Homework Task For @fendit: Don't get lost in the Fuss

.png)

After an educative class on mistakes while trading, professor @fendit gave us assignment task to complete, this is my attempt at doing so:

A. Place yourself in the following situation:

You bought BTC a couple of days ago at a price of USDT 62K. Suddenly, you see that this situation is going on (image below)

What would you have done before reading this class? What would you do now? Explain in detail if there's something you would do differently.

source

To be frank, I have been a trader for a couple of years, so I'd not have panicked and there'd not be much difference in what I would do before and after the class. I'll hold the coins I bought, BTC has over the years proven to be a bullish coin, and is one of the trustable large-cap coins. I'll have confidence in holding, but to make something out of this move shown above, if I have more money, I'll deposit, wait for the first cross of the moving averages, and short BTC. Drawing my trend-based Fibonacci extension I would set my take profit.

When the chart hit the low there (50931) by then I have taken my profits, I would wait for the long-wicked candle to close, then buy more BTC with my profits at that point, as they say, buy low, sell high.

B. Share your own experience when it comes to making mistakes in trading:

What mistakes have you done when trading and what did you learn from them? If you have little experience when it comes to trading, tell if you got to know about someone else's experience.

Which of the strategies discussed in this class you find the most useful for you? Why?

1. Mistakes made while trading

Lol....Where do I start from? Mistakes I have made in trading? I honestly do not think I can count. I have been a very stubborn person and a risk-taker at heart, I made so many mistakes before ultimately realizing that a good trader does his business effortlessly and without rush. Trying to categorize my trading mistakes, at least the ones I can remember, we have;

i. Over-Leveraging

Leverage trading helps traders like us with little capital make the big bucks, unfortunately, it also amplifies the loss. Time has proven I am a decent analyst, my price predictions are roughly 85% accurate, but I have liquidated a lot o accounts, countless. Why is that? Over-leveraging.

I tend to place a trade, then go all-in with 50-120x leverage, this does not give trades breathing space, and 90% of the time, a small wick will be enough to break the account, and I get liquidated or margin called. The painful part is, I end up being right, yet losing money to greed. It took me a really long time to set limits on my leverages.

ii. Fear Of Missing Out (FOMO)

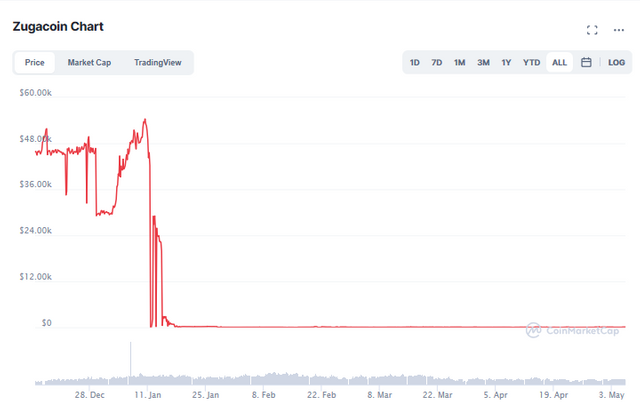

Early this year, when I returned to school in Enugu, Nigeria, I saw posters and flyers round the city, of a new coin, Zugacoin (SZC), and it was costlier than BTC at the time. Twitter trend no.1 was Zugacoin, january 10th, I bought into the hype from a vendor, at a high price of $53,000 with $200, and expected big things from the coin. In less than 24hours, I got the shock of my life as the coin dumped to $5. The hole $200 gone and I had less than $1 left. Although the coin pumped and dumped a few more days, now it trades currently at about $100.

That was a very big mistake, allowing the FOMO to pull the rug on me. Now I buy during dips and not pumps, This method has proved the wiser choice so far.

zugacoin chart

iii. Over Trading, Greed, Trading with emotions and Revenge Trading Combined

On different occasions i have done these, but for the sake of saving your time I will bring them all into one story. I tend to do these when I trade with my phone, this made me to switch to using my desktop. Easter weekend this year, I went out with some friends after hosting a steemit seminar to recruit newbies, and we spent a lot of money. I placed some trades, and recovered a lot more than we spent, we were at Dominos Pizza then. When I came home, it was 10 pm, I was already very tired and had over 7 successful trades averaging 60% profit each. I slept and I felt restless, I wanted

more, the greed woke me. @awesononso warned me to lead the markets I started trading and was making more profit, made money started trading too much, In one trade I let my emotions take the reins, by not closing out when I was in some lost, I lost all the money. I then withdrew some steem and changed to USDT to recover (revenge trading) and in one trade lost it all again. I slept very angry. Waking the next morning, I checked for where I made mistakes and then I saw that my emotions and greed clouded my judgment and I did not notice some setups.

Looking back now it's all funny because I would not know the things I do today If I did not make these mistakes. I thank God for all lessons learned

2. Which of the strategies discussed in this class did you find the most useful for you? Why?

Everything taught is very useful, It is very difficult to single out one, I will go with "Do not let your emotions control you"

Why?

I have learned over the years that the biggest mistakes I have made while trading is letting my emotions get in the way. I have closed trades that ended up playing out well too early and in loss because of fear, I have closed trades that hit my target levels in loss because I let greed take control and wanted more only to be a victim of reversal.

The solution to these haunting emotions is using only money you can lose, and using auto stops (Take profit and Stop loss). Let these do the work for you, close your computer and do other things, trust your analysis.

C. Place yourself in the following situation:

You're browsing Twitter and you see this: Image below

You see that whenever these kinds of things happen, BTC prices rush. What would you have done before reading this class? What would you do now? Explain in detail if there's something you would do differently.

source

There will be no difference in my actions before and after the class, although i will be more cautious;

Elon Musk is a charismatic and very powerful man. His tweets and comments over time have created a lot of FOMO and He has almost single-handedly taken a meme coin to the top 5 level. Although this effected has lasted for some time, It has not stood the test of time.

If I saw this tweet, at least within % minutes of posting (mind you I have his tweet notification on, 've used it to profit off doge in the past), I would head straight to my finance futures and make a little deposit. I would long doge with a medium leverage, on or below 20, and using 25% of my capital with 50% returns as aim. 20% loss as stop loss and I close my computer and let it play out.

Conclusion

While I have been trading for some time and have come across most of these concepts, it was really nice reading and learning again. Thank you for reminding me to stick to my principles, especially now that a lot of speculations are being thrown around in the markets.

Thank you for being part of my lecture and completing the task!

My comments:

Hey, so good to see you here! :)

Thank you for sharing your experience, I always appreciate when someone that's really into trading also wants to talk about what they've experienced.

I really enjoyed your work, you're so clear on your explanations that it's been a pleasure to get through your homework!

Overall score:

8/10