CRYPTO ACADEMY | SEASON 4 | WEEK - 1 | HOMEWORK POST FOR PROFESSOR @awesononso.

1 - WHAT IS BID-ASK SPREAD?

In conventional markets, this spread is always created by the market makers or providers of the broker liquidity.

In cryptocurrency markets, the spread is always a result of the difference or space between limit orders from the buyers and the sellers.

When a buyer wants to make an instant market price purchase, he/she will need to accept the lowest ask price from the seller of that asset. If a seller wants to make an instant sale, he/she will have to take the highest bid price from a buyer. The difference between the lowest ask price and the highest bid price is what we call BID-ASK SPREAD.

Assets with more liquidity e.g forex is always having a narrower bid-ask spread, this means that buyers and sellers can carry out their orders without causing any big changes in the price of an asset.

This is caused by the large volume of orders available in the order book. But a wider bid-ask spread will definitely cause more substantial price fluctuations when closing orders that have large volume.

2 - WHY THE BID-ASK SPREAD IS IMPORTANT IN THE MARKET.

The bid-ask spread is a very important concept in the market because a market maker can easily take advantage of a bid-ask spread just by buying and selling an asset concurrently. If the market maker is selling at the higher ask price and then buying at the lower bid price several times, then the market maker can take the bid-ask spread as arbitrage profit.

Even a narrow bid-ask spread can cause significant profits for the trader if he/she is trading it in a large quantity all day. Assets with higher demand are always having smaller bid-ask spreads as because the market makers always competing and narrowing down the spread.

3 - If Crypto X has a bid price of $5 and an ask price of $5.20

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Solution.

Spread = Ask price - Bid price

a) The Bid Price = $5

The Ask Price = $5.20

Therefore, The Bid-Ask Spread = $5.20 - $5 = $0.20.

b) bid-ask Spread in percentage = (Spread/Ask price) x 100

= (0.20/5.20) x 100

= 0.0384 x 100

= 3.846%.

4 - If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Solution.

a) The Bid Price = $8.40

The Ask Price = $8.80

Therefore, The Bid-Ask Spread = $8.80 - $8.40 = $0.40.

b) bid-ask Spread in percentage = (Spread/Ask price) x 100

= (0.40/8.80) x 100

= 0.04545 x 100

= 4.545%.

5 - THE ASSET WITH HIGHER LIQUIDITY.

Crypto X has a higher liquidity than Crypto Y because the spread in crypto X is smaller than the spread in Crypto Y.

6 - WHAT IS SLIPPAGE?

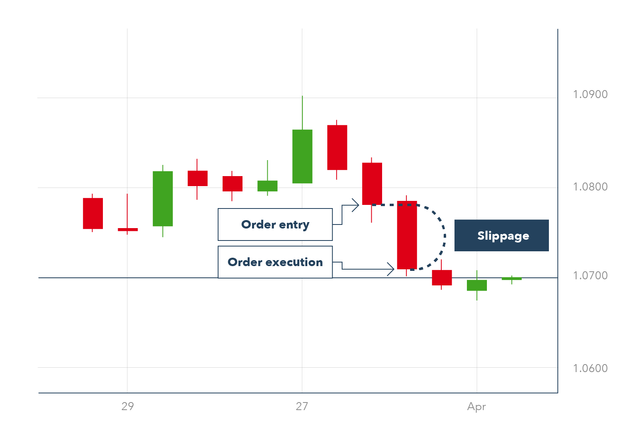

Slippage can be seen as the difference between the expected price of a particular trade and the price that the trade was executed. It is simply the situation where a trade is carried out at a different price than the price expected or requested. Slippage is something that can take place at any time, but is always happening during periods of higher volatility when market orders are being used.

It can also happen when a large order is carried out but there volume is not enough for the chosen price to maintain its current bid or ask spread .

7 - POSITIVE AND NEGATIVE SLIPPAGE.

POSITIVE SLIPPAGE.

Positive slippage is the type of Slippage where the price of a trade is opened or closed at a price level that is better than what the trader was expecting. For instance, a trade is opened and the price is less than what the trader intended, then it will offer more value to the trade.

For Example, a seller wants to place a sell order at $50, but there are a lot of buyers in the market who are willing placing buy orders for that asset with a price that is above $50. So the seller will now accept buy orders above $50 until his order is entirely filled. This will make the average price of his sell to be highi than $50, this is a clear case of positive slippage.

NEGATIVE SLIPPAGE

This is a situation where the price in which a trade is executed is worst than what was expected by the trader.

For Example, a trader wants to place a large market buy order at $200, but the market does not have enough liquidity to fill his order at that price. So he will have to take orders above $200 until his order is completely filled. This will make the average price of his purchase to be higher than $200, this is a clear case of negative slippage.

Hello @anselam,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

I noticed that parts of your work were paraphrased from other sources. Please always be as original as possible.

The part of slippages needed to be clearer with better illustrations.

You did not properly answer the second question.

Thanks again as we anticipate your participation in the next class.