose to do a spread with a narrow range. Bought October 2019 215/225 bull call spread for a net premium of $4.37 offering maximum profit potential of 129% if price moves 5% from $214.17 opening price. Price closed at $216.70 giving the first 1.18% of the move. The chart shows the bought call (215) as a blue ray and the sold call (225) as a red ray with expiry on the right margin.

It is hard to build a price scenario as price has to reach back to 2018 highs to make the maximum. The view is that Apple is under-valued on an earnings multiple and price can surprise. That is why I did a spread and not a straight call trade - someone else can keep the big upside potential. The market would be surprised.

Chicago Wheat Futures (ZW=F): Wheat Futures. Been watching commodity prices move off the lows. Added one new contract in Wheat as it is the commodity I am least exposed to (versus soybeans and corn)

Sold

Some profit taking to fund other purchases.

Zurich Insurance (ZURN.SW): Swiss Insurance. 73% profit since April 2016.

Lam Research Corporation (LRCX): US Semiconductors. 21% blended profit since April/June 2019. Jim Cramer idea to enter and to take profits off the table now.

Income Trades

2 covered calls written. Coverage is getting a bit tight with 10 days to go. Time to cancel outstanding orders.

Exxon Mobil Corporation (XOM): US Oil Producer. Sold September 2019 strike 74 calls for 0.27% premium (0.23% to purchase price). Closing price $71.49 (lower than last month). Price needs to move another 3.5% to reach the sold strike (tighter than last month). Should price pass the sold strike I book a 10% capital loss. Income to date amounts to 1.84% of purchase cost.

Randstad N.V. (RAND.AS): Europe HR Services. Sold September 2019 strike 46 calls for 0.45% premium (0.40% to purchase price). Closing price €44.49 (lower than last month). Price needs to move another 3.4% to reach the sold strike (tighter than last month). Should price pass the sold strike I book a 7% capital loss. Income to date amounts to 2.04% of purchase cost. Price did pass sold strike during the day's trade.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $480 (4.6% of the high). Price was not poised to go higher - it wanted to test support lower at $9954, which is pretty well where price turned.

Ethereum (ETHUSD): Price range for the day was $8 (4.4% of the open). Price makes an inside bar just testing down to support at $177. This is proving to be a key short term level.

Ripple (XRPUSD): Price range for the day was $0.01048 (4% of the high). Price trades around the $0.26 level all day but wanting to push lower. The low is still above the prior reversal low.

CryptoBots

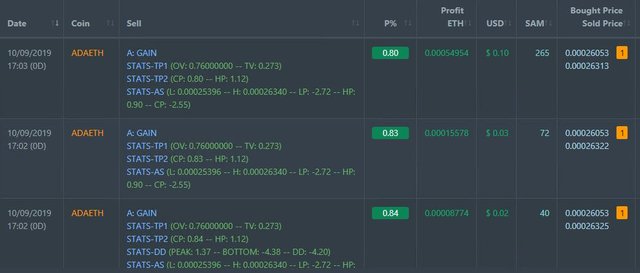

Profit Trailer Bot One closed trade (0.83% profit) bringing the position on the account to 9.69% profit (was 9.68%) (not accounting for open trades). Looks like 3 trades but really only one.

Dollar Cost Average (DCA) drops to 5 coins with ADA moving off and onto profit after one level of DCA.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 2 trades on AUDNZD for 0.52% profits for the day. Trades open on USDJPY short (1.15% negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

September 10, 2019

I think the current Apple product cycle is getting too long and will pressure growth and valuations. No real innovation offset by more services but growth will be a question given margins.

Posted using Partiko iOS

Market seemed to like the launch - price pushing to the top of my spread range which is what the trade idea was.

They certainly do seem to be short on ideas (or ideas the market likes). Of course, what the market will like is steady services revenues.

Disappointing to cop a downvote from @trafalgar all in the name of promoting good content. 469 posts about investing is a strong commitment to writing good content.

Good news is the writing improves my investing way more than the rewards that come from upvotes - by an order of magnitude.

Hi, @carrinm!

You just got a 0.46% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.