TIB: Today I Bought (and Sold) - An Investors Journal #260 - Australian Mining, Danish Banks.

Tariff deadline came and went. Markets focused on jobs data instead. Sold one third of iron ore producer and added more Danish banks exposure

Portfolio News

Market Jitters - Temper Tantrum No amount of doom talk from the media could make the markets ignore the US jobs report. They went up (US and Europe)

The jobs reports added 213,000 new jobs which was more than the median 200,000 estimate. Markets do prefer to trade based on data when they have a choice. The more important part of the jobs report was that the wage rate rise at 2.7% was below the median estimate which gives the Federal Reserve a little more wriggle room on a rate rise.

With so many mixed messages coming out of Washington, it may be a relief for investors to focus on some hard data such as the Fed minutes and payrolls report

Andrew Milligan, head of global strategy at Aberdeen Standard Investments.

https://www.ft.com/content/b8b11236-80bf-11e8-bc55-50daf11b720d

Messages out of China about tariffs are mixed. The premier Li Keqiang says China will keep opening its markets. The state owned media say that the US are a bunch of bullies and China will take action. The head of Sinopec, the state owned energy agency also used the bully word in a hard hitting speech.

https://www.sbs.com.au/news/china-to-keep-opening-markets-premier-li

The reality so far seems to be that the current tariffs schedule is being absorbed by the markets with Bloomberg Economics suggesting that they could cause a 0.2% drop in US GDP and 0.8% if it goes to the full slate. My read is Donald Trump will keep up the rhetoric for as long as he can ahead of the mid-term elections and he will adjust things depending how public opinion flows. The key card he has is that he using sections 232 and 301 powers for which he does not need Congress. That means he can delay, change amounts, change timings and withdraw at will. He will depending on how public and market opinion goes.

This is more than a game of bluff now but it is still a game.

World Cup The Google search for matters Russia do focus on the amazing Russia football story.

There is space also to wonder what is on Vladimir Putin's mind with the Trump summit rolling around soon on July 16. Whoever knows what is on his mind? Sanctions, adoptions, Crimea, Syria, Oligarchs, Meddling, Free trade. It is a long laundry list - I wonder what the Russia view is?

http://www.abc.net.au/news/2018-07-09/vladimir-putins-wishlist-for-meeting-with-donald-trump/9949488

No mention in the headline search of the death of the English woman who handled the Russian nerve agent

On the football fields, Russia went out and England went through. Belgium looked fantastic and France did the job. A European winner again is on the way.

What the World Cup headlines quietly forget about is some bad England fan behaviour in Russia and back home in England - needs a bit deeper Google work to find out what the fans think.

Bought

Jyske Bank A/S (JYSK.CO): Danish Bank. European bank investing has delivered scant rewards over the last 18 months because of the long wait for interest rates to rise. I have had good success investing in Danish banks though my current holding in Jutlander bank (JUTBK.CO) is under water. I was looking at the charts for Jyske Bank, which I have owned previously and can see a bottoming formation.

The chart is messy and somewhat directionless in the last 12 months after a strong run from the 2012 lows. Price has bounced off the resistance levels and cleared the next level up (two dotted red horizontals). I added a small holding. My thinking in going to Denmark, is that while Denmark is part of the European Union it is not part of the monetary union. They can start raising rates before Europe does. A quick comparison with leading Danish bank, Danske Bank - the orange line.

Its price has collapsed following a money laundering probe. Normally, I would be attracted to such a price reaction - maybe not this time as the bank is not that big and it might not have the wherewithal to wear a big fine.

https://www.thelocal.dk/20180708/danske-banks-money-laundering-scandal-spinning-faster

This entry level for Jyske Bank is below my last exit level but above my initial entry level (written up in TIB15). Maybe I should just have kept holding.

I will review Swedish banks as Sweden runs its own currency too. Norway is a different story as its currency is tied to oil prices which makes the country economy dynamics different.

Sold

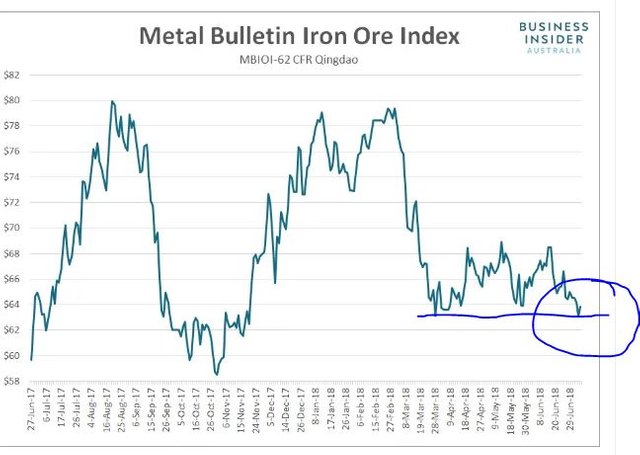

BHP (BHP.AX): Australian Miner. Iron Ore prices have been somewhat choppy since the announcement of the steel tariffs reaching a 3 month low on Thursday.

https://www.businessinsider.com.au/iron-ore-price-steel-mill-closures-china-2018-7

I decided to reduce my exposure to BHP, which is one of the world's largest iron ore producers, by one third. Position sold for 2.6% profit since August 2012. Funds are in Australian Dollars and will be used to pay my pension next month. This original position was opened by previous fund manager. Dividend yield is currently 4.4% and for Australian residents is fully franked - i.e., one gets the company tax paid refunded, which then offers a 6.28% yield after refunds. Dividends were reduced in 2016 following the commodities and oil price slump in 2014/5

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $371 (5.8% of the low). Price made a 2nd inside bar and then broke upwards to hold above the support level. Sunday trade was another inside bar - the market is looking for committed buyers who seem a bit scarce.

Ethereum (ETHUSD): Price range for the weekend was $44 (9.7% of the low). Price did move above the resistance line and closed above. There is more resistance at $510 dating back from late 2017 but it may not be that solid a level.

CryptoBots

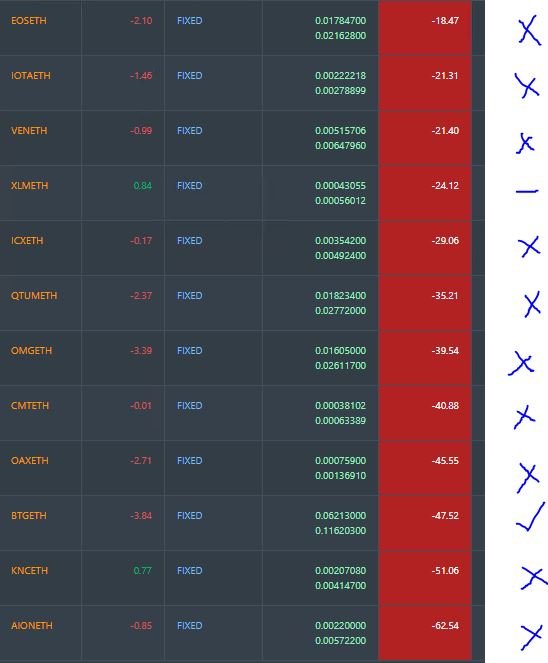

Outsourced Bot No closed trades. (213 closed trades). Problem children was increased by one with SNT rejoining at -13% (>10% down) - (18 coins) - ETH, ZEC (-51%), DASH (-51%), LTC, BTS, ICX (-45%), ADA (-43%), PPT (-55%), DGD (-53%), GAS (-59%), SNT, STRAT (-55%), NEO (-57%), ETC, QTUM (-49%), BTG (-60%), XMR, OMG.

BTG remains the worst.

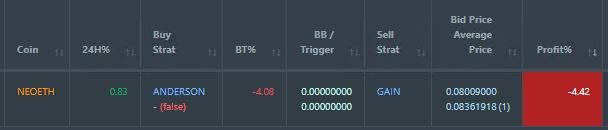

Profit Trailer Bot Still working on the whitelist setup - had selected the coins but not changed the volume screen. Bot did open one trade which is now on the DCA list (NEO).

I have fixed the screen and there are 6 possible buys. I will allow 4 open trades and run a manual stop loss at 7.5%. Before the collapse, I was getting enough winning trades to absorb a stop loss every now and then. I am not convinced an automatic stop loss will stay away from the pending list.

No closed trades. Pending list was unchanged at 12 coins with 1 coin improving, 1 coin trading flat and 10 worse.

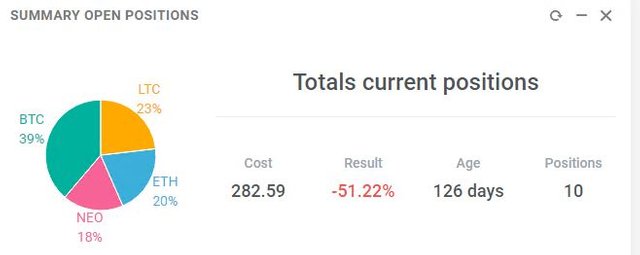

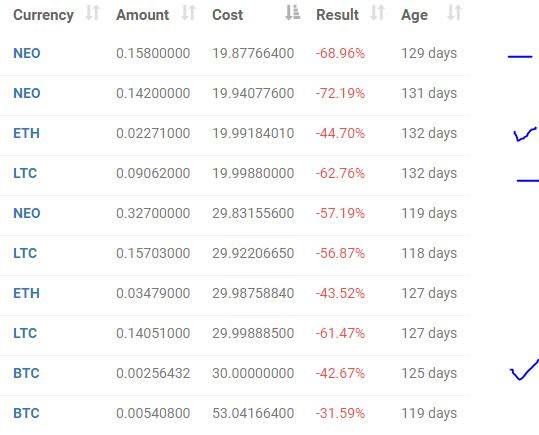

New Trading Bot Positions improved half a point to -51.2% (was -51.8%)

BTC and ETH improved 2 points. The other coins stayed flat. 126 open days now which tells one how long a buy and hold has to work when your trades are behind. - 4 months now.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 3.9% (higher than prior day's 3.8%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Iron Ore image comes from Business Insider Australia. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

July 6, 2018

no other word for you @carrinm, keep the spirit and success always, I always support you, good post.

Thanks. I have added you to my supporting team

thanks again, and thank you for supporting me too @carrinm.

Great post carrinm U just received a free upvote and resteem from @steemwhalepower please upvote this comment to help everyone who uses this service if you want me to remove this comment reply remove

send 0.100 sbd or steem for 2 upvotes and a resteem

@smartmarket upvote results

Before:

After:

Say $3.80 after 8 SBD cost at $1.15 per SBD. 5 to 10 votes. No voter accretion from getting on Trending page.

Try for yourself http://mymark.mx/SmartSteem as the returns are positive.