BTC Daily Technical Analysis: Undecided Market, to see the Possibilities for an Upward recovery or Continuation of the downward trend! / My New Hedging position to Hedge the old one.

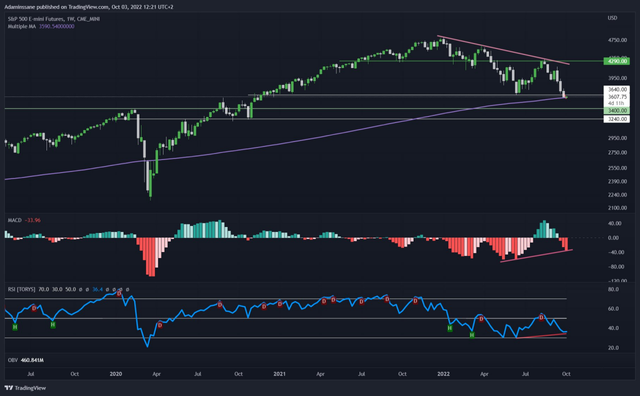

Bullish signals on the S&P 500 to be confirmed!!!

- Bullish divergence on the RSI and the MACD.

- The rebound on the 200 Weekly moving average at 3585.

Despite the close lower of the last June low at 3640, there is a chance to bounce off the 200 MA at 3585 and back above support, but that's not the case at the moment with strong selling Momentum on the MACD and the Friday candle which confirms the continuation of the downward trend.

https://www.tradingview.com/x/1ZOsVzfO/

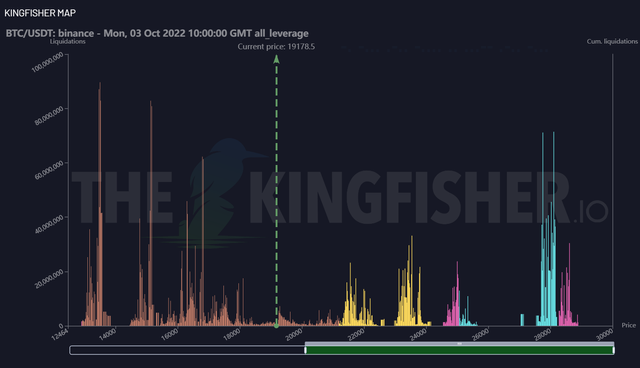

On Bitcoin, we always have more to liquidate in the south than in the north.

Traders with high leverage have calmed down as the spikes in close-to-price liquidations have diminished.

It's possible to go back to 19.6K given the liquidations close to the price to liquidate traders with high leverage, but it's still small peaks not big enough that market makers can care about!!!

Dollar Index DXY in Daily.

Bull:

- For the moment the DXY is rebounding on the 38.2% fibo which isn't in favor of the S&P 500 and the BTC which can continue to decline.

- The RSI still above 50 and the trend line office support (on the RSI).

- Today's candle shows buying strength with a long wick below and a small body above.

Bear:

- The MACD soon in the red with weak buyers.

- The next two supports on the dollar will be 111 on the 50% fibo and 110 on the 61.8%

- confirmations on today's closing!

https://www.tradingview.com/x/jKzP0TaE/

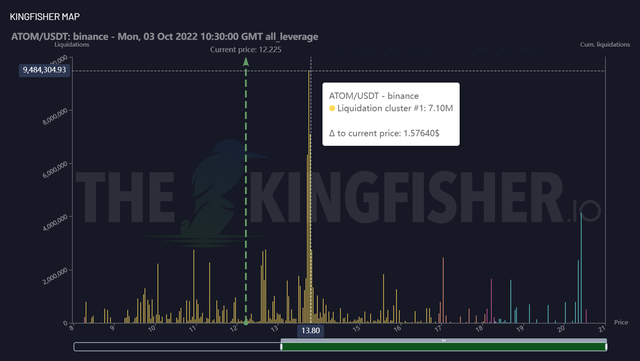

ATOM, unlike BTC, is shorting strongly with a large liquidation peak in the north towards $13.80

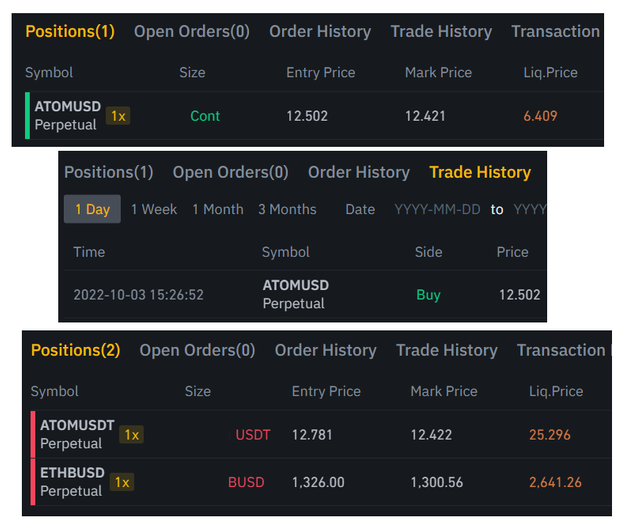

I took a Long on ATOM/USD (Coin-M) without closing the short ATOM/USDT on Futures, it allows me to hedge my Short position if there will be a rebound on the BTC and the S&P 500 and then to see if it's a hunt for Shorts stops before continuing the decline or it's a bullish recovery at least in the short term, or else the decline will continue without rebounding, until then we will see the price action.

Coin M on binance is like futures with leverage too except the position will be in native crypto ATOM not stable like USDT, USDC or BUSD, so losses or gains will be directly with ATOM.

- More Details for short Position on ATOM/USDT on Futures: https://www.publish0x.com/the-king-of-crypto/btc-daily-technical-analysis-bearish-scenario-based-on-ellio-xyeqqzk

👉 Follow the links below to the best & Secured Exchanges that I use for trading & often gives rewards for using their platform like Learn & Earn Program, making deposit & Trading on spot or Futures, Trading Competition, ...etc.

📈 Bybit: Get up to 4030 USDT in rewards just by signing up!

https://www.bybit.com/app/register?ref=7Wgmj

📈 Binance: 10% discount on Binance Futures trading fees!

https://www.binance.com/en/futures/ref/38451215

📈 FTX: Sign Up Bonus of 5% fee discount on all your trades.

https://ftx.com/referrals#a=1768923

📈 Phemex: Up to $180 in welcome bonuses waiting for you.

https://phemex.com/register?group=718&referralCode=BAR9K

📈 Kucoin: Rewards for users Up to 10 million USDT

https://www.kucoin.com/ucenter/signup?rcode=Kvyf2d

📈 Bitmex: Up to 80 BMEX Tokens Welcome Offer.

https://www.bitmex.com/app/register/xXePh3