Buy NEM Now? Science Says Yes!

In a sector full of technical analyses, it’s hard for newcomers to the cryptocurrency markets to figure out in which altcoin assets they should be investing. To better address this problem, I will rely heavily on science rather than on “pure” technical analysis.

Now, I love technical analysis just as much as the next guy. In fact, much of my work for the mainstream investing community revolves around technical analysis, as well as the fundamental approach. However, both the technical and fundamental methodologies are inherently subjective in nature.

For instance, the technicians argue about patterns and formations that they see. On the other end, fundamentalists determine “fair market value” based on arbitrary assumptions of the target company’s financial statements.

With science, and scientific methodologies, the observations are factual; the forecast, though, is theoretical.

Now, onto the good stuff!

Why invest in NEM?

I admit that the idea about analyzing NEM was inspired by a good Steemit friend, @fiord18. I asked him for his thoughts on the cryptocurrency market, and he suggested looking at NEM. I figured, why not? :)

I’m glad I did. Although NEM looks like a discounted opportunity from a traditional technical approach, I wanted to dig a little further. I wanted to determine the “behavioral psychology” of the NEM market – at what price point are investors confident in NEM?

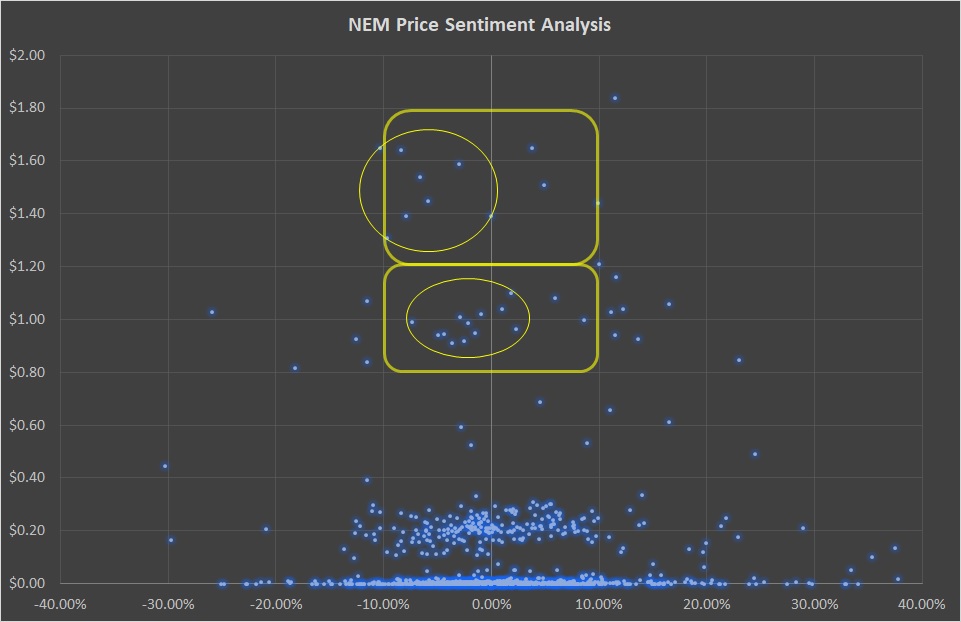

To answer that question, I need a scatterplot with two axis – price point and “price derivative,” or daily percentage change. Below is my work:

NEM Psychology

Notice that in the upper price ranges, from $1.20 and above, trading action is spread apart (diluted) between the prime trading magnitudes of +/- 10% (highlighted in yellow box). That tells me that traders are not very confident above the $1 level.

Now take a look at the range between 80 cents and $1.20. In the prime +/- 10% magnitude range (also highlighted in yellow box), the trading action is much more concentrated. Logically, this tells me that, in comparison to the upper price range (+$1.20), traders are much more confident.

At the time of writing, NEM has settled down into this “prime range.” If I’m a betting man (and I am!), I’m looking to load up on the NEM altcoin at these prices.

Great post! It's very well written! :)

I appreciate your analyses and really glad I cam across your posts.

I read earlier today there's a Japanese exchange that lost a huge amount of Ripple due to hacking $120M + and though it hasnt' been confirmed there's a rumor the same exchange also lost $600M worth of Nem. If this rumor were to continue to propagate, or worse be confirmed as valid, how do you think it might impact the price?

Purely my opinion, but perhaps these rumors have already been priced into the current NEM price? Based on my research on trading behaviors, most investors are confident at the 80-cent support line, so I think it will hold. Of course, we'll just have to wait and see to get the real answer! :)

I've seen it posted on multiple sources since yesterday, though the amounts quote vary between $400M and $600M. I follow along and see what else the market has to say in the next few days. I appreciate your insight. Thanks again. :)

Мне кажется удар по бирже имеет другую цель, NEM тут не причем,просто" убили 2 зайцев"...политика" верхов"...