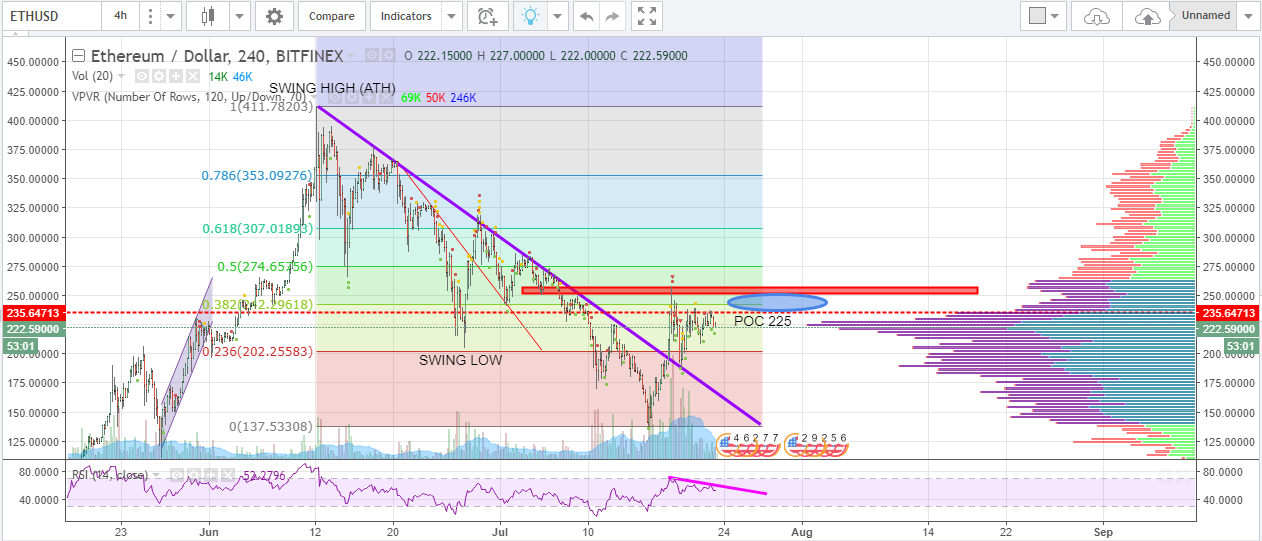

Ethereum USD - Sunday Morning Update - July 23, 2017: Balanced around 225 area

It's been a while since I last posted an update on Ethereum, and while I am working on my new Trader's Journal series, where I will be documenting a separate small account to show I trade, I thought it would be benefiting to look at ETHUSD again since it is poising for the next move.

POC shifter higher from 189 to 225, as seen from my last ETHUSD chart. The volume profile shown on the right is taking an odd 'b' formation, with a spike at the 225 level. Usually a 'b' profile means Long liquidation, big money has been taking profits at the top. The recent spiked rally might have been just short covering where sellers came in late after the liquidation and covered all the way to 250. This is where we set the top of the recent swing high, with 185-200 area for the low end of the range.

Also notice the decline in volume and RSI. Volatility, if I may say, has also been fairly low compared to past week. Some may say we are tightening the range, with sellers and buyers happy trading around 225 as noted earlier. This also is a sign of the next move coming up.

Zooming into the 30-min chart, and as I am typing this, ETHUSD is attempting lower, following BTCUSD price action. I usually look at both charts when assessing the current market situation. For the most part this strategy works, but at times they are non-concurrent. I will talk about this on another post where I will analyze market caps between coins to show how money flow may affect this pairing movement.

To end this post, this post I am going back to the daily chart. If all, this is the one chart you cannot ignore, as it will help summarize where the next leg up, if it were to happen, will be coming from. Notice the area around 235-240, where the top of the candle wicks on the past days are almost lined up and the past days is forming a wedge pattern. Once we see a break above this resistance line, we need to go back and find a safe place to enter for a long. If the moves hold we will see a nice pop, holding above 250-260 area will confirm the move for a shot to 300 area again.

On the flip side, if prices break below the ascending trendline (shown in blue), then 185-200 will be re-tested. Below this resistance zone, is a steep support area above, but we'll regroup and look at the situation again if this happens.

Hope you are enjoying your weekend. As always, feel free to post, comment, and let me know if you have any questions. Also, if you really want to take a look at another chart, I would be happy to help. Look for my next Trader's Journal series, which I will be start posting on Monday. Hope you can follow me in that journey where I intend to grow an account 33% a month. What did I get myself into :)

ETH looks weak IMO. And don't you think it's a good idea take a glance at ETHBTC chart?

Here we see a very clear triple bottom at 0.075

ETH is balancing right now. There is strong support below at 0.064, and strong resistance at 0.11. Wide range, just stuck between these two